This 14%-Yielding Fund Is Anything But Junk

2023.04.24 08:15

We’ve got a sweet opportunity to grab a 14% dividend sitting in front of us, and we can thank the ongoing sale on bonds for this deal.

This double-digit payer—which has held that huge payout steady for years—holds junk bonds, or corporate debt that falls below the investment-grade line.

Isn’t there more risk here? Sure. But we’re well-compensated by the big yields junk bonds pay. Heck, even the yield on the benchmark SPDR® Bloomberg High Yield Bond ETF (NYSE:) is a healthy 5.8% now.

But JNK really is for novice investors. When we go with CEFs like the one we’ll delve into in a moment, we can boost our payout by more than double, to 14%—and get paid monthly. Plus we can get this outsized payout while cutting our risk.

2022 Mess Masks Junk Bonds’ Appeal

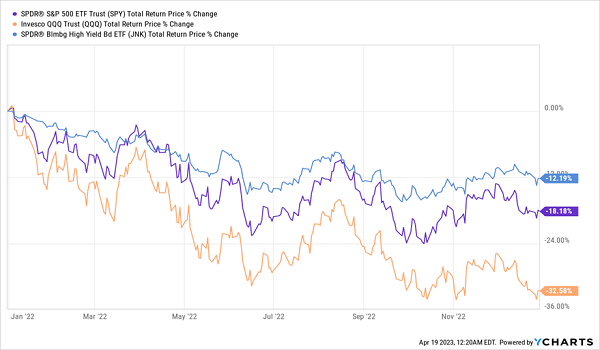

With the pummeling corporate bonds took last year, you can be forgiven if you want to avoid the space entirely. But look closer at the 2022 results for bonds—shown by JNK in blue below—as well as for NASDAQ benchmark Invesco QQQ Trust (QQQ), in orange, and the SPDR® S&P 500® ETF Trust (ASX:), in purple.

Bonds Offer Lower Volatility in Down Times

Bonds-Less-Volatile

While everything fell sharply in 2022, junk bonds fell much less and actually avoided the bear market (technically defined as a 20% drop from the most recent high).

The reason for junk bonds staying afloat for longer is that they provide cash flow to investors: the regular interest payments from bond issuers (mid-sized and large U.S. companies, in the case of JNK) offset the panic you get in short-term selloffs. That makes them a good alternative in uncertain markets.

And with corporates still down about 15% from their recent high, we have a nice window in front of us here. But as mentioned, JNK is not our best play. Instead we’re going to go with the Brookfield Real Assets Income Fund (RA), a 14.2%-yielding junk-bond CEF with an incredible history.

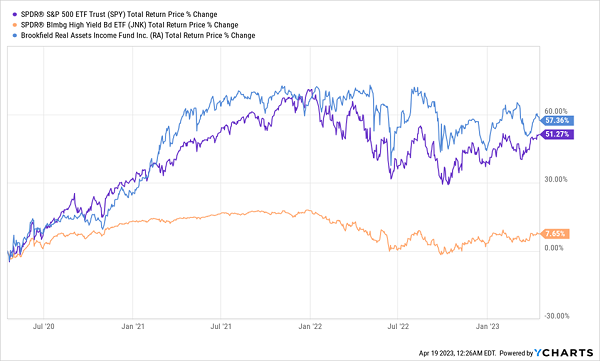

As you can see below, RA (in blue below) not only beat bonds (in orange) but also the S&P 500 (in purple) over the last five years, with dividends included:

Crushing the Indexes

RA-Outperforms

Sure, the S&P 500’s 51.3% return is close to what RA delivered, but what’s really important here is that the S&P 500’s sub-2% income stream is a fraction of RA’s dividend yield. This means that over the last three years—one of the most volatile periods in stock-market history—RA holders got essentially all of their return in safe dividend cash.

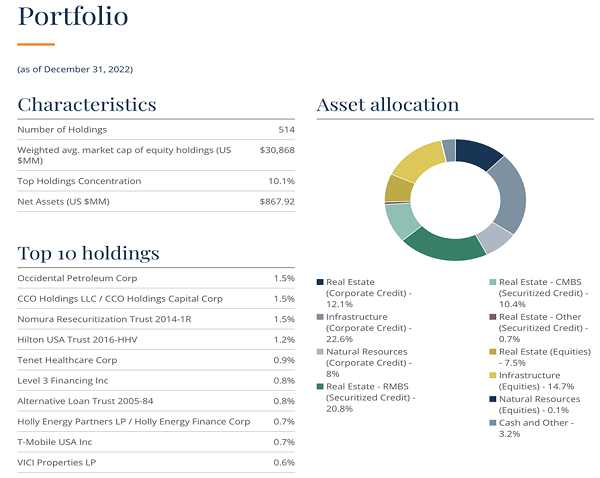

RA-Holdings-Data

Source: Brookfield Asset Management

RA maintains that income stream by collecting income from its bonds, then passing it to investors in the form of monthly dividends.

RA’s diversification is both its strength and its defense against uncertain markets. With half of its assets in bonds and debts connected to real estate, the fund’s income stream is backed by physical properties being rented out. And since RA uses the bond market instead of investing in real estate directly, it’s not exposed to rising rates in the same way the mortgage market is.

That has helped the firm maintain payouts at the same level since its inception at the end of 2016. In other words, RA shareholders have been getting a yield of 10% or higher for years, even though many so-called experts say that’s impossible.

Except, of course, it isn’t. RA has been cleverly rotating its portfolio as rates rise so it sells older bonds that yield less (since they were issued when rates were low) and buys new bonds and other kinds of debt that pay higher rates of interest. That’s made RA’s income stream more secure, not less.

One more thing: as I write this, RA trades at a 10% premium to net asset value (NAV, or the value of its portfolio). Even though we don’t like to pay premiums for CEFs, the key thing to pay attention to here is the current premium in relation to historical trends.

And with RA trading at around a 10% premium, on average, over the last five years, this price is acceptable in light of the overselling of corporate bonds in the last 16 months, RA’s high yield and the team of experts behind it. (Brookfield is a real estate juggernaut with $800 billion in assets and more than a century of experience.)

Finally, there are plenty of other junk-bond CEFs out there, so RA shareholders can hold it for years, then, when the time comes, swap their high-yielding shares for another high-yielding CEF trading at a lower premium (or ideally a discount). Rinse and repeat.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”