Trade Tensions to ‘Trump’ Forex Seasonality This Month?

2025.02.05 04:56

February Forex Seasonality Key Points

- Most major currency pairs have seen quieter moves in February on average since 1971.

- The budding trade war and developments on the tariff front could well outweigh the modest historical seasonal tendencies in February.

The beginning of a new month marks a good opportunity to review the seasonal patterns that have influenced the forex market over the 50+ years since the Bretton Woods system was dismantled in 1971, ushering in the modern foreign exchange market.

As always, these seasonal tendencies are just historical averages, and any individual month or year may vary from the historic average, so it’s important to complement these seasonal leans with alternative forms of analysis to create a long-term successful trading strategy. In other words, past performance is not necessarily indicative of future results.

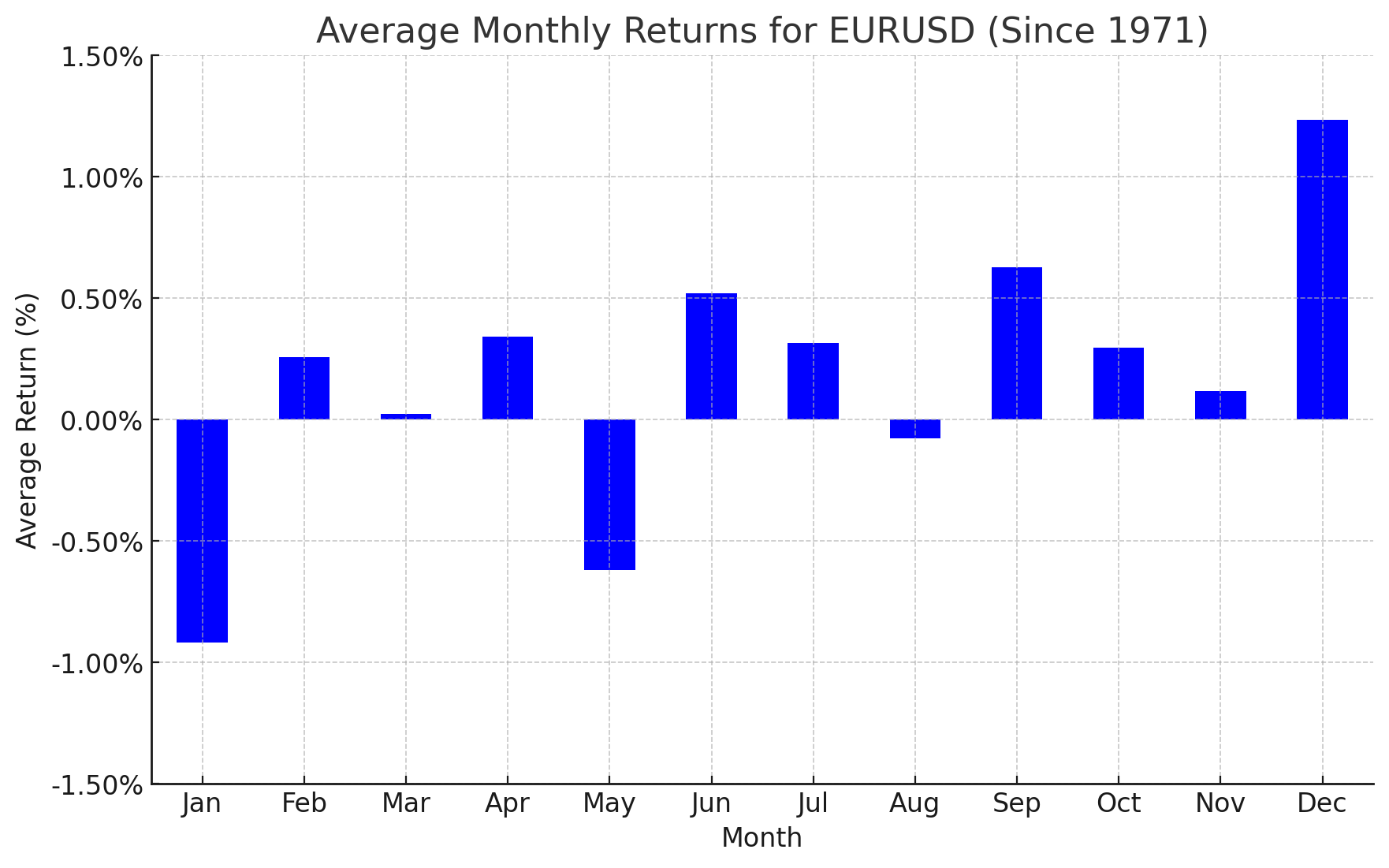

Euro Forex Seasonality – EUR/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Historically, February has been a middle-of-the-road month for , with the world’s most widely-traded currency pair sporting an average return of +0.26% over the last 50+ years. In January, EUR/USD bucked its historical trend for weakness, closing near flat after testing key support at 1.0200 midway through the month. For this month, traders will be hoping for a breakout from the pair’s new range between 1.02-1.06, though the seasonal chart above suggests we may ultimately see more consolidation.

