The Next Leg Down

2022.11.09 16:56

[ad_1]

A primary cause of skyrocketing product prices and service prices? Central banks electronically printed obscene amounts of dollars, making the value of those dollars worth less.

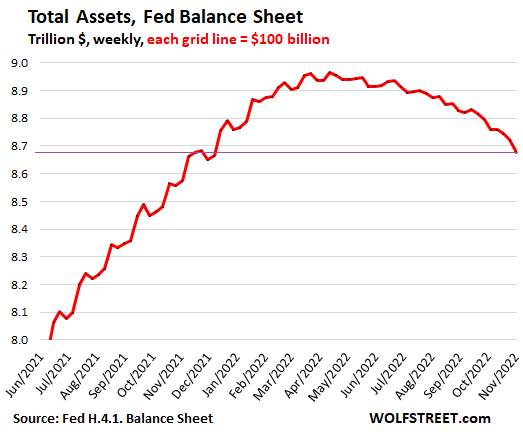

The Federal Reserve has been trying to undo its policy error by terminating some of the excess digital money. The problem? While the Fed has removed roughly $280 billion from the economy, the federal government has injected nearly $400 billion into the economy via deficit spending over the same period.

Total Assets, Fed Balance Shhet

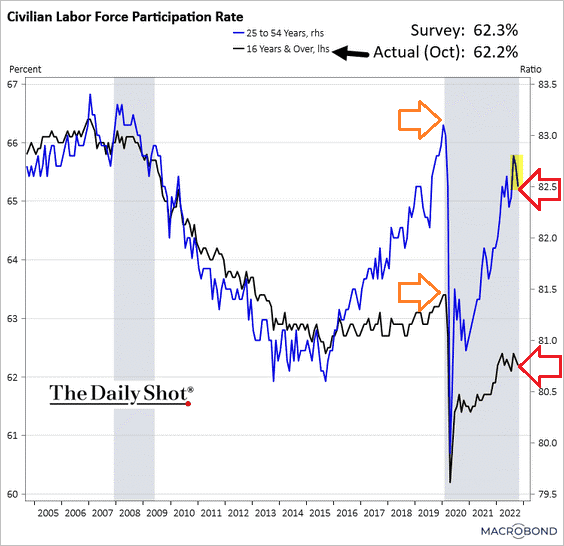

Even secondary contributors to inflation have continued to cause trouble. Millions of able-bodied workers, including prime-aged workers (25-54), have yet to return to the workforce since the pandemic.

The significance? An already tight labor force is even tighter than ever, putting upward pressure on wage inflation.

Civilian Labor Force Participation Rate

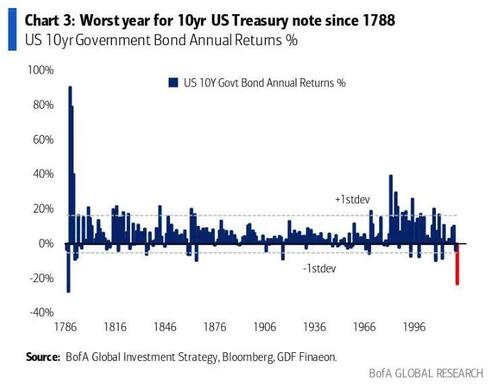

The Federal Reserve’s key course of inflation-fighting action has been (and continues to be) the hyper-speed hiking of rates. And that has led to the worst calendar year losses for intermediate-term bonds in recorded history.

10-Year Treasury Annual Returns

In a similar vein, growth-oriented companies that gorged on debt and venture capital have been crucified. The stock bubble popped. And the former high-flying ARK Innovation ETF (NYSE:) witnessed decimation exceeding losses of 75% from the peak.

