This 1-Click Buy Crushes the 60/40 Portfolio, Pays 8% in Cash

2024.09.02 06:43

Just a week ago, I wrote to you about the dangers of investing in a tired investor go-to called the 60/40 portfolio.

You know the one—the so-called “rule” that you should invest 60% of your holdings in stocks and 40% in bonds to reduce your overall volatility.

But investing this way—according to arbitrary standards like 60/40—is a recipe for leaving money on the table, especially when we’ve got a terrific way to get a much bigger dividend stream from stocks, which we’ll get to in a moment.

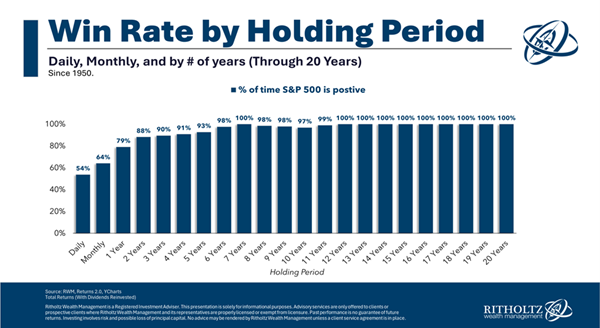

Your Odds of Long-Term Profits in S&P 500 Stocks? 100%

I’m coming back to this topic so soon because I recently read Ben Carlson’s fantastic analysis of the 60/40 portfolio. It tells us something every investor should be aware of:

If you were to, say, skip the 60/40 portfolio and invest only in stocks (and by stocks, I mean the S&P 500 broadly) for 12 years or longer, we’d have a 100% probability of earning a profit. Or at least that’s what history tells us. See Carlson’s chart:

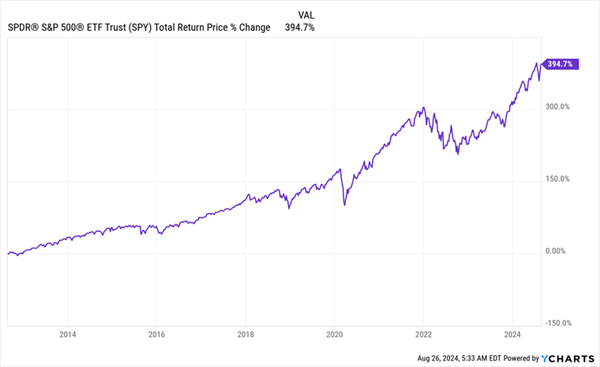

Plus, if we go back the last 12 years, we can see those profits are very strong indeed:

Stocks Deliver in the Long Run, Even With Volatility

That means if you avoid or downplay stocks, you’re missing out. Most millionaires (and billionaires, of course) know this, which is why they invest in stocks more than the middle class does.

The 60/40 Portfolio Doesn’t Work Anymore

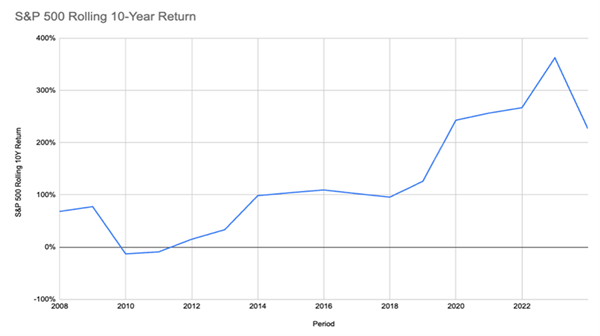

Carlson also points out that the 10-year returns for the 60/40 portfolio “have been impressive,” noting that the 60/40 portfolio returned 116% over the last 10 years, which sounds good by itself.

I do disagree with him here, because that return pales in comparison to what you’d get by owning just the S&P 500 over that span:

Source: CEF Insider

The performance shown above amounts to a much bigger 226.5% return by the end of 2022.

In fact, stocks outran the 60/40 portfolio in all but three years over the last 25: In 2010, 2011, and 2012. But of course, these were short-term phenomena. Investors who ignored that and leaned more toward stocks did much better than the 60/40 crowd.

Now don’t take this to mean we’re arguing against a diversified portfolio here—absolutely not! (My CEF Insider service recommends 8%+ yielding funds that invest in stocks, as well as corporate bonds, municipal bonds, real estate investment trusts, preferred stocks and more.)

The takeaway is this: The 60/40 portfolio may cut your volatility, but if you’re blindly following it, you’re leaving money on the table compared to another, more personalized approach that better fits your investment goals and temperament.

