Trump Vs. Harris Debate Aftermath: How Policy Stances Can Shape Portfolio Strategy

2024.09.12 10:11

The long-anticipated presidential debate has concluded, and now the real work begins: analyzing what it means for the stock market. While the debate generated a lot of political buzz, the financial markets remained relatively steady.

Polls show a tight race with no clear frontrunner, but the debate illuminated the key policy differences between the candidates – differences that could offer investors crucial insights into how to navigate the coming months.

A split government often benefits the stock market more than a single-party dominance.

Historical data suggests that markets perform better when control is divided between parties, as this typically leads to more balanced budgets and increased flexibility for the Federal Reserve to adjust monetary policy.

Below, we’ll analyze the differences in both candidates’ policies and the specific stocks or sectors that stand to benefit from them.

1. Nucor to Benefit From Import Tariffs?

The candidates’ positions on taxes, immigration, and trade are critical areas of divergence. In particular, tariffs could significantly impact specific sectors or individual stocks.

For instance, Trump’s proposed tariff hikes—60% on Chinese imports and 10% on other goods—could escalate the trade war with China and dampen global economic growth. However, domestic producers might benefit.

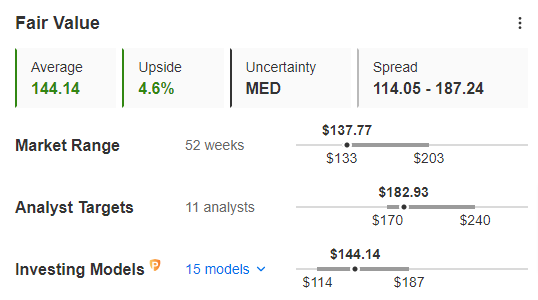

Take Nucor (NYSE:), a major U.S. steel manufacturer. Despite recent declines in net profit and a downward trend in stock performance, tighter tariffs could bolster its business.

Source: InvestingPro

The company’s financial health remains strong, with positive indicators from InvestingPro, suggesting it could see an uptick if tariffs increase.

2. Potential Upside for Centene Under a Harris Administration?

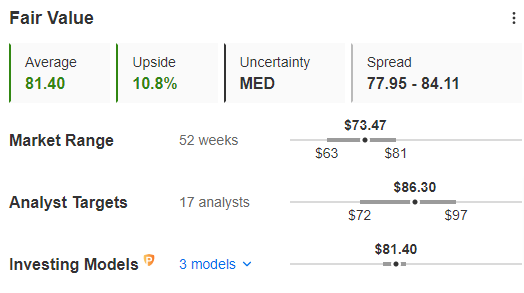

If Kamala Harris takes office, her focus on expanding government involvement in health care could benefit companies like Centene Corp (NYSE:).

Known for its government health programs, Centene might see growth if Harris pushes a left-leaning health agenda. The company’s solid financial health and over 10% growth potential make it an intriguing candidate for investors.

Source: InvestingPro

Technically, Centene’s stock is eyeing a key level around $81 per share. A break above this resistance could signal a return to an uptrend, with the next target around $92 per share.

Bottom Line

In summary, while the political landscape remains uncertain, the debate has highlighted important policy areas that could influence the market. Investors should keep an eye on how these policy differences play out and adjust their strategies accordingly.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.