These Stocks Are Getting Ready for a Major Breakout Post Q2 Earnings

2024.07.02 08:38

- Exceeding earnings expectations is one of the main catalysts behind a stock market rally.

- With earnings season right around the corner, many companies are getting ready to report great numbers.

- We’ll take a look at 4 such stocks that could do so and see if they’re worth buying at current levels.

- Unlock AI-powered Stock Picks for Under $7/Month: Summer Sale Starts Now!

Corporate earnings remain a major driver of stock market gains, and the coming earnings season is shaping up to be particularly impressive. Many companies are set to not only deliver strong results but also exceed analyst expectations.

This trend of positive earnings surprises often translates into increased demand for a company’s shares. Today, we’ll leverage the powerful tools of InvestingPro to identify stocks with the potential to outperform analyst forecasts in the current quarter.

By diving into key data and insights provided by InvestingPro, we’ll uncover companies poised to impress investors and potentially propel their stock prices higher.

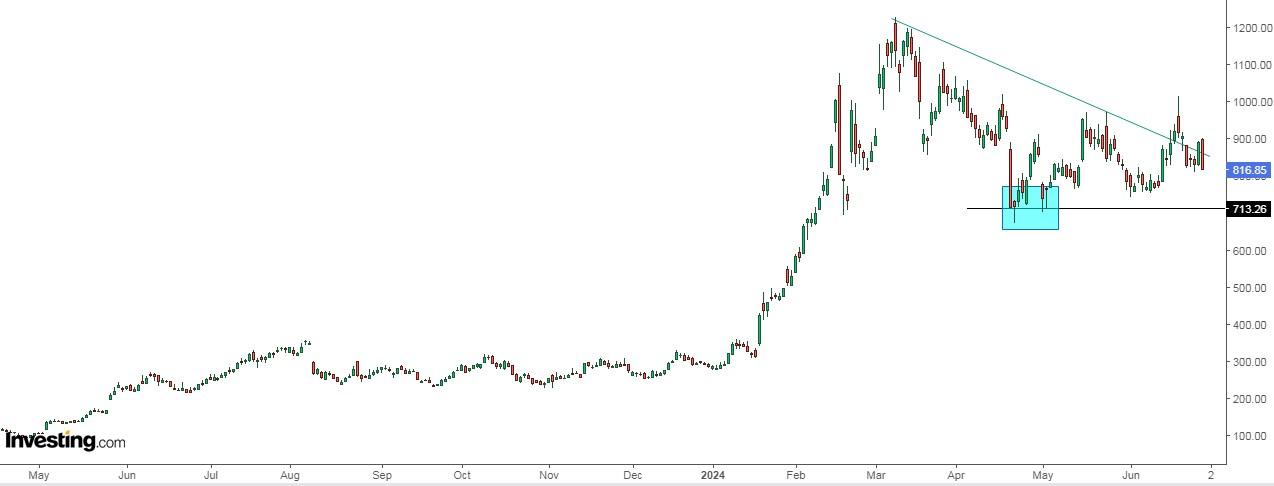

1. Super Micro Computer

Super Micro Computer (NASDAQ:) specializes in servers, network devices, management software, and high-end workstations. It was incorporated in 1993 and is headquartered in San Jose, California.

Its shares joined the S&P 500 in March, replacing Whirlpool (NYSE:). It is now poised to potentially enter the in September, replacing Walgreens (NASDAQ:), which was delisted from the in February.

Despite having the smallest market capitalization among Nasdaq 100 constituents, it does not meet the requirement that each member represents at least 0.1% of the index’s total market value.

Scheduled to report earnings on August 6, the company anticipates a remarkable 146.90% revenue growth for the quarter, marking the highest among all companies.

Additionally, an expected EPS increase of 158.20% underscores its strong performance outlook.

Source: InvestingPro

Super Micro’s recent business achievements and strong market positioning in the AI server space suggest it is well poised to maintain its competitive edge.

Its beta is 1.23, indicating the stock moves with higher volatility.

Source: InvestingPro

The average price target given to it by the market is at $1032.

