Top 3 Tech Stocks Poised to Surge Amid Growing Likelihood of Soft Landing Scenario

2023.08.17 07:54

- A soft landing is a more likely scenario, according to a survey by Bank of America

- There are three tech stocks you can consider buying if that scenario plays out

- The stocks are currently undergoing a corrective phase alongside the US indexes, nearing key support levels

August hasn’t been very kind to U.S. stock indexes so far as they continue to correct. Looking ahead, one of the major factors likely to steer the market in the coming months is the U.S. GDP trajectory.

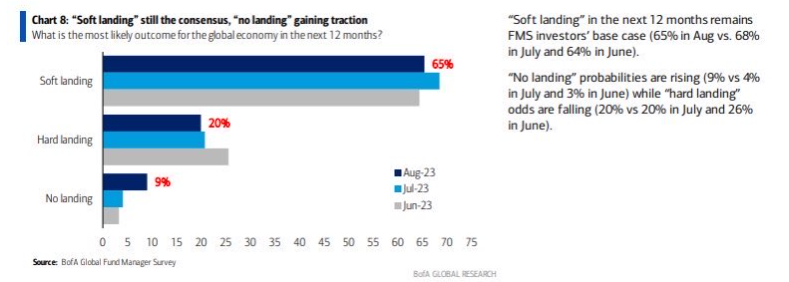

According to a survey conducted by Bank of America, around 65% of respondents predict a soft landing. Interestingly, this aligns with the signals coming from Treasury Secretary Janet Yellen and the Federal Reserve.

Survey of US Economy’s 12-Month Trajectory

Survey of US Economy’s 12-Month Trajectory

Source: BofA

The main argument to this viewpoint revolves around the consistent inversion of yield curve, which historically has been a reliable predictor of a recession.

However, if we assume the more optimistic scenario, which is a soft landing, three tech industry companies deserve our attention. They’re currently undergoing a corrective phase, yet they possess the potential to resume their upward trajectory if the soft landing scenario unfolds.

Let’s try and analyze them one by one.

1. Belden

Belden (NYSE:), a network component manufacturer, stands as one of the prominent suppliers of high-speed network cables in the United States.

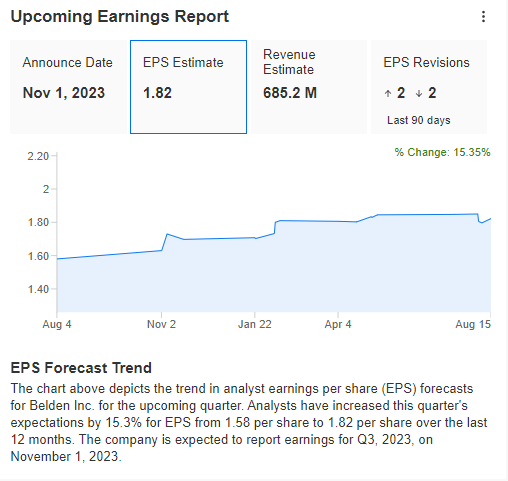

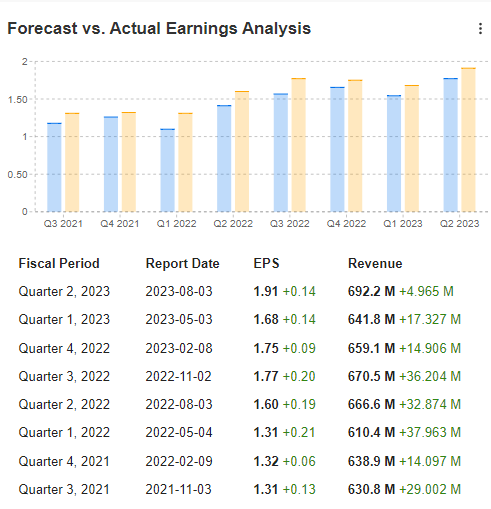

With a reputable brand presence and robust financial stability, the company adeptly meets its current financial commitments. Notably, Belden has consistently surpassed market expectations in its quarterly results and forecasts growth in earnings per share.

