The Fantastic 4: Blue Chip Stocks that Manipulated Their Share Prices Via Buybacks

2023.04.13 03:50

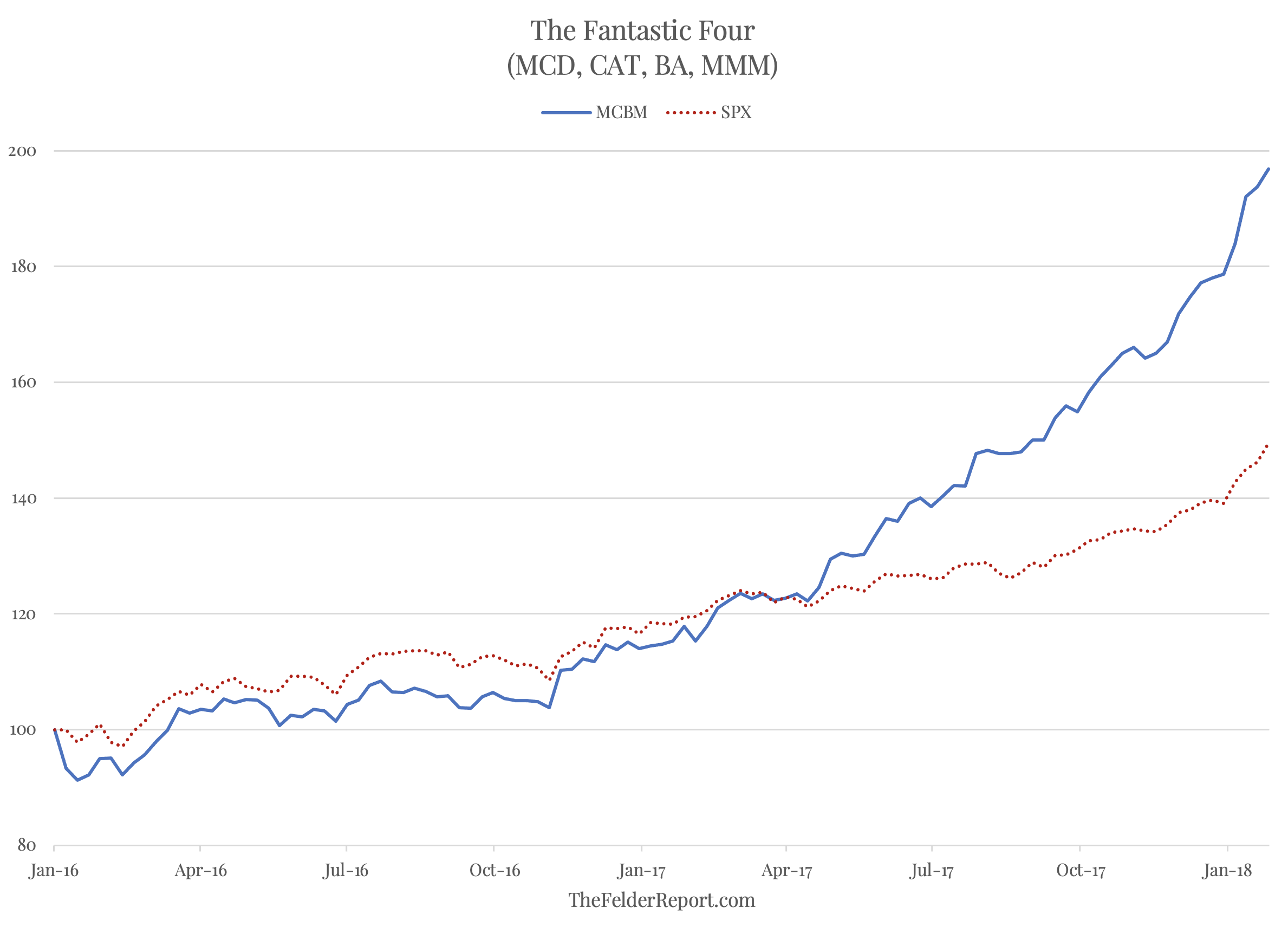

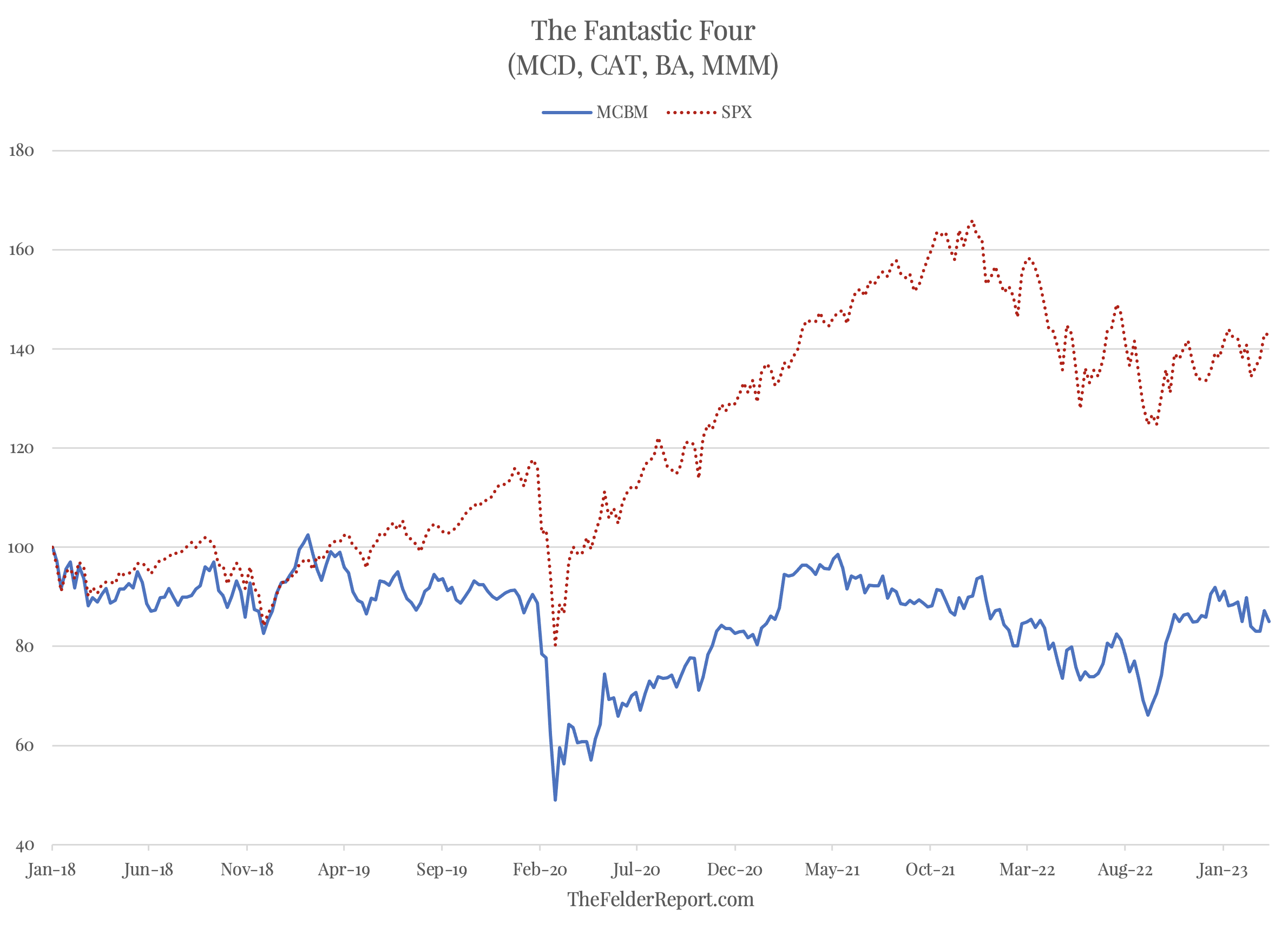

Back in early 2018, I highlighted a quartet of stocks that had seen a surge in their prices that was far more significant than could be justified by their underlying business trends. That group was McDonald’s Corporation (NYSE:), Caterpillar (NYSE:), Boeing (NYSE:) and 3M (NYSE:).

In the two years leading up to January of 2018, these stocks had dramatically outperformed not just the broad stock market but even the popular FANG stocks despite the fact that their underlying business trends were far less exciting. For this reason, I dubbed them “The Fantastic Four.”