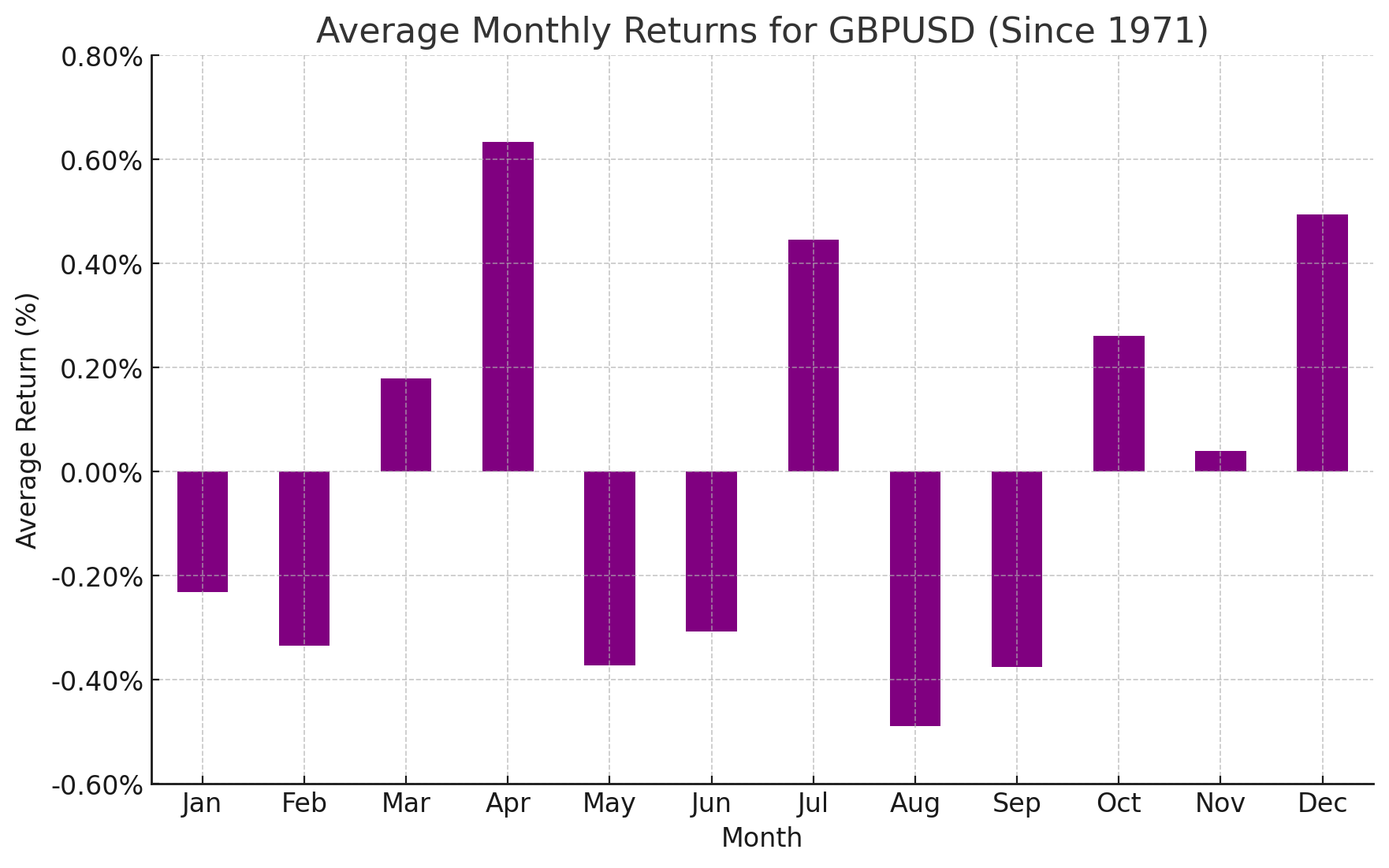

British Pound Forex Seasonality – GBP/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Looking at the above chart, has historically seen bearish price action in February, with average returns of around -0.33% since 1971. The British pound also fell sharply through the first couple weeks of the year before recovering heading into February. For this month, support in the 1.2250-1.2300 area will be the key “line in the sand” for bulls to defend to prevent steeper losses.

