The Shiller Ratio Tells Us There Is More Pain to Come

2023.01.11 16:01

[ad_1]

As earnings season kicks off, the market is primed to witness some surprising turns in the coming days, weeks, and months ahead.

Powell’s speech today kept investors thinking about future interest rate hikes and what that all will mean.

and continue to rise as a hedge against inflationary pressures from an increasingly robust labor market alongside continued consumer spending.

is creeping up slowly. Value stocks outperform growth, while the is vulnerable.

These data points are monitored continuously to get a clearer idea of where the market will be in a few months.

We also watched similar events unfold and brought a favorite indicator for times like this. Financial professionals watch these factors across markets closely.

The CAPE Ratio Explained

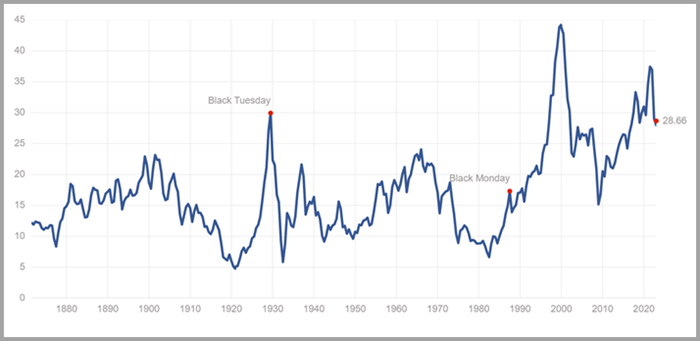

Nobel prize-winning economist Robert Shiller created the cyclically adjusted price-to-earnings (CAPE) ratio to compile a valuation measure that averages profits over the last ten years, so it takes the stock price divided by a 10-year average of earnings.

The CAPE Ratio is far from perfect, but it is an interesting measure to judge valuations. For example, shortly before the dot.com bust in 2000, the Schiller Ratio was 44.

The historical average is 16.7; on Tuesday, January 9, 2023, the Shiller Ratio was 28.66, similar in prices to 1929.

The price-earnings ratio is based on average inflation-adjusted earnings from the previous ten years, known as the Cyclically Adjusted PE Ratio or (CAPE Ratio).

A simple yet powerful measuring stick that helps identify and analyze trends in the business cycle, equipping those seeking financial gain better insight into potentially inflated market conditions.

ETF Summary

- S&P 500 (NYSE:): 385 support and 395 resistance.

- iShares Russell 2000 ETF (NYSE:): 177 pivotal support and 184 resistance.

- Dow Jones Industrial Average ETF Trust (NYSE:): 333 support and 340 resistance.

- Invesco QQQ Trust (NASDAQ:): 268 support and 276 resistance.

- S&P Regional Banking ETF (NYSE:): 56 support and resistance 62.

- VanEck Semiconductor ETF (NASDAQ:): Support is 216 and 223 resistance.

- iShares Transportation Average ETF (NYSE:): 220 pivotal support, and 230 is now resistance.

- iShares Biotechnology ETF (NASDAQ:): 127 is pivotal support 168 overhead resistance.

- S&P Retail ETF (NYSE:): has 60 pivotal support, and 66 is now resistance.

[ad_2]