Time to Buy This 4.6% Tax-Free Dividend as Powell Hits Pause

2023.08.29 05:51

There’s a crop of outsized dividends out there that are absurdly underpriced—I’m talking 14%-off discounts here. And our opportunity to pounce has arrived.

I’m talking about municipal bonds, which, like corporate bonds, look set to bounce as the economy slows and interest rates top out—then start to move lower. As rates ease off, bond yields will dip, putting a lift under bond prices (as yields and prices move in opposite directions).

The upshot? AI-powered stocks will lose their luster, and bonds and bond proxies—including utilities and “munis”—will likely be the darlings of 2024.

Heck, even a modest decline in rates would be enough to boost these assets. Which is why we’re loading up on them now. (I gave you some utilities with growing dividends to target in .)

I know, I know. Municipal bonds, issued by state and local governments to finance infrastructure projects, don’t exactly get most folks’ hearts racing. But that’s not their job. Instead, these “recession-resistant” plays should be a cornerstone of your portfolio due to their stability.

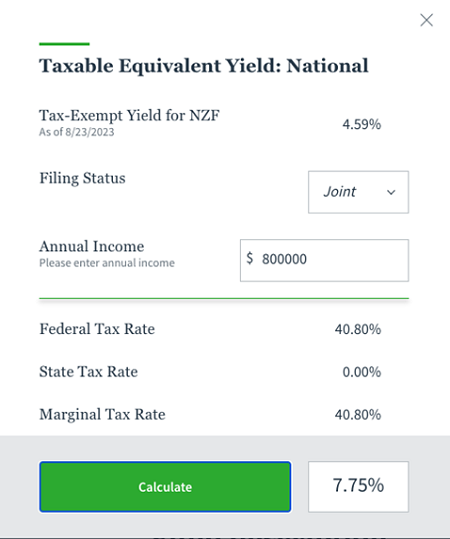

The biggest draw here is that munis don’t attract Uncle Sam’s attention: most Americans pay zero taxes on their muni dividends. This is no small detail: the 4.6% yield on the Nuveen Municipal Credit Income (NYSE:), for example, amounts to a whopping 7.75% for a top-bracket filer filing jointly:

NZF Tax Adjusted Yield

Source: Nuveen.com

Plus we get to buy cheap when we pick up our munis through closed-end funds (CEFs). Which we always do, for a bunch of reasons, starting with the fact that the small and insular world of munis is tough for us to access on our own, so doing so through a fund is the best option here.

Moreover, CEFs pay much bigger dividends than muni-bond ETFs. The go-to muni-bond index fund, theiShares National Muni Bond ETF (NYSE:), for example, yields just 2.5% today.

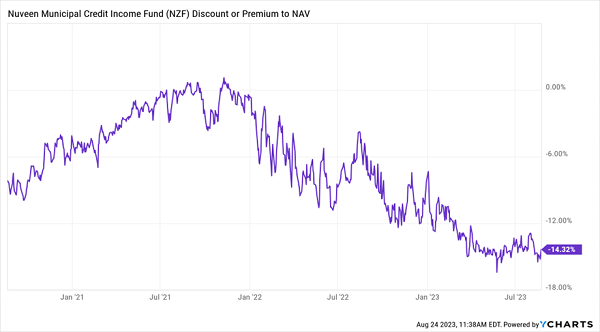

Finally, investors have been slow to pick up on the coming “rates-down-bonds-up trend,” leaving us some terrific deals on muni CEFs. NZF, for example, trades at a 14.3% discount to net asset value (NAV, or the value of the muni bonds in its portfolio) today. That’s far below its 6.6% discount over the last five years.

NZF Drops to the Bottom of the Bargain Bin

NZF Discount NAV

In other words, just a move back to that 6.6% average discount would imply a 9% price gain. And that’s before we account for potential gains from the coming “rate rollover.” That, of course, is also in addition to NZF dividend—7.75% on a taxable-equivalent basis for our top-bracket ballers.

ETFs? They never go on sale, so you’re stuck relying only on portfolio gains for upside.

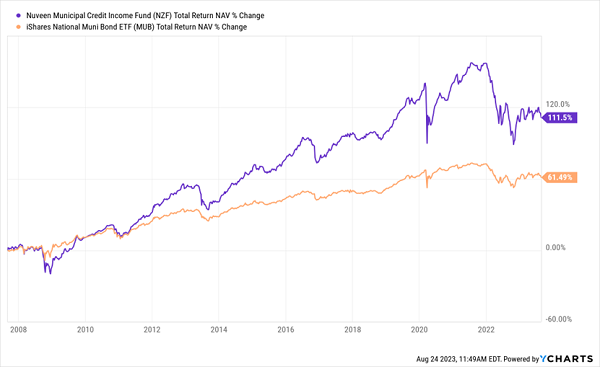

In terms of performance, NZF has a 22-year history behind it, having been launched in 2001. Moreover, its NAV return (or the return of its underlying portfolio) has easily beaten MUB since the latter was launched in ’07:

NZF’s Managers Crush the Benchmark

NZF Outperforms

Truth is, we expect benchmark-beating returns from a muni CEF because the muni-bond market is tiny compared to the stock market, and the best of these funds have managers with deep connections, which is key to getting the best new issues. That’s an edge a “robotic” ETF like MUB simply can’t match.

Finally, NZF’s payout looks safe: its bond portfolio boasts an average coupon of 4.1%, just a hair below its 4.2% yield on market price. It gets better: because of the fund’s discount, its yield on NAV (or the yield on its underlying portfolio, in other words), is just 3.9%. That’s key because it’s the yield on NAV, not on the discounted market price, that management needs to earn to fund our 4.2% (before tax advantages) payout.

The bottom line here is that if you’re looking to bulk up your muni-bond holdings, NZF is a solid pick. And as I mentioned a second ago, its 14.3% discount won’t last: it’s just too low compared to the historical average.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”