Source: InvestingPro

2. Western Digital

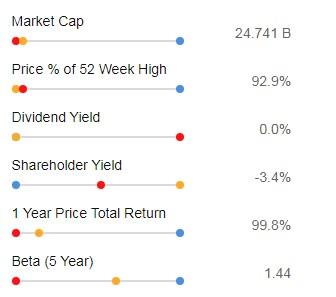

Western Digital Corporation (NASDAQ:) manufactures, develops, and sells data storage devices and solutions. It was founded in 1970 and is headquartered in San Jose, California.

On July 31, it presents its accounts. EPS is expected to increase by 234.48%.

Source: InvestingPro

In the ever-evolving data storage landscape, Western Digital stands out as a major player, with its diverse product portfolio catering to various market segments.

As the industry witnesses a cyclical recovery, its exposure to the hard disk drive (HDD) markets positions the company to potentially benefit from the upturn.

Its beta is 1.44, indicating that the stock is more volatile than the S&P 500.

Source: InvestingPro

The market assigns it an average price target of around $87.67.

Source: InvestingPro

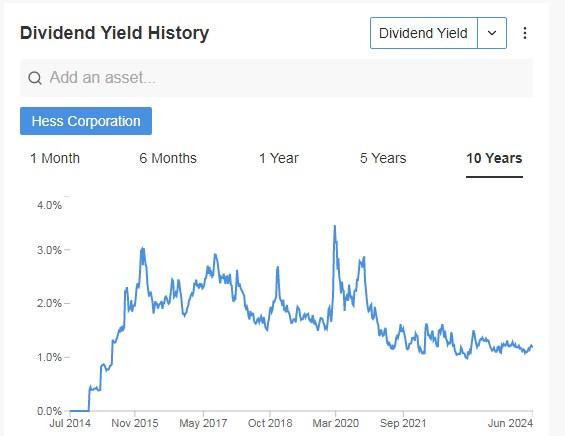

3. Hess

Hess (NYSE:) is an energy company involved in and production. It was formed through the merger of Hess Oil and Chemical and Amerada Petroleum in 1968 and is headquartered in New York.

Hess has maintained dividend payments for 38 consecutive years, demonstrating a commitment to returning value to shareholders.

Source: InvestingPro

It will report its earnings report on July 24, with revenue expected to increase by 46%. In the previous report it achieved EPS 83% higher than expected.

Source: InvestingPro

The target price given by the market is based on approximately 8.75 times the estimated debt-adjusted cash flow for the fiscal year.

Separately, Hess shareholders approved a proposed merger with Chevron (NYSE:), a significant move in the oil industry, worth $53 billion. A majority of Hess’ 308 million outstanding shares voted in favor of the merger.

The company has shown strong performance over the past five years. This, along with a moderate level of debt, paints the picture of a company that has managed its finances prudently while achieving growth while maintaining healthy financial health.

Source: InvestingPro

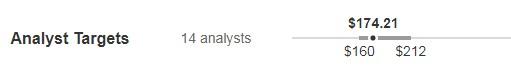

The market gives it an average price target at $174.21.

Source: InvestingPro

4. Nvidia (NVDA)

Nvidia (NASDAQ:) is a technology company, a world leader in artificial intelligence (AI) software and hardware. It is engaged in designing graphics processing units (GPUs). It was incorporated in 1993 and is headquartered in Santa Clara, California.

On August 15 we will know its accounts, expecting an increase in EPS of 159.29% and revenue of 113.70%.

Source: InvestingPro

Nvidia continues to see demand outstrip supply, particularly with the shortage of H100 and H200 GPUs. The company is scheduled to launch its next-generation Blackwell platform in September or October.

Its shares have suffered a 15% correction from their peak against a backdrop of elevated earnings expectations, but this drop is healthy and even necessary in the face of being able to reset valuations to more sustainable levels. Moreover, after a strong revaluation, it is normal for many investors to cash out.

Nvidia could join the Dow Jones in the coming months after completing a 10-for-1 stock split in early June. Recall that Apple (NASDAQ:) and Amazon (NASDAQ:) joined the index after completing this process. To top it off, their financial health is very good.

Source: InvestingPro

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $7 a month!

Tired of watching the big players rake in profits while you’re left on the sidelines?

InvestingPro’s revolutionary AI tool, ProPicks, puts the power of Wall Street’s secret weapon – AI-powered stock selection – at YOUR fingertips!

Don’t miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.