ARK, Nasdaq 100

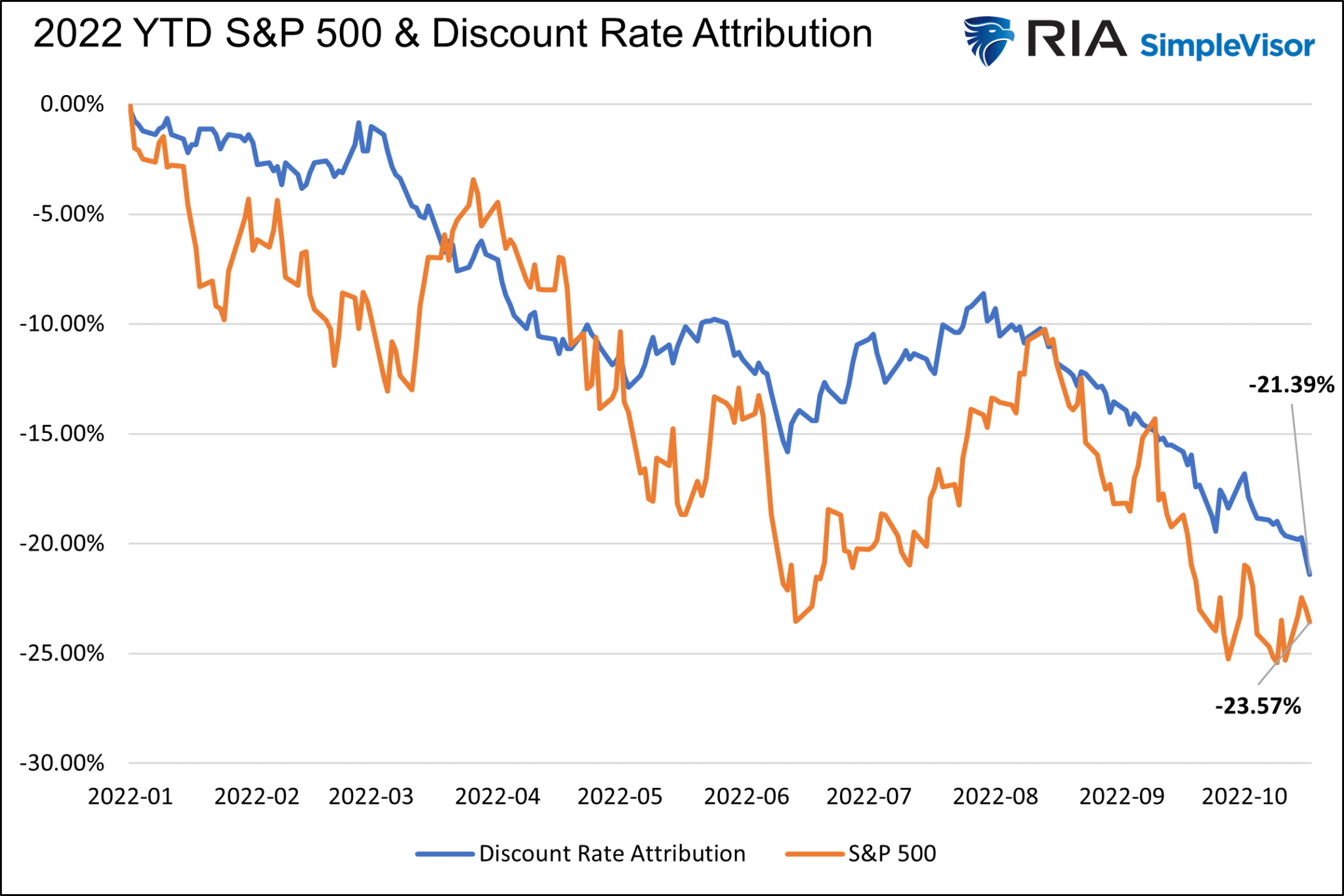

As for the broader ’s 20%-plus decline, the evidence shows it is primarily a function of the dramatic increase in interest rates. According to Michael Lebowitz, a prominent financial analyst, the year-to-date descent for the broad market indicator may be 90% attributable to the consequential rise in rates.

Mr. Lebowitz charts the stock index alongside the running present value of a $100 cash flow expected ten years from each date on the x-axis. Meanwhile, the discount rate to formulate the blue line below is equivalent to a 5.5% risk premium plus the yield of the 10-year Treasury.

