Trump, SoftBank CEO announce $100 billion US investment, in echo of 2016 event

2024.12.16 14:00

By Jeff Mason and Steve Holland

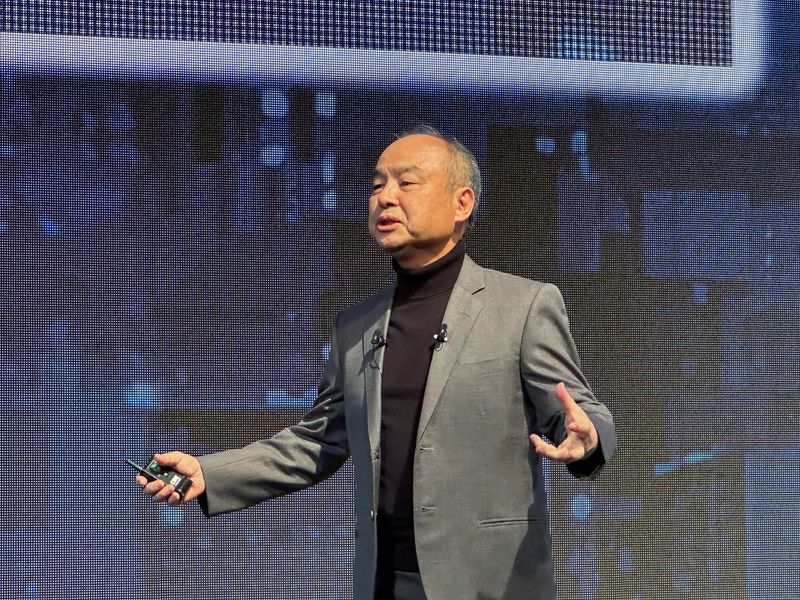

PALM BEACH, Florida (Reuters) -President-elect Donald Trump, with SoftBank (TYO:) Group CEO Masayoshi Son at his side, announced on Monday that SoftBank would invest $100 billion in the U.S. over the next four years in what would be a boost to the U.S. economy.

Trump said in his joint appearance with Son that the investment would create 100,000 jobs focused on artificial intelligence (AI) and related infrastructure, with the money to be deployed before the end of Trump’s term.

Trump said the investment was evidence of “monumental confidence in America’s future.” He playfully encouraged Son to make the investment $200 billion. Son chuckled and said that he would try.

The $100 billion pledge, made at a flag-bedecked event at Trump’s Mar-a-Lago club in Palm Beach, Florida, fits in with Trump’s vow to bolster the U.S. economy and reduce the effect of inflation on Americans during his second term, which begins on Jan. 20.

Trump called Son “one of the most accomplished business leaders of our time.”

The Monday announcement echoes a similar pledge Son made with then-President-elect Trump in December 2016 at Trump Tower, when Son said he would spend $50 billion and create 50,000 jobs.

While that money was eventually spent, it is unclear whether those jobs were created. The company has been rebuilding its finances after the failure of high-flying office-sharing startup WeWork (OTC:) and after some of the tech firms it is invested in through its Vision Fund unit fell out of favor among investors.

Trump has an affinity for splashy announcements promising thousands of jobs, even though such investments do not always pan out. Early in his first term he announced a $10 billion investment by FoxConn in a Wisconsin factory that promised thousands of jobs that was mostly abandoned.

It is unclear how SoftBank plans to fund the new investment. As of Sept. 30, SoftBank had about $29 billion in cash and cash equivalents, according to its most recent earnings report. After a sharp decline in shares between 2021 and 2023, its stock has recovered, gaining nearly 50% year-to-date.

The funding could come from various sources controlled by SoftBank, including the Vision Fund, capital projects or chipmaker Arm Holdings (NASDAQ:), CNBC said.

Son has been a strong proponent of the potential for AI and has been pushing to expand SoftBank’s exposure to the sector, taking a stake in OpenAI and acquiring chip startup Graphcore.

In October, Son reiterated his belief in the coming of artificial super-intelligence, saying it would require hundreds of billions of dollars of investment.

Son said at the time he was saving up funds “so I can make the next big move,” but did not provide any details.

Trump promised last week that he would extend fast-track permitting to any company that invests $1 billion or more in the United States.