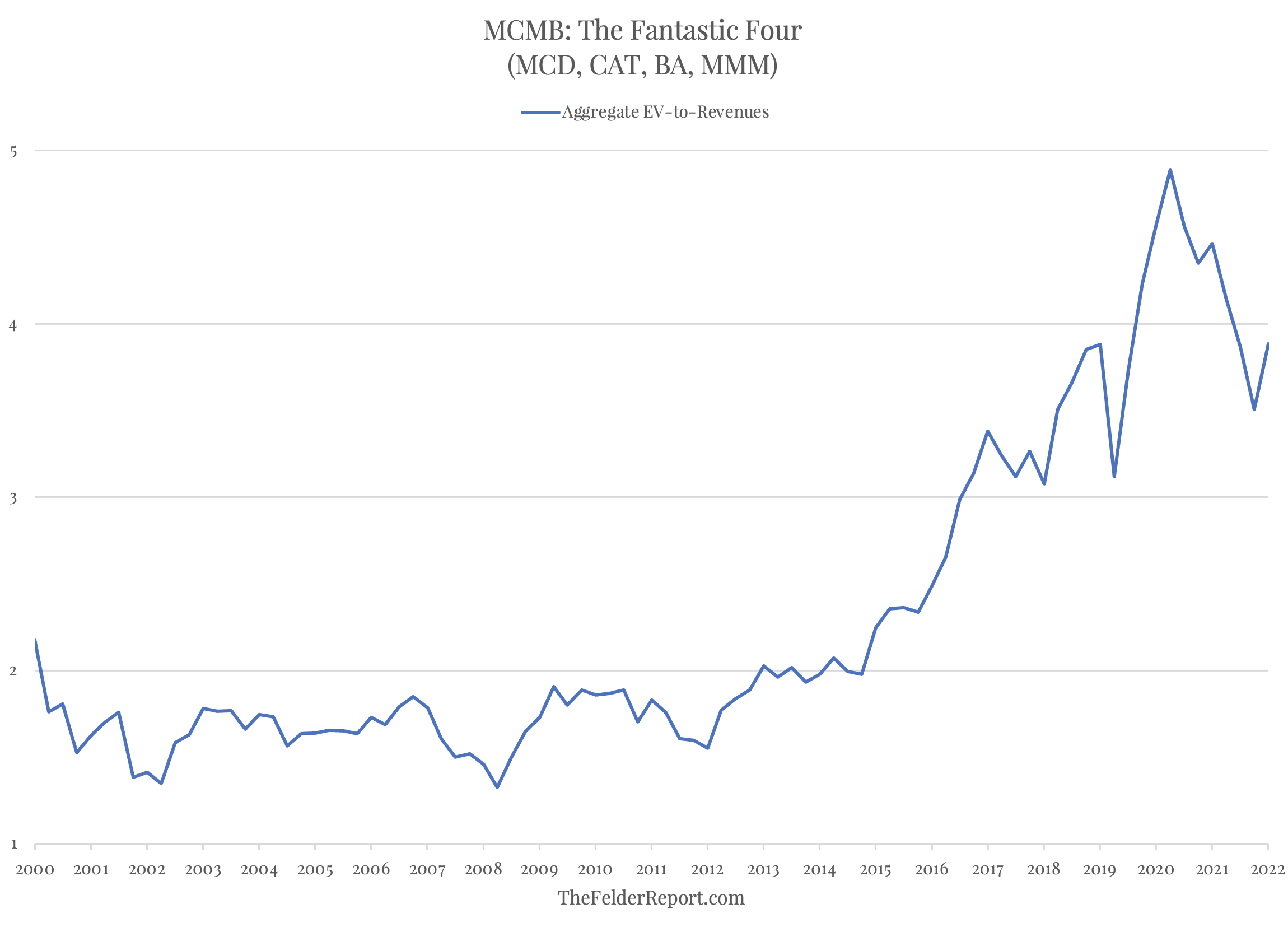

On the surface, the fact that these “blue chip” stocks were soaring in such dramatic fashion was fairly tough to explain. Even more difficult to understand was their soaring collective valuation (especially considering the fact that their aggregate sales were actually declining). After forming a range of about 1.5 to 2-times enterprise value-to-revenues, these stocks as a group saw this ratio soar to unprecedented heights in the back half of the 2010’s.

