The Labor Market and the Stock Market

2023.02.02 07:50

[ad_1]

By the time you read this, the buzz of what the did and Powell’s presser will be over, at least for the day.

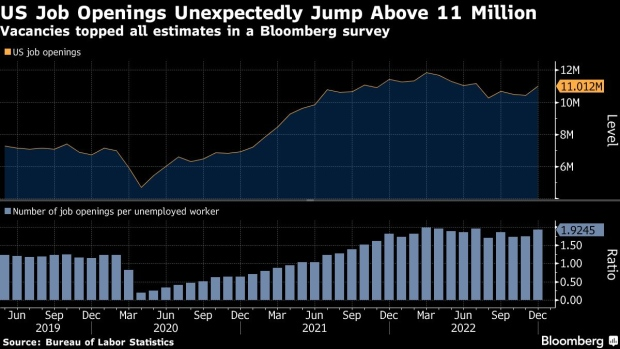

JOLTS Chart

We will not repeat the obvious.

What we are way more focused on is the underlying reasons that the Fed, unless they are willing to goose rates to over 8%, will have little impact on the

A) Upcoming Commodities Super-Cycle and

B) The unique undefinable labor market is already leading to demand for higher wages, and employers are forced to keep the staff they already have. In other words:

C) Yet another indication of the continued robustness of the labor market and dilemma for the FED.

JOLTS: Useless indicator or Harbinger of More Inflation?

The Job Openings and Labor Turnover Survey (JOLTS) program produces data on job openings, hires, and separations.

Here is the part we find most fascinating and most difficult for the Central Bank to reconcile.

The largest increase in job openings is in the services area-hotels and restaurants. 1.74 million positions have been posted.

Plus, in the UK and in France, workers are striking. They do not want to work for pay raises of 3% when inflation is at 10%.

Then add that many companies are posting huge profits and stock buybacks (although by half of what that has been over the last decade.).

How far can people be pushed?

The report tells us that regardless of whether the Fed and ECB fight against inflation while trying not to spiral economies into recession, there is a bigger battle.

Social upheaval, rising food prices, wages not keeping up. With JOLTS up, corporate layoffs continue. FedEx (NYSE:) is the latest example.

Sounds pretty inflationary, no? Regardless, we will continue to watch what our market indicators tell us about market breadth.

We are particularly interested in the (collapsing) and the performance of (cleared $1950).

We also have keen eyes on the ratio between the high-yield bonds and long bonds-now flashing more of a risk-off scenario despite the recent rally in the indices.

ETF Summary

- S&P 500 (NYSE:): Still looking for the December high of 410.49 to clear with a target of 420.

- iShares Russell 2000 ETF (NYSE:): 190 now support and 202 major resistance.

- Dow Jones Industrial Average ETF Trust (NYSE:): 343.50 resistance and the 6-mont calendar range high.

- Invesco QQQ Trust (NASDAQ:): 300 is now the pivotal area.

- S&P Regional Banking ETF (NYSE:): 64.00 resistance.

- VanEck Semiconductor ETF (NASDAQ:): I hHaven’t written Sister Semis on a tear for a while.

- iShares Transportation Average ETF (NYSE:): Also strong so these are good signs-234.74 Dec highs to hold.

- iShares Biotechnology ETF (NASDAQ:): Multiple timeframes count, and this has failed the 23-month MA so far.

- S&P Retail ETF (NYSE:): If you love the modern family, then clearly, they point to a happy time unless the inverted yield curve troubles them soon. 69 support 72 pivotal.

[ad_2]