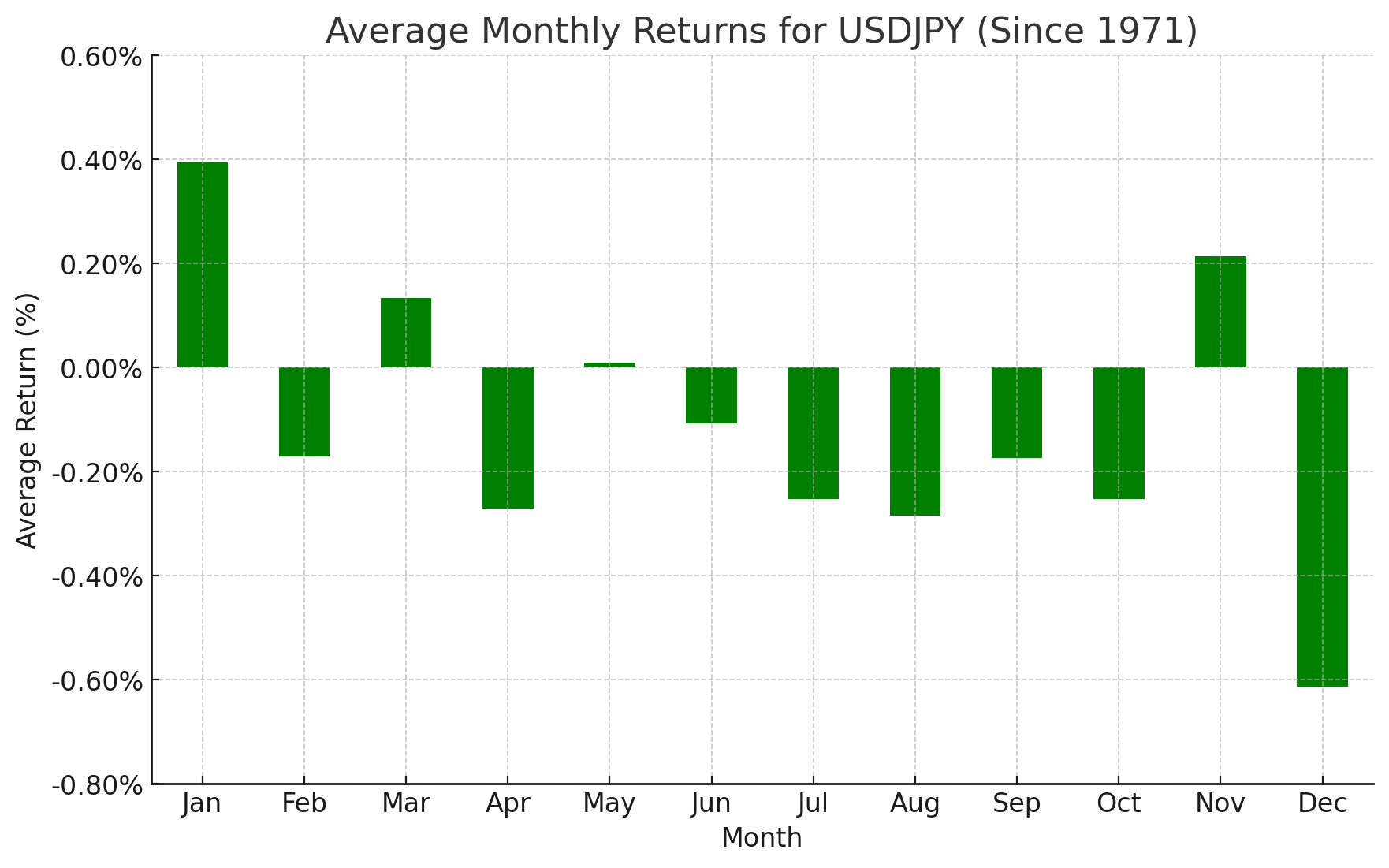

Japanese Yen Forex Seasonality – USD/JPY Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

February has historically been a modestly bearish month for , with the pair falling by an average of -0.17% since the Bretton Woods agreement, though ultimately this is near the average of the pair’s moves across all months in the sample period (-0.11%). With the Bank of Japan finally starting to raise interest rates and USD/JPY potentially breaking a bullish trend line off the September lows, there’s potential for even more downside from a traditional technical analysis perspective.

