The PCE Pebble

2022.10.28 12:21

[ad_1]

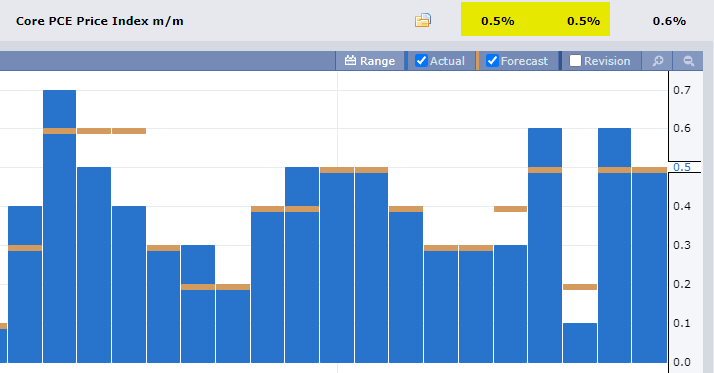

Happy Friday everyone and welcome to the end of this insane earnings week. The massive news yesterday evening was AAPL and AMZN, but the big event this morning was the , which is the Fed’s inflation gauge. It was projected to come in at 0.5% for the month, and that’s precisely what was reported. (Because, in spite of the 30% inflation you see whenever you shop, the actual rate is, ya know, 6%).

