The Dollar Reaches a Potential Inflection Point

2024.11.15 04:40

As the Election Day dust settles, the has found itself at fresh year-to-date highs. The post-election rally of around 3% has been underpinned by rising yields, a byproduct of an improving domestic growth outlook and rising inflation expectations. This backdrop has the market recalibrating the potential depth of Federal Reserve (Fed) rate cuts over the next year. Fed funds futures are pricing in only three 0.25% cuts by the end of next year, including about a 75% chance of a rate cut next month.

The Fed has penciled in five cuts by December 2025, but noted last week at their Federal Open Market Committee (FOMC) meeting inflation remains “somewhat elevated” and highlighted how “growth of consumer spending has remained resilient and investment in equipment and in tangibles has strengthened.”

At the post-FOMC press conference, Fed Chair Jerome Powell further added, “It’s actually remarkable how well the U.S. economy has been performing with strong growth, a strong labor market, and inflation coming down. We’re really performing better than any of our global peers.”

Powell’s latter point of relative outperformance has been a big driver of capital flows into the , especially when you compare the U.S. economy to Europe — the euro currency is the biggest weight (58%) within the US Dollar Index. Economic activity in Germany and France, the Eurozone’s two largest economies, continues to sputter, with Purchasing Managers’ Index (PMI) data in both countries pointing to a contracting manufacturing sector. This has put added pressure on the European Central Bank (ECB) to keep cutting interest rates, including about a 25% chance of a 0.50% cut next month. The potential for fewer cuts from the Fed and a more dovish ECB has been a big factor behind the dollar’s advance over the last few months.