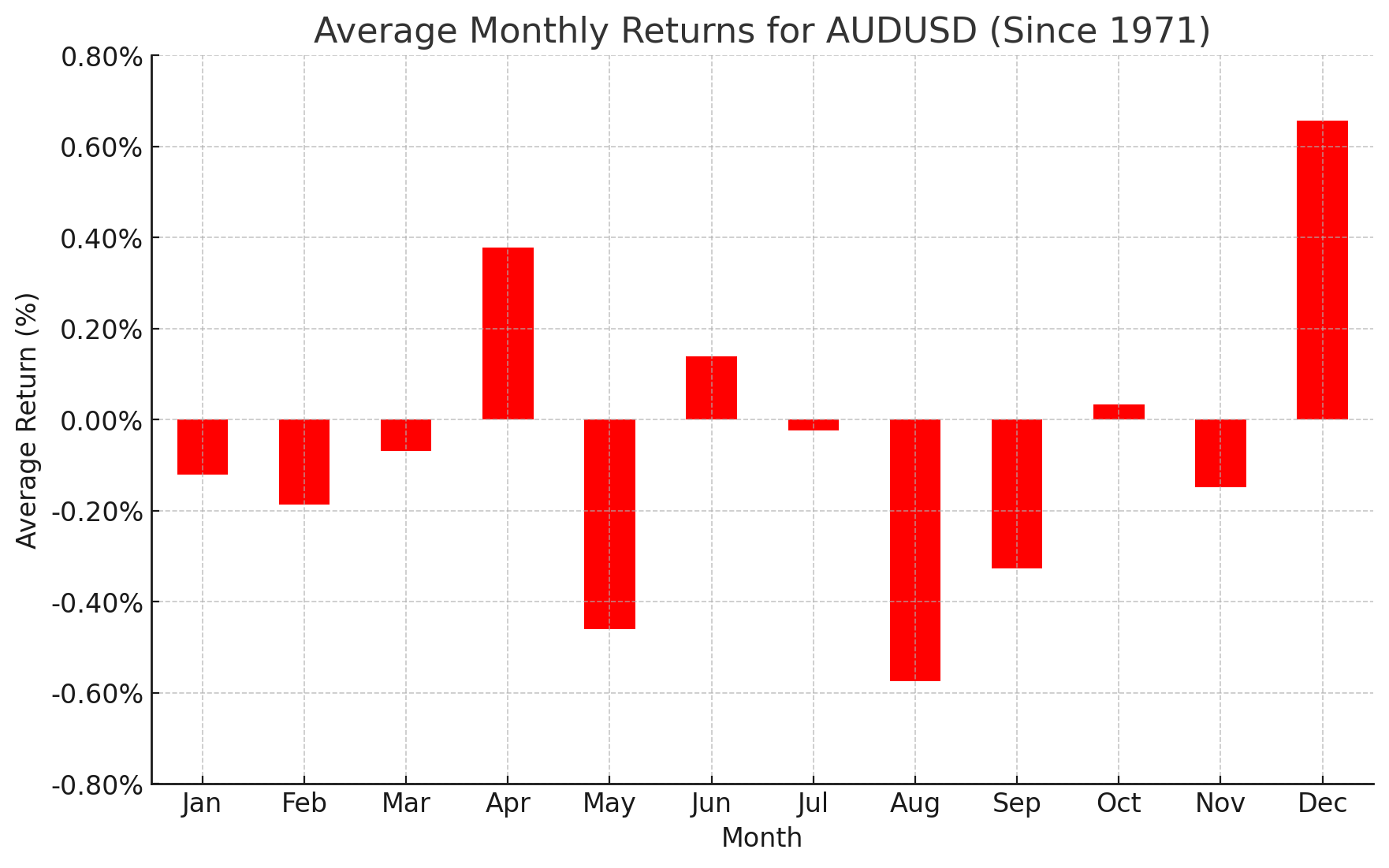

Australian Dollar Forex Seasonality – AUD/USD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Turning our attention Down Under, has also seen modest bearish returns in February, with an average loss of -0.19% across the month. Last month, AUD/USD just held above support at multi-year lows near 0.6170, raising bullish hopes for a bounce back in February; that said, a confirmed break of that support level would leave little in the way of near-term support until well below 0.6000.