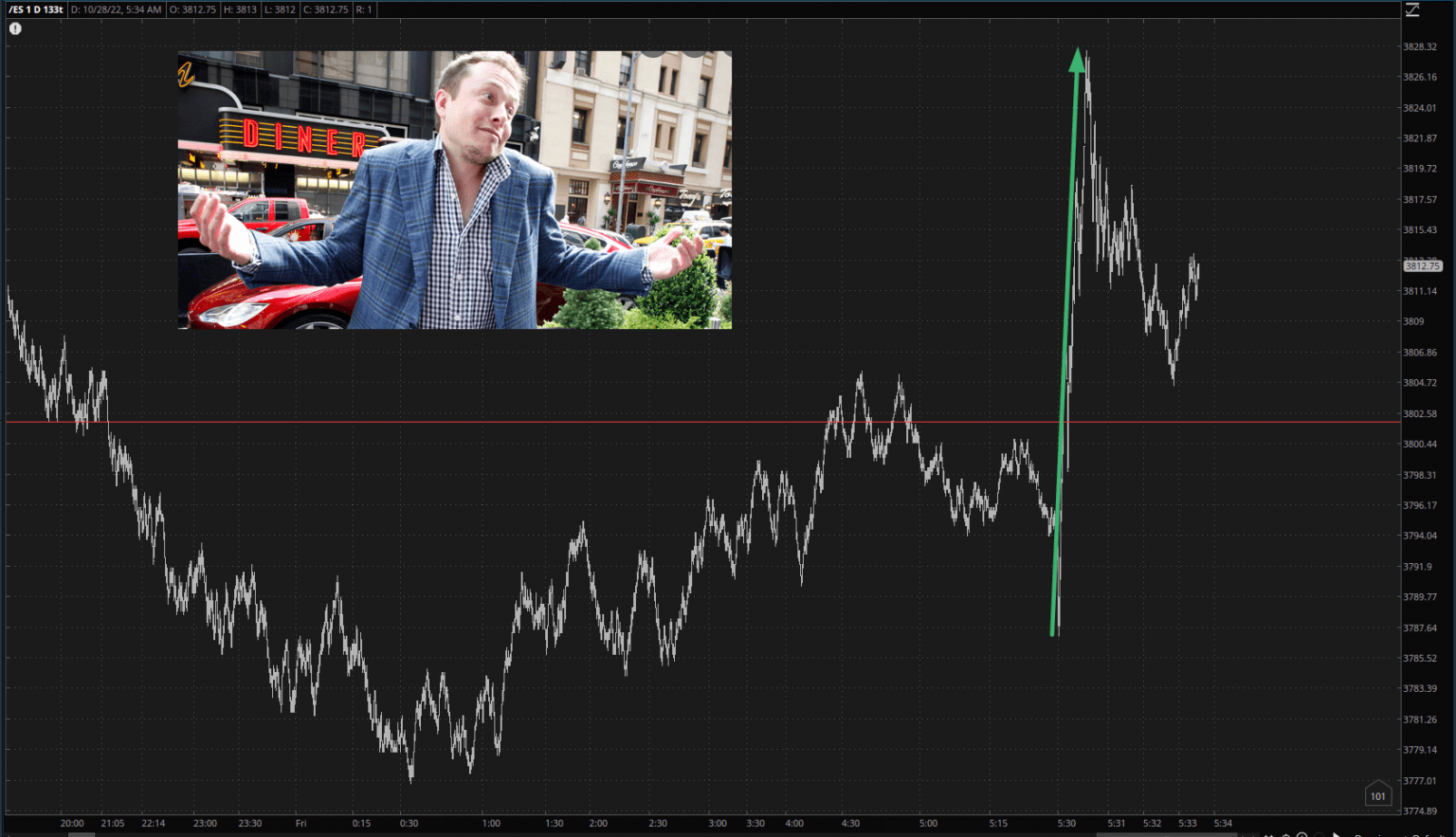

The market immediately spasmed 40 points higher, pushing the into the green. Why? Was it simply relief that inflation wasn’t even hotter? That blast-off was soon eradicated, and although we are well above the lows, as I am typing this, pretty much everything is red again. I’ve got to say, having Alphabet (NASDAQ:), Microsoft (NASDAQ:), Meta (NASDAQ:) and Amazon.com (NASDAQ:) completely get destroyed and then looking at an ES, which is down 0.35% right now, is hardly encouraging.