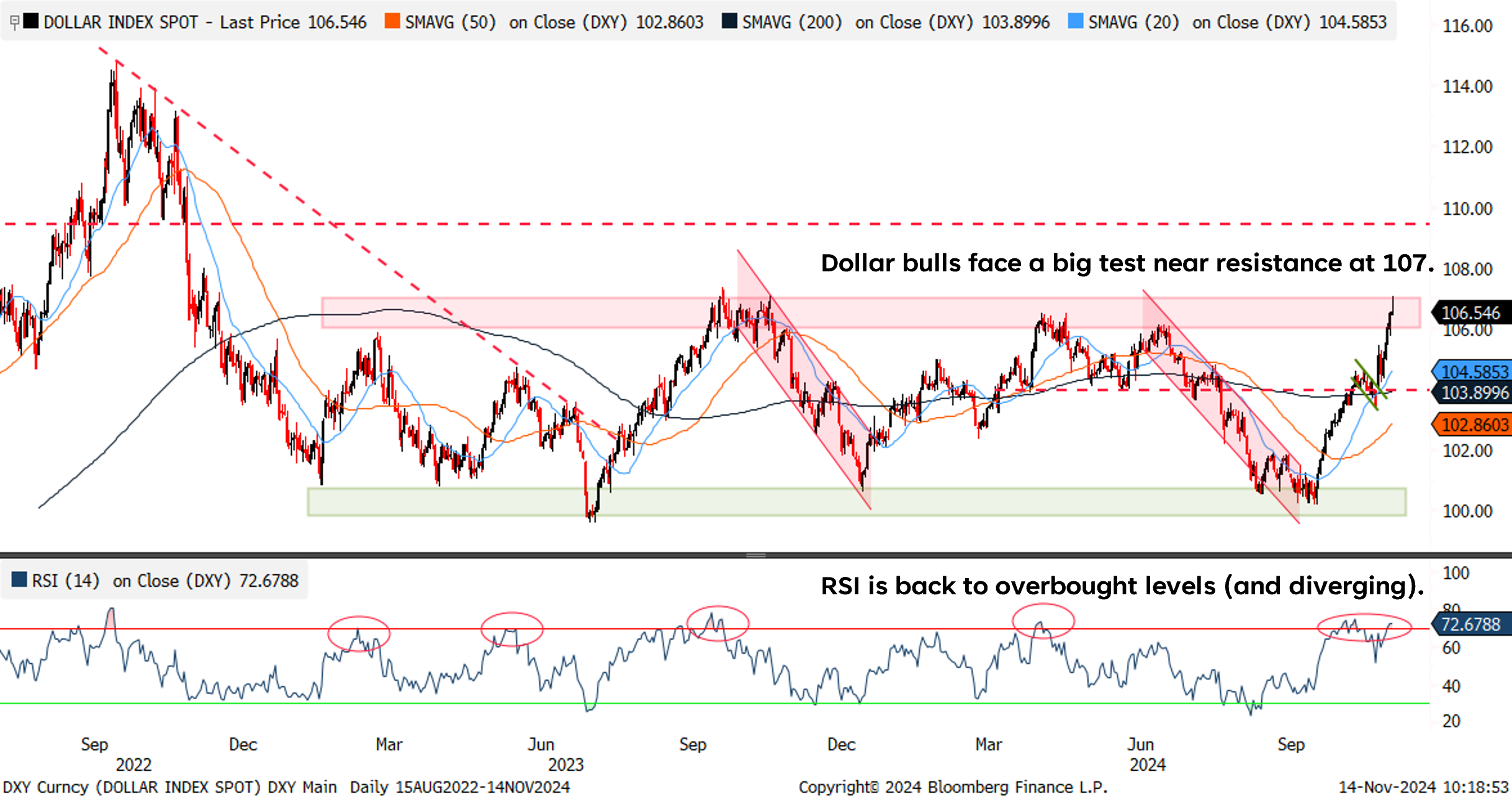

From a technical perspective, the dollar broke out of a bullish flag pattern last week after clearing resistance at 104. The rally has continued into key resistance from the upper end of the dollar’s longer-term range at 107, a major test for dollar bulls. And while momentum remains bullish, overbought conditions have developed. The Relative Strength Index (RSI) — a momentum oscillator used to measure the velocity of price action to determine trend strength — has climbed into overbought territory with a +70 reading (note the lower RSI high vs. October as well, suggesting upside momentum could be losing some steam).

The Dollar Faces a Big Test Near 107

Source: LPL Research, Bloomberg 11/14/24

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Seasonal Headwinds Return

Overbought conditions coupled with overhead resistance are usually a pretty good recipe for a pullback, especially when paired with weak seasonal trends.

