Tiger Management May Have Just the Right Portfolio for an Eventual Fed Pivot

2023.05.11 06:49

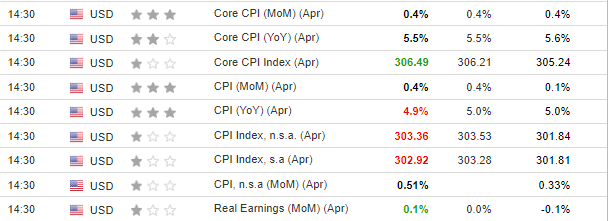

- US inflation data did not provide a clear answer on a possible Fed pivot.

- The market continues to price in the start of rate cuts as early as September.

- Technology portfolios stand to gain the most if the market scenario plays out. Will Tiger Global Management return to an upward trajectory?

Yesterday, the market received the US inflation data with moderate optimism. The session ended with the index up 0.45% and the up 1.04%.

The reading, at 4.9% year-on-year, was lower than the forecasted 5%. However, the Federal Reserve remains concerned about the high , which stands at 5.5% year-on-year.

Economic Calendar

In the event of rapid interest rate cuts in September, the stock market could rally, and technology companies could be the primary beneficiaries.

Julian Robertson – A Financial Markets Legend

Julian Robertson, considered one of the most prominent investors in history, died last August at 90. He began his serious investment career in 1980 by founding the Tiger Management Fund with $8.8 million in capital.

As a result of an impressive average annual return of 32%, the fund’s capitalization reached $22 billion in 1998.

A year after the fund closed in 2000, the next iteration of the firm was Tiger Global Management, which still exists today and was founded by one of the analysts who grew up under Julian Robertson’s wing – Chase Coleman III.

Currently, the firm’s capital is divided between two strategies, one of which is investing in publicly traded companies.

According to a report available as of February 14, 2023, the fund’s portfolio primarily includes companies in the technology sector, with the biggest stake in Microsoft (NASDAQ:).

With our InvestingPro tool, we will take deep dive into Tiger Global Management’s portfolio structure. Readers can do the same for virtually every company or fund in the market just by clicking the following link.

Will Tiger Global Management Rebound After a Weak 2022?

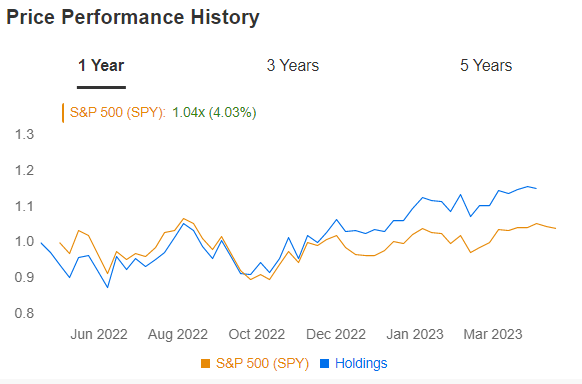

2022 was a year to forget for this fund, which lost more than 50% of its value as the stock market entered a bear market.

Despite this, the portfolio has rebounded for the past six months and outperformed the S&P 500 over the same period.

Investment Portfolio Vs. S&P 500

Source: InvestingPro

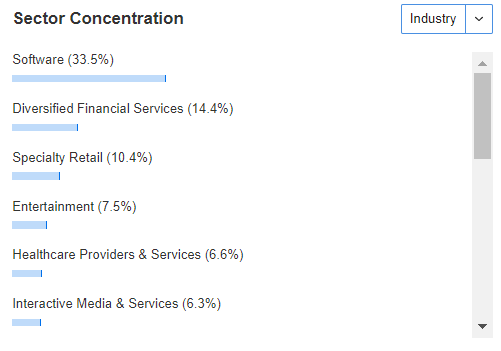

Looking at the sector breakdown, Tiger Global Management’s biggest exposure is to Software (33.5%) (of which Microsoft is 11.6%) and Financial Services (14.4%).

Other notable holdings include Visa (NYSE:) and Mastercard (NYSE:) (12.2% combined). Both are globally well-recognized companies that can provide stability to the portfolio.

Investment Portfolio Structure

Source: InvestingPro

Based on the current holdings, technology giant Microsoft is crucial to the portfolio’s overall performance.

Microsoft Impresses With Revenues and Profits

The US tech giant has been on an uptrend since the beginning of the year. As a result, it has already managed to make up more than half of the losses stemming from a disastrous 2022.

Technically, the demand side is attacking a strong supply zone in the $312 area.

MSFT Daily Chart

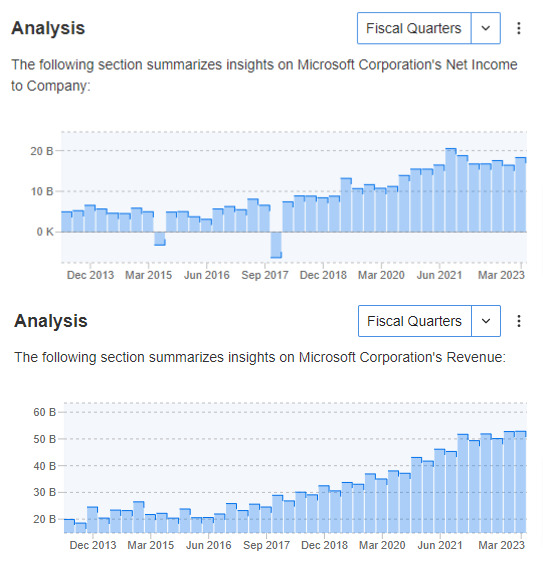

Fundamentally, the company stands out with its stable and relatively high revenues and profits compared to the pre-pandemic period.

Microsoft Revenue and Net Income

Source: InvestingPro

In the most likely scenario, the stock is expected to break through the current resistance and continue its uptrend toward the previous high at around $350 per share.

However, on the downside, a temporary pullback to $295 is likely if the stock fails to break out.

Are you seeking more actionable trade ideas to navigate market volatility? The InvestingPro tool helps you easily identify winning stocks at any given time.

Start your 7-day free trial to unlock must-have insights and data!

Here is the link for those who would like to subscribe to InvestingPro and start analyzing stocks or legendary investors’ portfolios themselves.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any type of asset is evaluated from multiple points of view and is highly risky; therefore, any investment decision and the associated risk remain with the investor.