The Fall Of The Tech Giants

2022.11.03 12:23

[ad_1]

- Are cloud investments over?

- Earnings from Amazon, Microsoft, and Google

- Semiconductor earnings collapse; are we there yet?

The stock prices of Amazon (NASDAQ:), Microsoft (NASDAQ:), and Google (NASDAQ:) were holding up relatively better through this tech downturn. But disappointing earnings have now sent their shares down ~40%ytd. The main driver was disappointing cloud growth for Amazon and Microsoft, and lower advertising spend for Google.

Are cloud investments over?

Cloud spending is one area where we expect strong secular growth for years to come. But there are several aspects of the hyperscalers’ business model that is not well understood by investors.

- When companies move their operations to the cloud they are essentially shifting risk from their balance sheet to the cloud vendors (i.e. moving their cost structure from fixed to variable). This means that during downturns, they can optimize their spending (i.e. cut their spending in areas that are not critical).

- The hyperscalers (AWS/Amazon, Azure/Microsoft, GCP/Google) take the risk during downturns (e.g. excess capacity, higher energy costs), and generally work closely with clients to help them reduce costs, which in turn results in lower revenues for the cloud vendors, but more workloads over time in a relatively consolidated market.

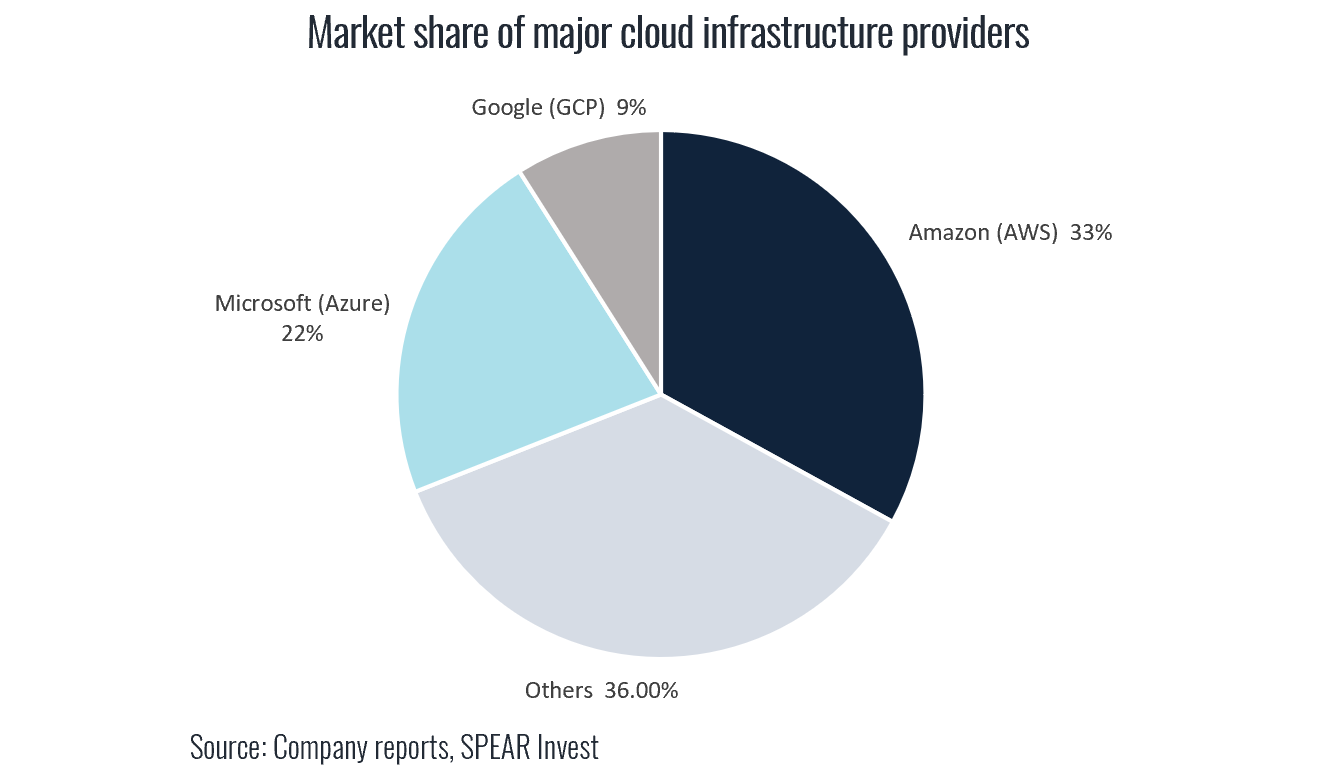

Market Share Of Majr Cloud Infrastructure Providers

Market Share Of Majr Cloud Infrastructure Providers

All three cloud vendors noted that their customers are in the process of optimizing spend, resulting in slower than expected growth. It is important to point out that growth is still coming at 25%+ but it is lower than previous quarters and expectations.

