This ‘Crisis’ Isn’t Much of a Crisis for the Financial Sector

2023.03.28 03:57

Looking at the two blog posts from this weekend, I realized the key data metrics weren’t updated as of Friday night’s close.

S&P 500 data:

- The forward 4-quarter estimate fell to $221.34 from $221.49 the prior week and versus $221.91 as of 12/31/22;

- The PE ratio on the forward estimate is 17.9x vs. 17.7x vs 17.2x as of 12/31/22;

- The S&P 500 earnings yield is 5.57% vs. last week’s 5.66% and, as of 12.31.22, 5.81%;

S&P 500 EPS grew 5% in 2022 and is currently expected to grow 2% in 2023 as the current estimates stand.

This weekend, the difference between the expected 2023 technology sector earnings growth and the returns of some key tech ETFs were highlighted here.

After thinking about it for a bit, the same should be done for the financial sector.

Here’s the financial sector’s annual EPS growth and what’s expected for 2023 as of 3.24.23:

- 2023: +12% EPS growth expected

- 2022: -13.2% (actual)

- 2021: +65.7% (actual)

Source: IBES data by Refinitiv (2022 actual results aren’t final until 3.31.23).

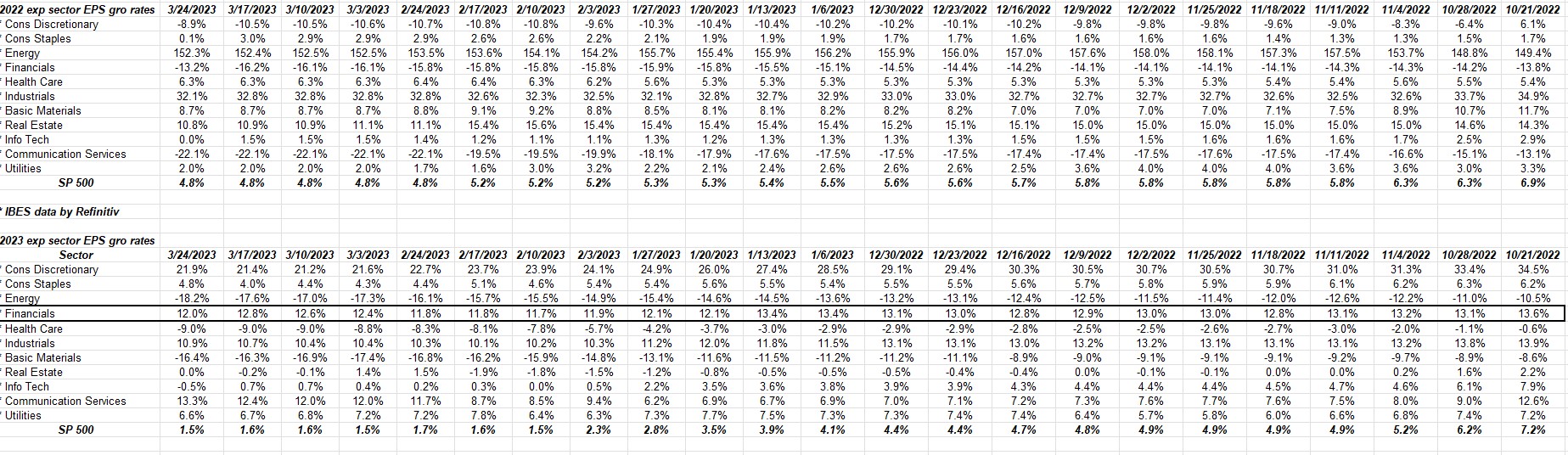

SP 500 EPS Growth By Sector

SP 500 EPS Growth By Sector

This table, updated weekly from IBES data by Refinitiv, shows the progression of the financial sector (NYSE:) EPS changes for 2023 since last fall.

Obviously, we are most interested in what’s happened since March 6, 2023, or around the collapse of Silicon Valley Bank (SIBV). As readers can see, there has been very little degradation in the expected earnings growth rate of +12% for 2023 (so far).

Maybe this “crisis” won’t be much of a crisis at all for the banking system, but if you’re keeping an eye on that discount window borrowing at the Fed – like the church confessional – it’s a window into which banks might have issues.

One thing I learned about Covid and the revenue and EPS estimates put out by Wall Street, when there’s an exogenous shock or a one-off event, modeling with accuracy goes right out the window.

Q1 ’23 S&P 500 earnings start with the big banks and financials in 2-3 weeks. Becky Quick and Joe Kernan had Mike Mayo on @CNBC before the market opened Monday morning, March 27th, 2023, and he thought that the “mismatch” issue would cost the banks 3% of their EPS over 3 years (not sure if that was each year or cumulatively), but either way it struck me as being a smaller amount than expected.

Take this all with a healthy skepticism. It can all change very quickly and without much warning. More detail to come this weekend, maybe before.