U.K. CPI: A Return To Double-Digit Inflation On Tap

2022.10.18 04:08

[ad_1]

The UK has been the epicenter of market volatility this week, primarily for reasons unrelated, or at least tangential, to traditional economic data. With rumors about cabinet resignations swirling, the political and fiscal policy drama is likely to extend throughout the week, but traders will also shift their focus to the critically important UK (CPI) report midweek.

The UK’s Office for National Statistics (ONS) is scheduled to release the September CPI report on Wednesday, 19 October at 6:00 GMT (7:00 BST, 2:00 EDT)

Consensus expectations are for headline CPI to print at 10.0% year-over-year, with the reading expected at 6.4% y/y.

UK CPI preview

Two months ago, we learned that the UK inflation rate crossed into double-digit territory for the first time in over forty years. UK consumers received the smallest of reprieves when annualized inflation fell to “just” 9.9% last month, but if the leading indicators are to be believed, the headlines will be heralding the return of double-digit inflation by midweek.

In terms of the specific components to watch, petrol prices fell by about 4% last month, and the used car market continued to soften, but those domestic declines may be overwhelmed by foreign demand after sterling fell sharply through the middle of September. Notably, the BOE noted in its September statement that “given the Energy Price Guarantee, the peak in measured CPI inflation is now likely to be lower than projected in the August Report, at just under 11% in October. Nevertheless, energy bills will still go up and, combined with the indirect effects of higher energy costs, inflation is expected to remain above 10% over the following few months, before starting to fall back.”

While the aforementioned political situation in the UK will remain key, this week’s UK CPI reading will still be one of the biggest factors driving the Bank of England’s early November decision on interest rates. As we go to press, the market is pricing in about a two-in-three chance of a 75bps interest rate hike from BOE Governor Andrew Bailey and company, with a roughly one-third probability of a 100bps rate hike. Overall, traders are pricing in 187bps of increases by the end of the year.

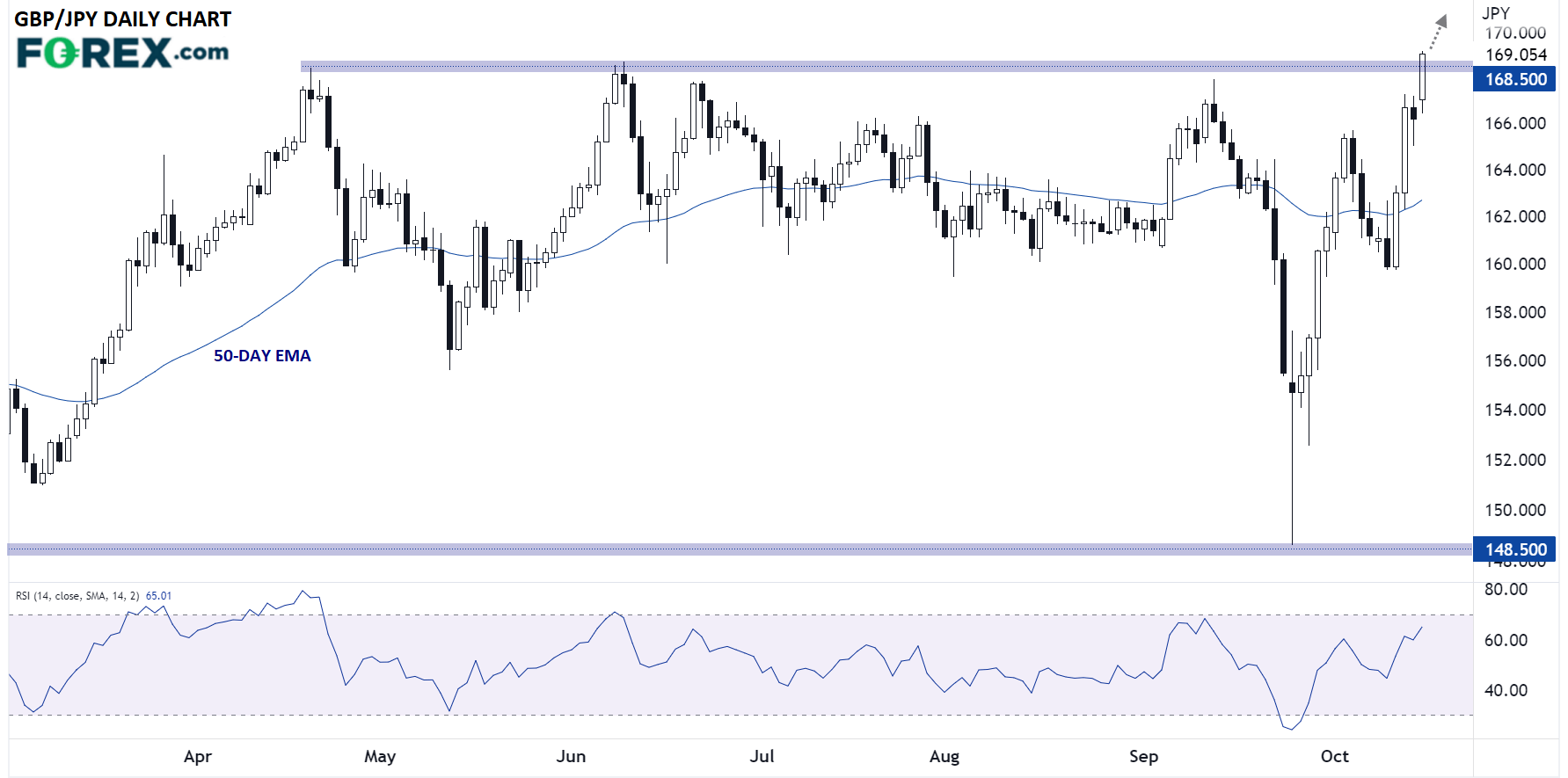

Pair to watch: GBP/JPY

Even for a pair notorious for its volatility, the moves in over the last month have been astonishing. After testing 6.5-year highs near 168.50 midway through September, GBP/JPY collapsed nearly 2000 pips in two weeks to test 18-month lows near 148.50…before rallying all the way back 2000+ pips to break above previous resistance in the 168.50 zone as we go to press.

There are still some big dominoes to fall on both the fiscal and monetary policy front, but a hotter-than-expected inflation reading could confirm the bullish breakout in progress and open the door for a continuation into the mid-170s or beyond as the monetary policy divergence between the two island nations continues to widen.

Source: TradingView, StoneX

Original Post

[ad_2]

Source link