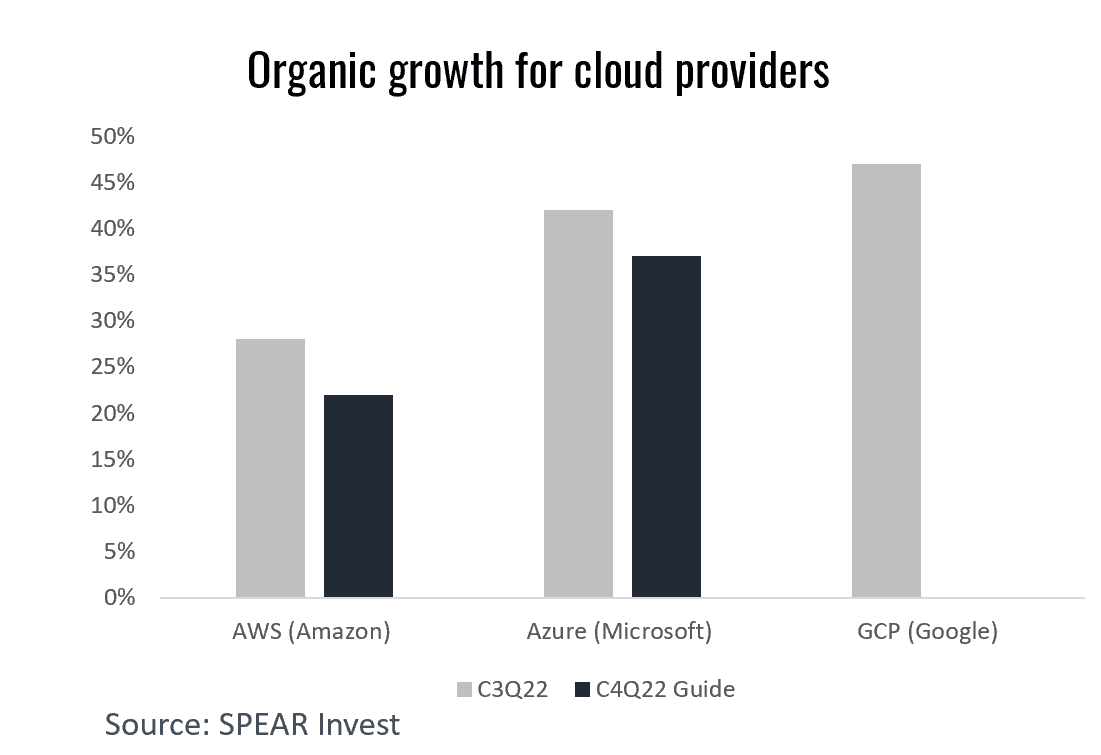

- AWS fared worst from the three reporting 28% growth and noting that growth trended down to the low-twenties towards the end of the quarter, which is now embedded in the 4Q22 guidance (potentially conservative).

- Azure reported 42% growth in C3Q22 and guided to 37% growth for next quarter, below the 39% Street expectations. This was disappointing at first, but looked better compared to the AWS result.

- GCP reported 47% growth on a significantly smaller base and with an easy comp (~9%). The company cited similar optimization efforts.

Organic Growth For Cloud Providers

Organic Growth For Cloud Providers

It was surprising to investors that instead of the hyperscalers focusing on their own profits (or lack thereof), they were more focused on talking about ways they can help their clients reduce costs. As an example, AWS cited several ways in which the company is helping clients reduce costs:

- managing workloads better

- switching to lower cost products that have different performance profiles

- switching to Graviton chips that have higher performance ratios

The reason for this is not because AWS is not a profit maximizing entity, but because over time as customers extract more value they will likely move more workloads to their cloud.

Semiconductor earnings collapse

Despite all the negative PC datapoints since May, NVIDIA’s (NASDAQ:) warning last quarter, Advanced Micro Devices’ (NASDAQ:) pre-announce this quarter, earnings for semis continue to surprise to the downside. But stock price reactions are starting to be mixed, implying that the bottom may be in sight.

- AMD came inline with the pre-announcement (revenues/EPS lower by 17% / 36% vs. the prior guide). The company guided Q4 revenues at $5.5bn (down 1% qoq), 8% below analyst estimates. The stock outperformed on this result.

