Threat of tariffs will loom large amid auto, tech glitz at CES

2025.01.03 06:32

By Abhirup Roy

SAN FRANCISCO (Reuters) – Auto and tech giants showing off their latest innovations at the CES trade show in Las Vegas next week can expect a barrage of questions on a topic that is usually not central to the consumer-focused event: tariffs.

The gathering is one of the largest of manufacturers, analysts and suppliers in the United States and comes days before the inauguration of President-elect Donald Trump, who has pledged big tariffs on imports from Canada, Mexico, China and other U.S. trading partners. This has sparked concerns about spiraling costs for businesses as well as consumers.

“This will be a hot topic,” said strategy consultant Deborah Weinswig, CEO of Coresight Research, who said the proposed tariffs have come up in almost every conversation she has had with clients ahead of CES. “This is going to be something that definitely senior leadership is going to have to address.”

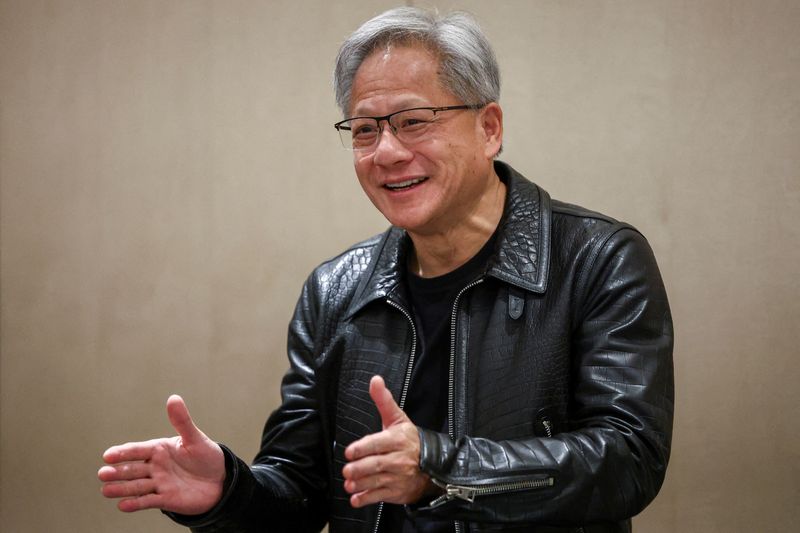

CES 2025, formerly known as the Consumer Electronics Show, runs Jan. 7-10 and is used to debut products ranging from new automotive technology to quirky gadgets, as well showing new ways to use artificial intelligence. Among the highlights this year is a keynote speech from AI chip giant Nvidia (NASDAQ:)’s celebrity CEO, Jensen Huang.

While AI will still be the buzzword on the show floor, the issue of tariffs will be top-of-mind in policy sessions, press conferences and on the sidelines.

Companies may be asked about changing suppliers and moving production to the United States to mitigate supply-chain disruptions – moves that take time and are expensive, analysts have said.

Honda (NYSE:), for instance, sends 80% of its Mexican output to the U.S. market. It has warned it would have to think about shifting production if the United States were to impose permanent tariffs on vehicles imported from the country.

Nearly half of new cars sold in the U.S. as well as a significant share of parts on the rest are made elsewhere, according to estimates from Edmunds. European and American carmakers could lose up to 17% of their combined annual core profits if the U.S. imposes import tariffs on Europe, Mexico and Canada, according to an S&P Global report.

PLANNING IN HYPER MODE

In addition to tariffs, Trump has said he plans to begin rescinding policies meant to promote the adoption of EVs.

Many suppliers, already struggling because of weaker than expected EV demand, are operating on “razor-thin” margins and will have to radically adapt their cost structure this year in the face of potential tariffs, said Felix Stellmaszek, global leader of the automotive and mobility sector at Boston Consulting Group.

“Add to this supply-chain uncertainties and labor shortages and it’s clear that many suppliers are in dire straits,” he said. “The scenario planning is in hyper mode.”

Between responding to potential tariffs, automakers and their suppliers – including Honda, Toyota (NYSE:), Bosch (NS:), and Continental – are expected to provide updates on their race to develop cars with software-driven enhancements, self-driving technology and AI that makes vehicles easier and safer to drive.

Among the speakers will be Delta Air Lines (NYSE:) CEO Ed Bastian, Volvo (OTC:) Group CEO Martin Lundstedt, Panasonic (OTC:) CEO Yuki Kusumi, and X Corp CEO Linda Yaccarino. Every industry is likely to face questions about tariffs.

“‘How are companies going to work together from a supply-chain perspective?” said consultant Weinswig. “How are we going to mitigate rising costs? Can technology solve this? There’s still so much that’s not known, we’ve seen that everyone’s trying to figure out every possible scenario.”