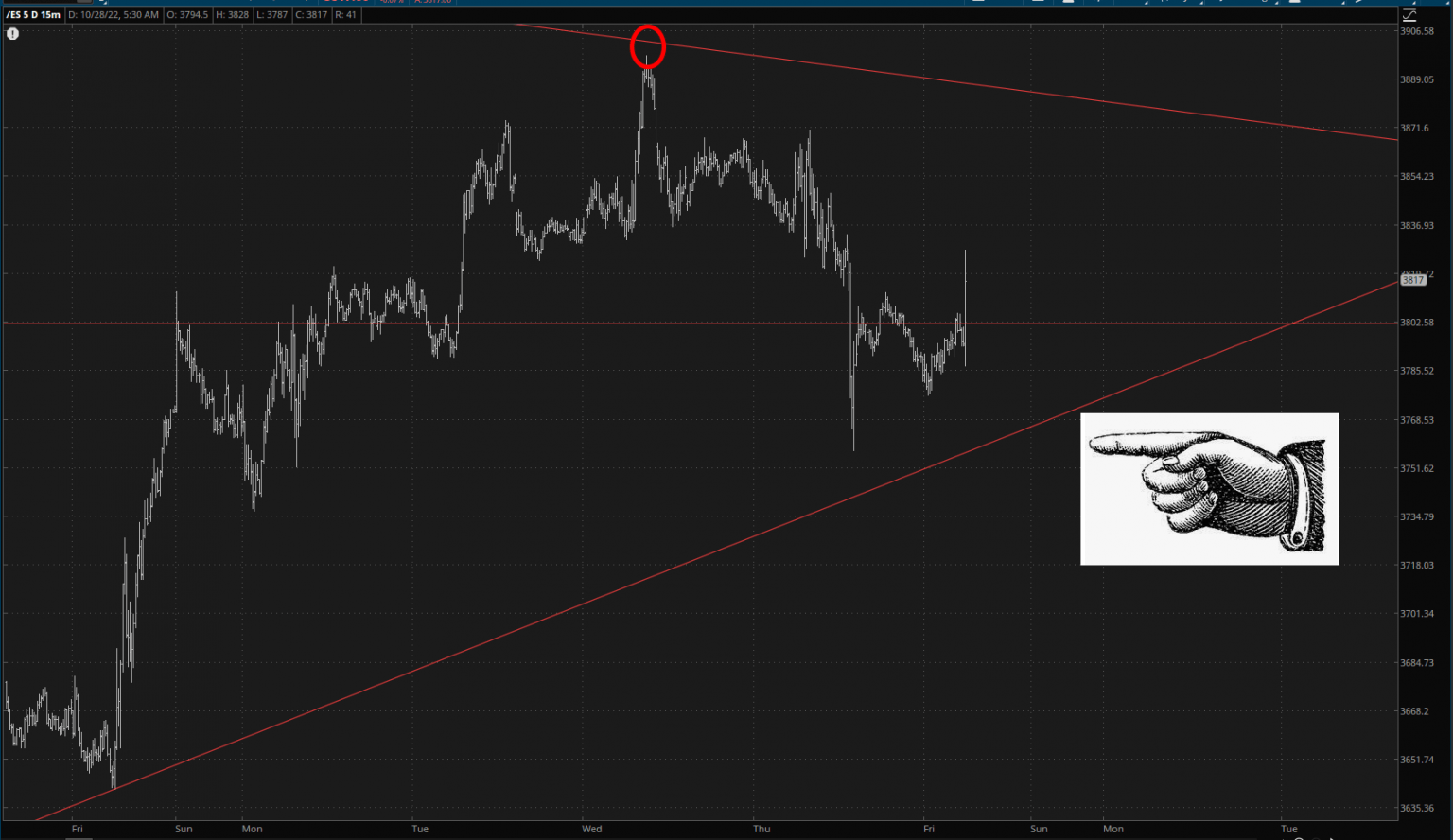

Thus, we’re still in the exact same predicament. On the one hand, my target of 3900 (circled) was almost perfectly achieved and repelled. On the other hand, in spite of a tidal wave of crummy earnings reports, the intermediate-term uptrend is fully intact, until such time as we snap below the level the disembodied handing is pointing out.

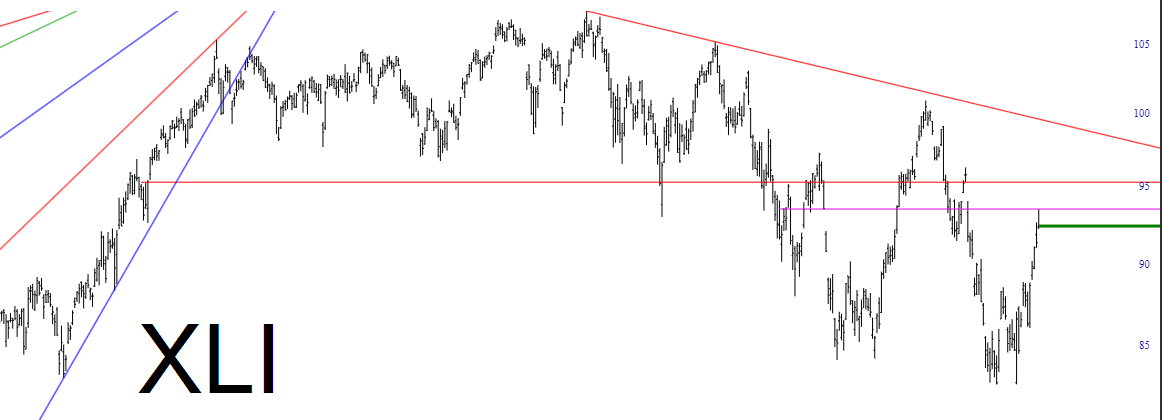

All I can say is this – just take a look at any ETF representing the broad market and try to convince yourself it is poised for a magnificent new bull market. I have puts on the item below, and it looks positively ill.

I’ll close in mentioning that the ZB doesn’t seem to be holding up nearly as well as equities are in the face of this PCE news, so I’d suggest keeping an eye on that. I am entering the day with 27 bearish positions (25 on equities, two on ETFs) and a small amount of cash left. It’s been a not-great trading week for me, but I’m hoping to end it on a good note, and I wish the same to all of you.

[ad_2]

Source link