MCMB – The Fantastic Four Chart

MCMB – The Fantastic Four Chart

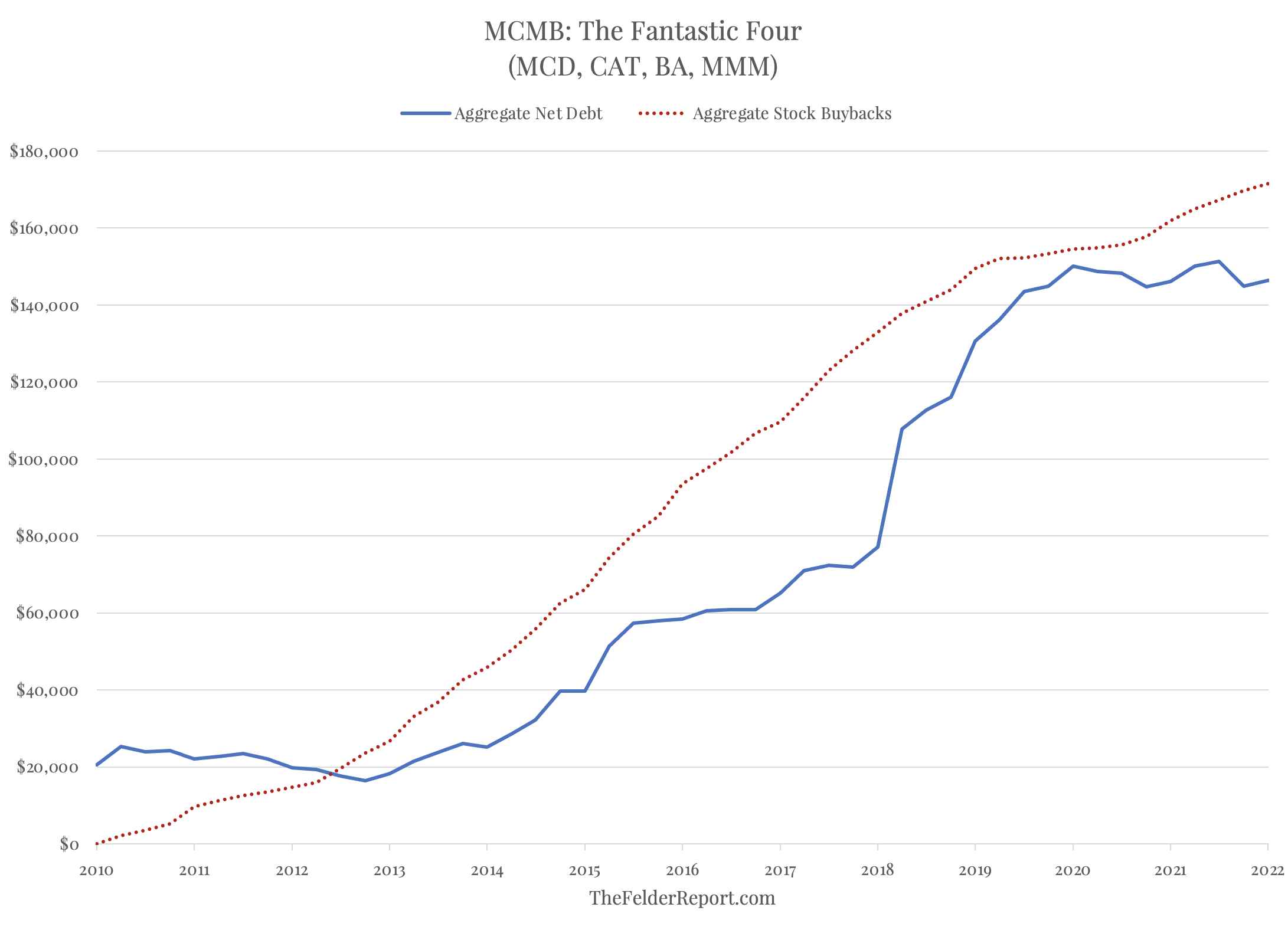

Looking at their balance sheets, however, the answer became immediately obvious. As a group, they had taken on over $100 billion in new debt in order to finance buyback programs of almost exactly the same amount. In essence, it was just a massive equity-for-debt swap and all that new debt-financed demand for shares explained how valuations soared even as business conditions stagnated.

Even as share counts fell, market cap rose due to all the buying they were doing; add in all the new debt on the balance sheet and enterprise values were soaring even faster than the share prices.

