The Tech Trade Has Legs

2023.06.20 17:41

Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

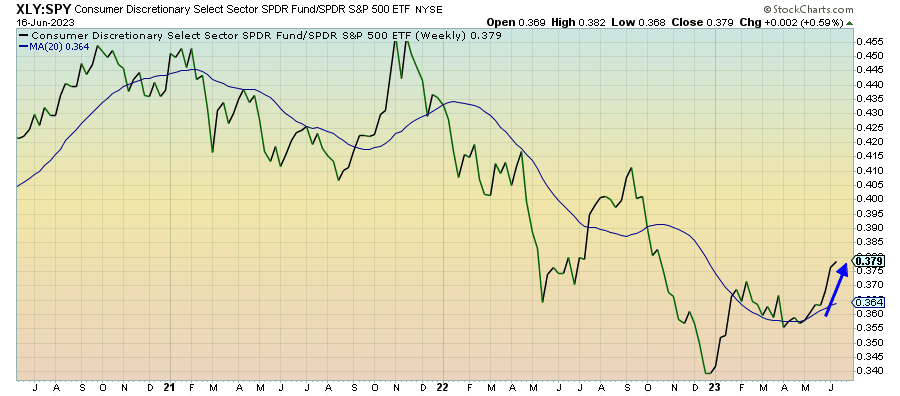

Consumer Discretionary – The Fed’s Hawkish Statement Actually Helps

Consumer discretionary () stocks have managed to avoid some of the up-and-down whipsaws that tech has over the past few weeks. The Fed’s statement that it anticipates two more rate hikes in 2023 has growth investors feeling as if it’s an implicit acknowledgement that a potential recession is still far off. An unexpected rise in U.S. retail sales also helped the cause.

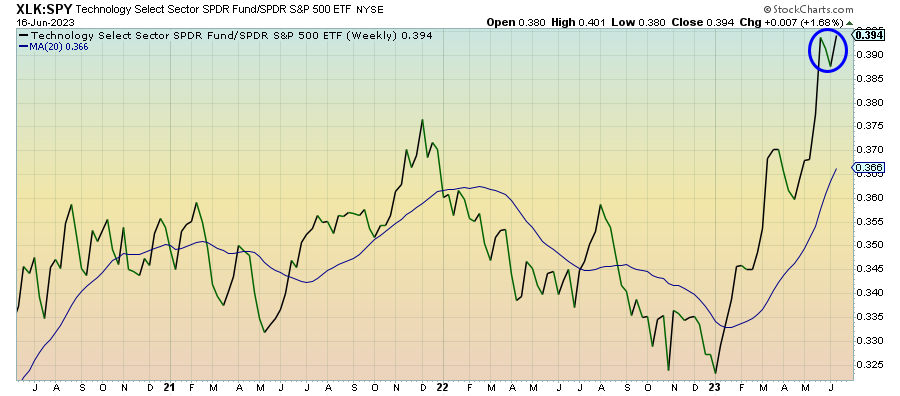

Technology – Euphoria Still Alive & Well

For now, it looks like the downturn from early June was merely an aberration. Tech stocks () moved steadily higher throughout the entire week, but especially so after the Fed’s hawkish rate pause. There’s still a good deal of euphoria surrounding the AI and disruptive innovation trade and I’m not sure valuations are sustainable at this level. Sentiment may still push this ratio higher, but I sure would be hesitant about getting aggressive at these levels.

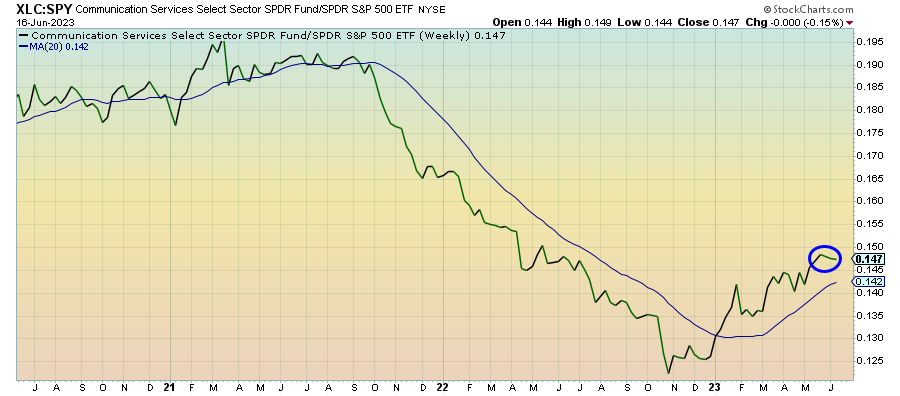

Communication Services – A Volatile Ride Ahead?

Communication services () has leveled off a bit here, but I wouldn’t dismiss the broader trend here. All of the risk signals are risk-on at the moment and this ratio has a history of regularly establishing new highs over the past six months. If artificial intelligence emerges as a longer-term trade beyond just the short-term mania, this sector should be a prime beneficiary, but it’s likely to be a volatile ride.

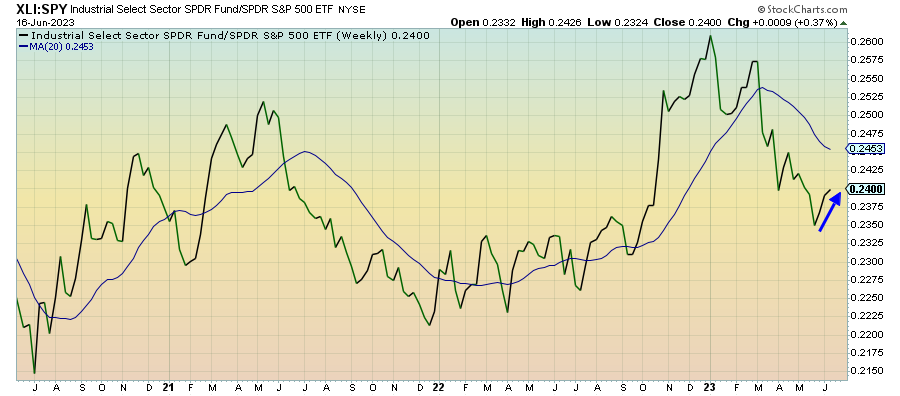

Industrials – Getting The Lift

While tech and growth maintain control of market sentiment, cyclicals continue to be lifted higher by the demand for risk assets. While the manufacturing sector (), in general, remains relatively weak, there’s enough momentum building for the delayed recession narrative that even the names from this group are getting the lift. Industrials generally need an economic expansion to outperform and the idea that a recession might be further off today than it was yesterday could be enough.