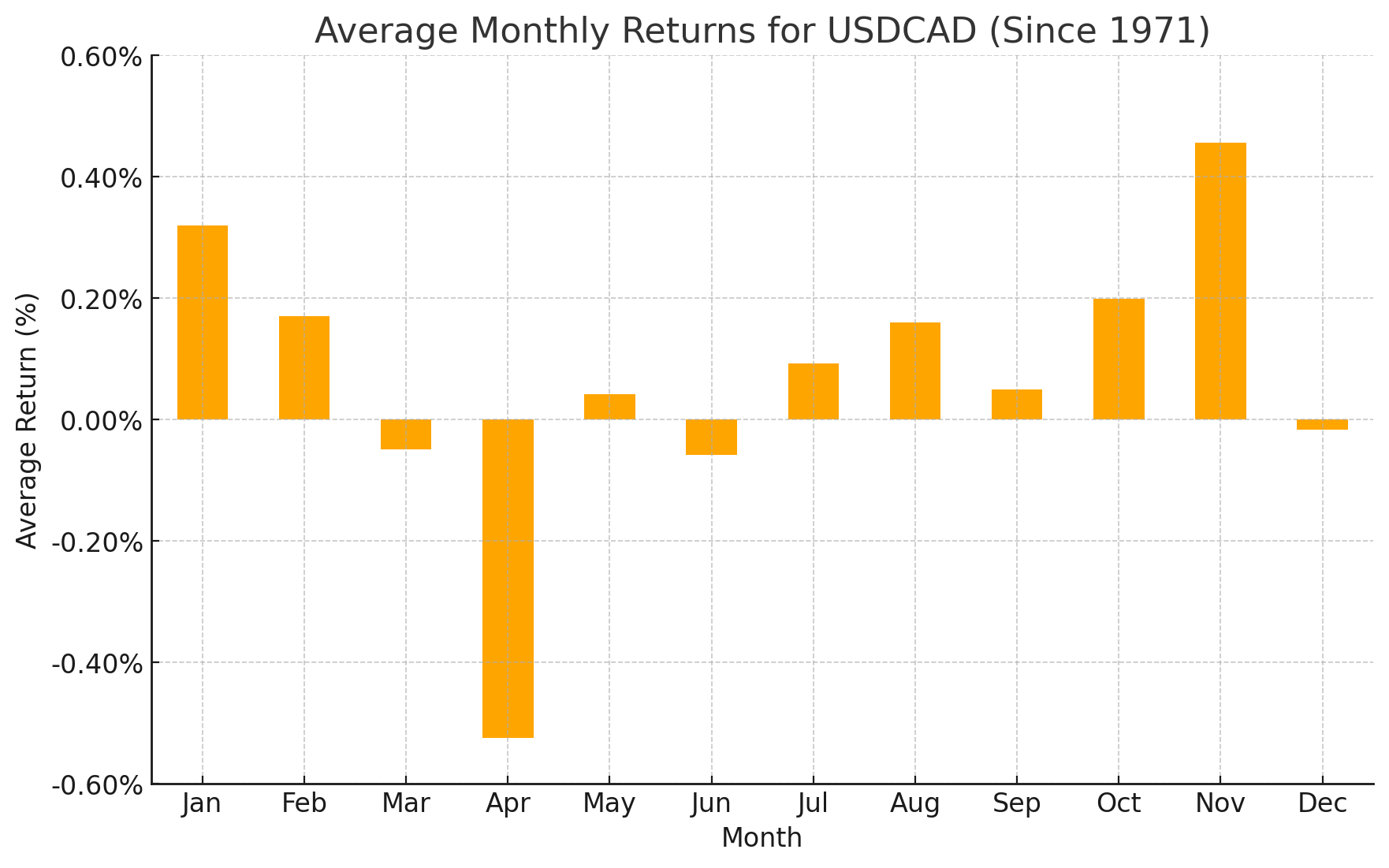

Canadian Dollar Forex Seasonality – USD/CAD Chart

Source: TradingView, StoneX. Please note that past performance is not necessarily indicative of future results.

Last but not least, February has been a slightly bullish month for going back to 1971, with an average historical return of +0.17%. While it can be useful to understand the historical seasonal tendencies in certain environments, the North American pair faces much more significant pressure from the budding trade war between the US and Canada, and those headlines will likely be a bigger driver for USD/CAD this month than the (rather lackluster) seasonal trend.

As always, we want to close this article by reminding readers that seasonal tendencies are not gospel – even if they’ve tracked relatively closely so far this year – so it’s important to complement this analysis with an examination of the current fundamental and technical backdrops for the major currency pairs.

Original Post