Belden Upcoming Earnings

Source: InvestingPro

Forecast Vs. Actual Earnings

Source: InvestingPro

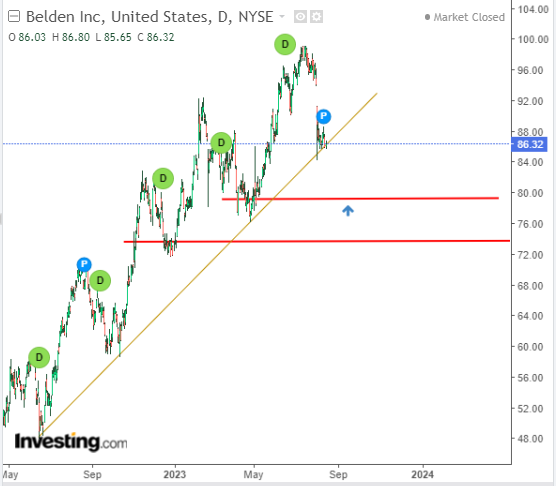

The stock’s correction phase might persist until it reaches the $80 range, which coincides with a significant demand zone. If this level is breached, it could trigger a decline toward the $73 mark.

Belden Daily chart

In the bullish scenario, a breakout toward new highs above $100 would be in the cards.

2. STMicroelectronics N.V

STMicroelectronics NV (NYSE:) stands as Europe’s largest chipmaker, poised to reap the benefits of increased investment in the semiconductor and integrated circuit industries across the continent.

The European Commission’s survey anticipates a doubling of chip demand by 2030, with a strategic focus on reducing dependency on non-EU suppliers.

To achieve this, the newly announced European chip act aims to mobilize over 40 billion euros to bolster the European market in this sector, positioning STMicroelectronics N.V. as a significant beneficiary.

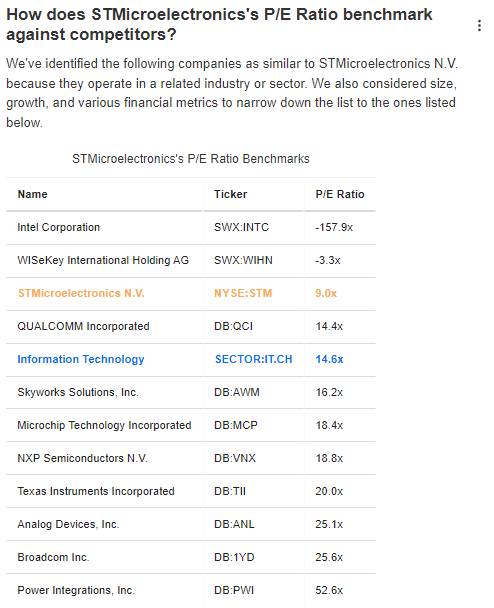

From a fundamental standpoint, STMicroelectronics showcases several positive indicators, with its price-to-earnings ratio currently at a competitive level compared to its peers.

STMicroelectronics P/E Ratio

Source: InvestingPro

Given the favorable economic factors and strong fundamentals, the continuation of the upward trend can be considered a baseline scenario.

3. Vishay Intertechnology

Vishay Intertechnology (NYSE:) is a prominent manufacturer of electronic components and passive semiconductors, enjoying a significant presence in this sector with a diverse customer base across various regions.

Just recently, the company’s leadership unveiled plans to establish a cutting-edge resistor factory, a move poised to substantially enhance its production capacity in this domain. If executed according to plan, this long-term endeavor should bode well for the US-based manufacturer.

The stock price has remained in an uptrend for a while, before undergoing some expected correction. The ongoing corrective phase is currently approaching a solid support level near $26.

Vishay Tech Price Chart

As the stock continues its descent, it’s prudent to keep an eye on how the stock reacts to upcoming support around $24.

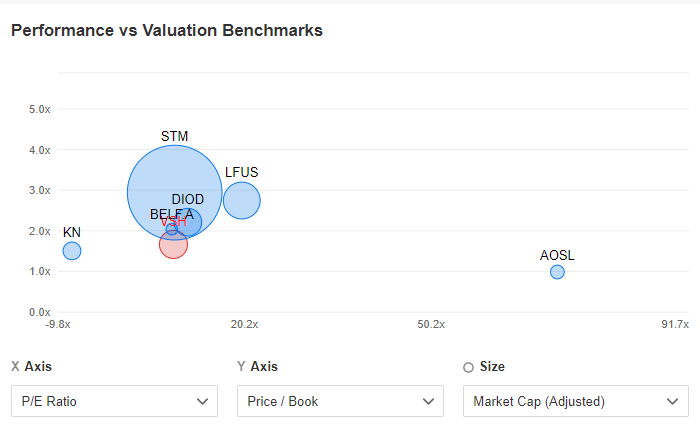

Additionally, it’s noteworthy that the company’s fundamental metrics, including price/earnings and price/book value ratios, are quite decent in comparison to the broader sector. This is despite the stock’s previous rally.

Vishay Technology Peer Comparison

Vishay Technology Peer Comparison

Source: InvestingPro

***

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor’s own.