The result? Just like ultra-low interest rates propelled the stock bubble to unfathomable heights, sky-high interest rates are the main reason for the precipitous drop in the S&P 500 so far.

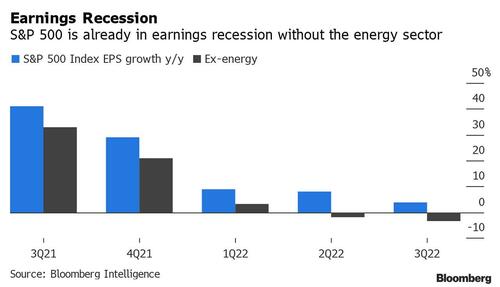

Perhaps ironically, the overall stock market may not have seen the bottom. That’s because lower and lower corporate earnings have yet to meaningfully impact stock pricing.

Consider the reality that, absent outliers, earnings tend to decline 20% in recessions. It follows that if the Fed is successful in beating inflation by causing a “mild recession,” prices may drop another 15%-20% to maintain similar valuation levels.

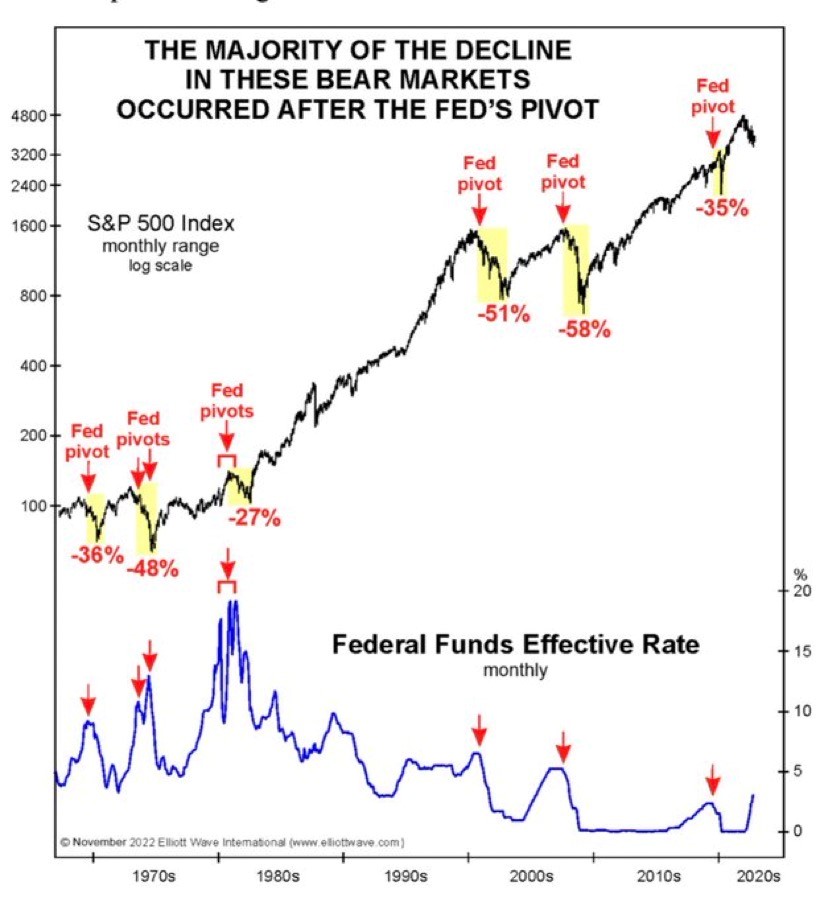

Not sure the stock market could drop from the 3800 level to the 3000 level? Take into account the enthusiasm for a Fed that may soon “pivot” from tightening to neutrality. Previous pivots came at the onset of recessions, ushering in a continuation of falling asset prices.

Be careful what you wish for? You betcha. The bottom tends to occur around the moment that the Fed is capitulating with massive cuts to its overnight lending rate as well as promises to create digital greenbacks.

Original Post

[ad_2]

Source link