What About Income?

The 60/40 portfolio was invented to help mitigate volatility. Long ago, when the stock market was less well understood, the 60/40 portfolio seemed like a smart “let’s do this just in case” idea. And since deep-data analysis wasn’t as easy in the ’80s, ’90s and 2000s as it is today, the idea stuck around due to inertia.

Fortunately, we now have those research tools, and they tell us there are much better ways to go. Take the allocation of your holdings you devote to stocks, for example. You and I both know the big problem on that side of things is income.

An S&P 500 index fund like the SPDR® S&P 500® ETF Trust (ASX:), the ETF used in the performance charts above, yields just 1.2% today.

That’s why, when it comes to your portfolio’s stock allocation, we prefer closed-end funds (CEFs), rather than ETFs, for a simple reason: CEFs yield much more (8%+ yields are common in this corner of the market), so you get more of your return in cash.

That’s much safer than relying on paper gains, as you would with an S&P 500 index fund.

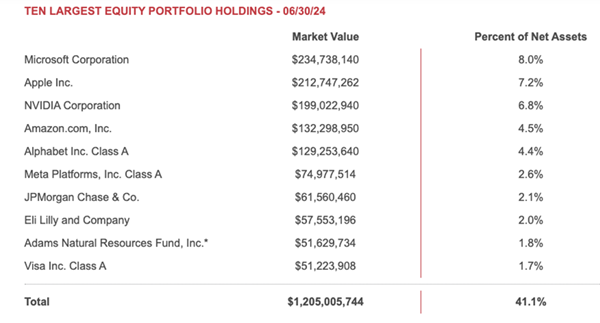

To see what I’m getting at, consider the Adams Diversified Equity Fund (NYSE:), a CEF that yields 8% and is 100% invested in large-cap stocks: the same names you’d find in the S&P 500 index, in fact. This means you can likely buy ADX without having to “swap out” many of the blue chips you likely own now.

You can see that the bluest blue chips, like Microsoft (NASDAQ:), Amazon.com (NASDAQ:), JPMorgan Chase & Co (NYSE:) and Visa (NYSE:) are among ADX’s top-10 holdings:

Source: adamsfunds.com

One thing to note is that ADX does have a fairly heavy tech weighting, at 32.6% of the portfolio, so you’ll want to take that into account when adding it to your portfolio.

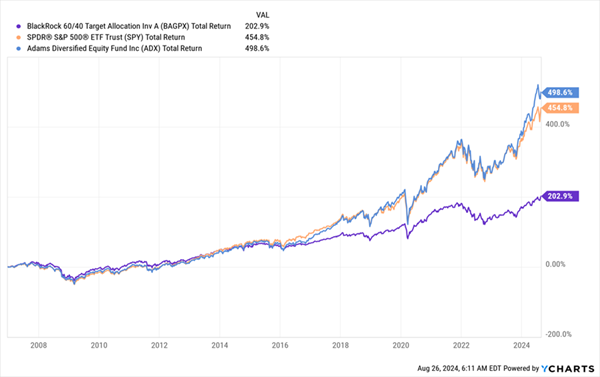

But here’s the real standout fact about ADX: It’s older than pretty much any other fund out there, having launched in 1929, just ahead of that year’s stock-market crash. Its track record is proven: ADX has outrun both the S&P 500 and the 60/40 portfolio in the last 17 years.

ADX Beats the Stock Index Fund and the 60/40 Portfolio

ADX also trades at a 10.7% discount to net asset value (NAV, or the value of its stock holdings), a deal you can’t find in ETFs, which always trade at par with their portfolio value.

The bottom line? We don’t need to sacrifice returns for income (through flawed strategies like the 60/40 portfolio or otherwise), thanks to high-yielding CEFs like ADX.

This Diversified CEF Portfolio CRUSHES 60/40, Yields 8.7%

The great thing about CEFs, as I mentioned earlier, is they go well beyond stocks, so you can set up a personalized portfolio spread across just about every asset class you can think of: stocks, bonds, real estate investment trusts (REITs) and more.

AND you can squeeze a big income stream out of all these investments while doing it.

Best of all: You don’t need to do any work because I’ve done it all for you! I’ve built a 5-CEF portfolio that holds blue chip stocks, preferred stocks, corporate bonds and REITs.

One of these 5 even uses a smart option strategy to juice its dividend—and cut its volatility, too.

On average, these 5 CEFs yield a stout 8.7%. And they’re cheap today, which is why I’m forecasting double-digit price upside in the next 12 months.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”