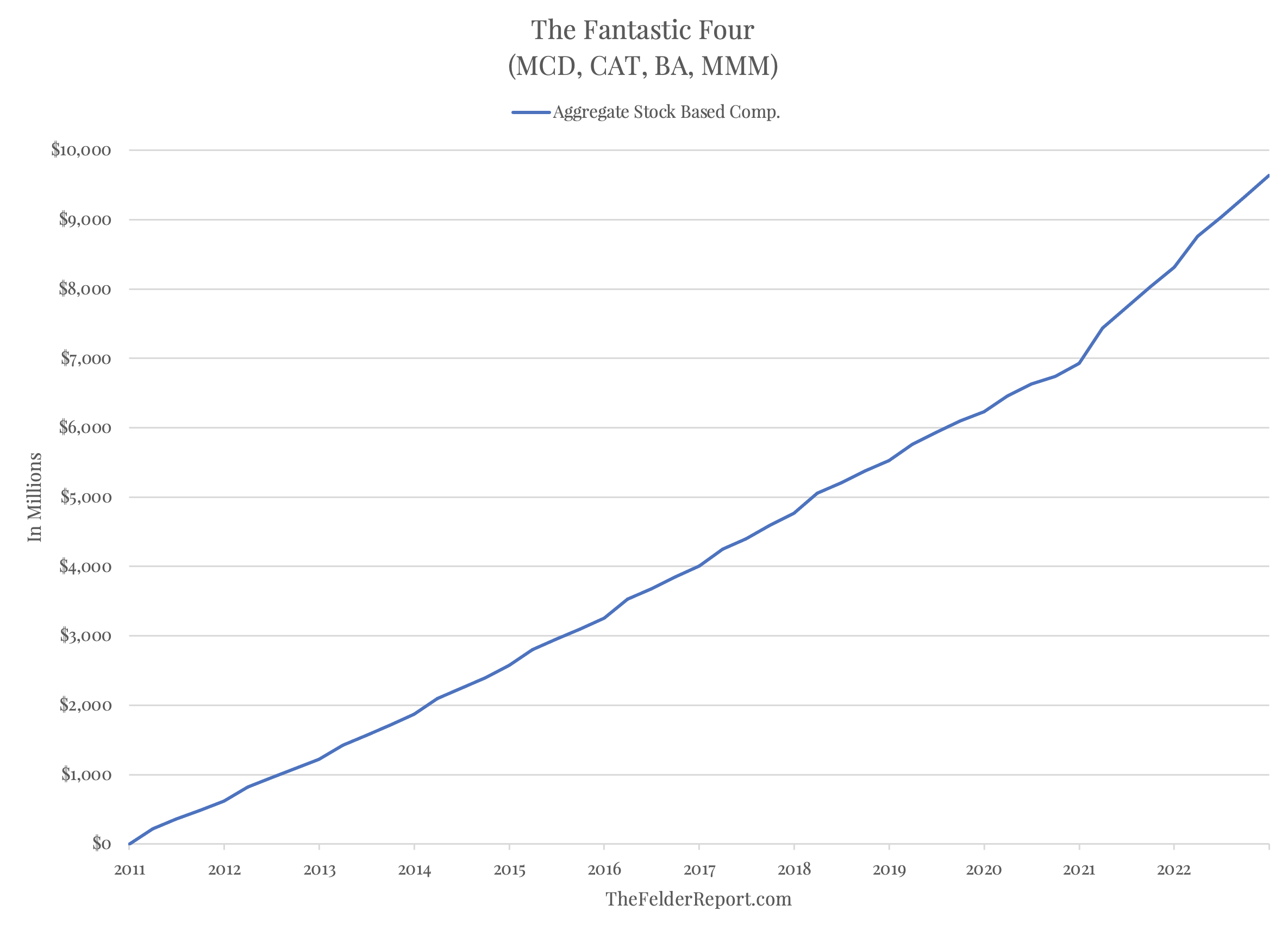

Certainly, shareholders benefitted from this in the short run but the primary beneficiaries of this massive exercise in financial engineering were top executives whom were granted billions of dollars in options-based compensation (and sold shares personally even as the company was buying).

This is why I have argued in the past that many stock buybacks in the open market (as opposed to far more transparent tender offers) are really just thinly-veiled stock price manipulation schemes. Because the majority of their compensation comes in the form of options, executives have a huge incentive to engage in manipulation and statistics show they do, in fact, pursue such policies.

The problem, of course, is that all that debt that was so cheap in years past is not so cheap anymore. Interest rates are far higher today than they were when this equity-for-debt swap was undertaken and so that short-term manipulation of the stock price could have costly long-term ramifications if interest rates remain elevated.

Already these stocks have essentially been dead money since I first wrote about them five years ago. However, their valuations remain extreme, mainly due to all that debt that remains on the balance sheet, and their underlying business trends haven’t gotten any more exciting in the interim.

To be sure, these companies are not distressed by any means. However, that doesn’t mean that rapidly rising interest expenses eating up more and more operating income can’t represent the sort of structural headwind to profits that would inspire a reversion in valuations in the group back closer to historical norms. And that could be a very painful experience for shareholders who haven’t already followed executives’ lead in unloading billions of dollars in shares into the stock price strength created by the buyback binge in the first place.