This Tool’s Sell Signal Saved Investors From 35%+ Drawdowns in These Stocks

2024.07.19 08:16

- Long-term investing success is about learning to protect profits.

- Wise investors know when to book profits in a stock that is overvalued.

- In this article, we discuss a tool that can help investors achieve exactly that.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Savvy investors would know that holding the bag on overbought winners for too long is the fastest way to give away an otherwise great year of profits.

A classic example is Peloton (NASDAQ:) – one of the pandemic-era darlings. Investors who bought it at the high of the Covid crash and sold it in 2021 made a life-changing 300% gain on the trade. However, those who missed the sell signal and kept on holding the stock until today have not only given back all their gains but also lost a massive 87% on their initial investment.

Now, with on the rise and the rotation out of tech and mega-cap stocks in full swing, staying long in the wrong stocks might be becoming a more dangerous game by the day again.

But how can you prevent that from happening with the stocks you’re currently holding?

There’s only one way: by knowing the true value of that asset at the current point in time.

While that may seem complicated at first look, the good news is that it has gotten much simpler with our state-of-the-art Fair Value tool – available for less than $8 a month as part of our summer sale using this link.

By deploying the best-in-breed combination of fundamental and technical metrics, including 17+ industry-recognized evaluation models, this tool can tell you at the click of a button whether it is time to buy or ditch any given stock in the market.

In fact, our users have already been benefiting from this trend in a big way, both on the ups and downs of the market.

Check these real-life cases for more details on how it can change the game for you.

1. Insulet: Fair Value Foresaw the Downward Spiral, Now Signals Potential Bottom

Insulet Corporation (NASDAQ:), a developer and manufacturer of insulin delivery systems, was on the brink of a relentless downtrend that left investors wondering where the bottom might be.

When the stock was trading at $315.16 in March 2023, our fair value tool sent a timely sell signal, accurately predicting a downside of 37.21%. True to form, the stock plummeted over 40%, leaving it near $194 today.

The burning question on investors’ minds now is: has Insulet reached its fair value and is a bottom in sight? This is precisely where our fair value tool shines again.

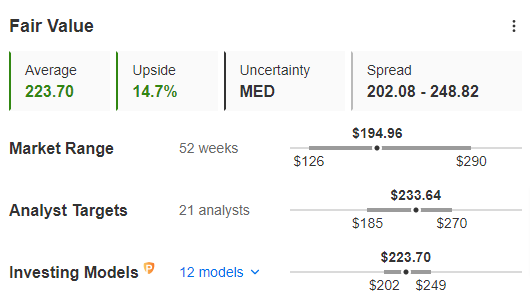

Our tool currently indicates a potential upside of 14.7% from current levels, placing the fair value target near $223.

Source: InvestingPro

Analyst sentiment appears even more bullish, with a target price of $233. Based on this assessment, Insulet appears to have finally hit its fair value and could be poised for a bounce. This coincides with a recent upgrade by Zack’s rating to a strong buy.

With these factors aligning, could Insulet’s downtrend be nearing its end? While only time will tell for sure, our fair value tool’s past accuracy and the current bullish signals offer a compelling reason for optimism.

2. MarketAxess Holdings: Fair Value Saves Investors From a 39% Loss

MarketAxess Holdings (NASDAQ:), a global electronic trading platform for institutional investors, was on a tear. On January 26, 2023, the stock hit $369 amid a short-term rally.

Little did anyone know, except for the fair value tool, that a long-term sell-off was about to begin. This tool, with uncanny foresight, signaled a downside of almost 42% at that critical moment.

This timely warning gave InvestingPro subscribers invested in MarketAxess a chance to exit before the selloff ensued. Those who heeded the signal avoided a hefty loss – the stock has since plummeted 39% since and currently trades around $221.

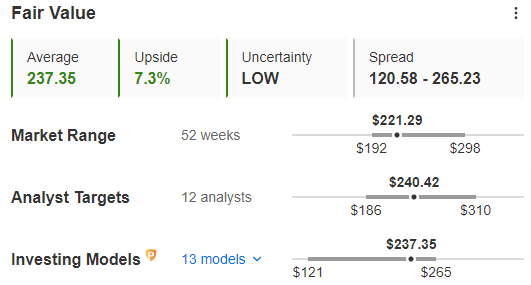

Currently, the tool is predicting a 7.3% upside for the stock after it has already gained about 4% this week, hinting at a potential rebound that could be in the offing.

Source: InvestingPro

This is just one example of how our fair value tool empowers investors.

Subscribe now for less than $8 a month using this link to see all other overvalued stocks right now!

Bottom Line

With so many possible headwinds ahead for the stock market, such as extended valuations, election-driven volatility, and earnings, now might be the time to bullet-proof your portfolio by selling overvalued stocks and buying only true value plays.

There’s no excuse for bag-holding a stock for too long anymore; subscribe now for less than $8 a month and know the true value of all stocks in the market.

*Subscribe via this link with an extra 10% discount using our exclusive coupon code OAPRO1.

Disclosure: The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.