- Intel (NASDAQ:) mediocre results; 3Q better-than-feared but 4Q guide worse-than-expected as macro headwinds intensified (potentially lasting into 2023).The company outlined significant cost reduction efforts, expecting $1b in COGS savings and $2b in opex savings in CY23 yoy, and $8-10b in longer-term annual cost savings. The stock had a positive reaction ~10%.

- Qualcomm (NASDAQ:) just a strong quarter, but provided disappointing guidance for the December quarter (revenues/EPS guided 20%/32% below consensus). The company cited elevated inventory in the channel ($2bn or roughly 8-10 weeks), which according to management will take several quarters to work through.

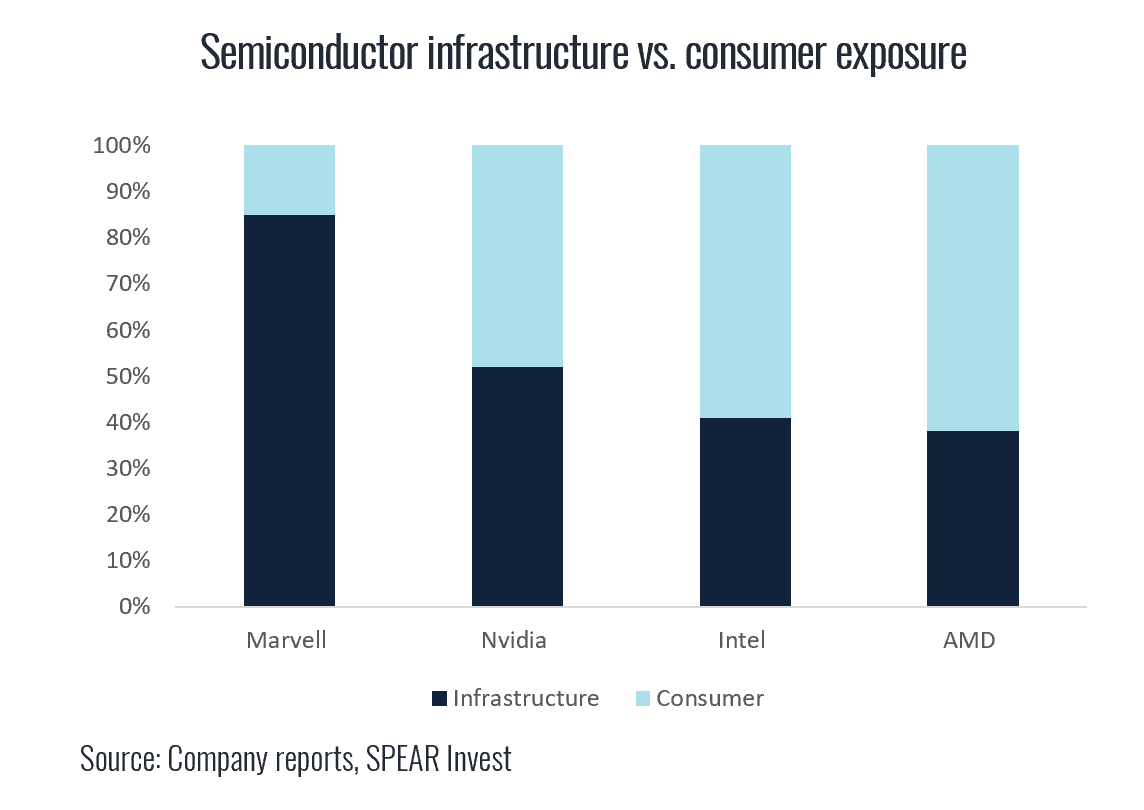

The downside, thus far, has been centered in the consumer end-market with data center spending holding up relatively better.

Semiconductor Infrastructure vs Consumer Exposure

Semiconductor Infrastructure vs Consumer Exposure

The Macro BackdropYesterday, the Federal Reserve delivered its latest monetary policy announcement, with the central bank hiking rates by 75 basis points, in-line with expectations. The Fed chair speech on the other hand, was significantly more hawkish, resulting in a steep market sell-off. There were two interesting datapoints to highlight:

What does this mean for industrial tech stocks?

It is important to note that for long term investors, rates moving back to “neutral” from “restrictive” territory, creates an attractive set up, as the return to normal would act as a valuation support. The upside/downside will depend on the earnings trajectory in 2023 and beyond. Disclosure: Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice. All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statement and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR’s objectives will be achieved. Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. |

[ad_2]

Source link