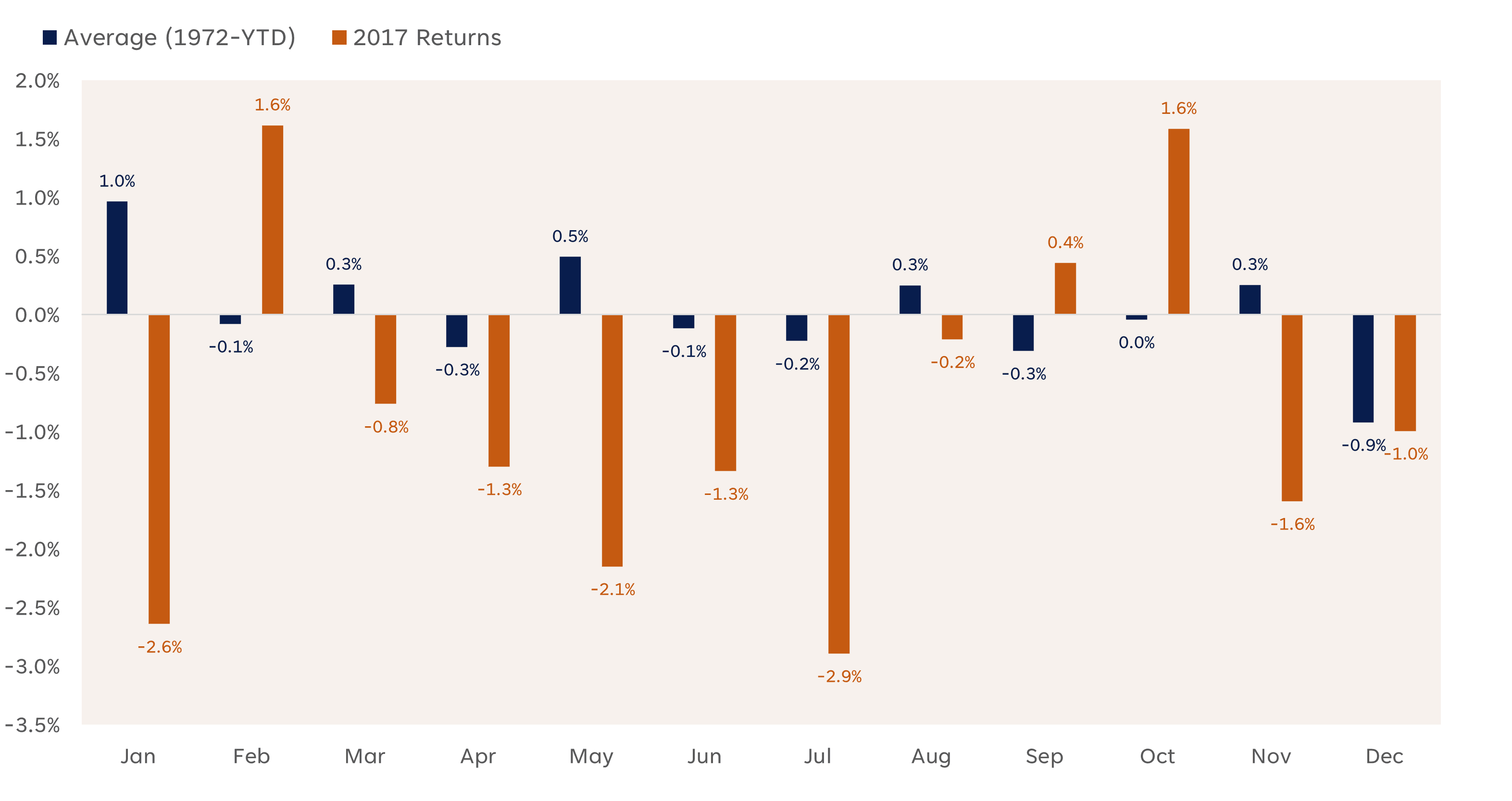

For the US dollar, December has historically been its worst month as the greenback has generated average returns of -0.9% during the month and finished positive only 37% of the time (since 1972). Following the 2016 election, the dollar gained 3% in November followed by a 0.7% gain in December; however, strength quickly dissipated as the dollar dropped 2.6% in January, as highlighted in the chart below.

Monthly Returns of the U.S. Dollar Index

Source: LPL Research, Bloomberg 11/14/24

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

may be a big beneficiary if the dollar does pull back. The precious metal is the most negatively correlated commodity to the greenback and is approaching oversold levels after dropping nearly 8% from its late October high. Outside of dollar strength and rising yields, President-elect Donald Trump’s decisive election victory and pledge to end ongoing geopolitical conflicts has reduced gold’s safe-haven appeal.

Technical damage is beginning to mount. Gold has pulled back through support at the 50-day moving average (dma) and violated the October lows near $2,600. Additional downside support sets up at $2,532 (August highs) and the $2,475–$2,485 range (prior highs and a key Fibonacci retracement level).

The recent selling appears to be more of a product of profit-taking pressure than shorts entering the market. The bottom panel of the chart highlights elevated managed money/speculator long futures positions in gold tapering off modestly, while short gold positions have largely been muted.

Outside of macro forces such as rates and the dollar, global gold demand remains strong. The World Gold Council recently reported total gold demand rose 5% in the third quarter, a record year-over-year increase and the first time total demand has topped $100 billion. One of the big drivers was a return in gold ETF demand last quarter, which was positive for the first time in over two years as fear of missing out sentiment kicked in with gold climbing to new highs.

Oversold Gold Approaching Support

Source: LPL Research, Bloomberg 11/14/24

Disclosures: Past performance is no guarantee of future results. Any futures referenced are being presented as a proxy, not as a recommendation.

Summary

The dollar has rallied notably in the wake of the U.S. election. An improving growth outlook has pulled yields higher as the market recalibrates toward a shallower Fed-cutting cycle. In contrast, deteriorating economic conditions in the Eurozone have increased expectations for a more dovish ECB, putting added pressure on the . Tactically, the dollar is overbought and running into key overhead resistance at 107, a logical spot for a potential pullback, especially as weak seasonality trends unfold in December. Gold has struggled against the sharp rise in the dollar, but the precious metal is approaching oversold conditions within a rising price channel, setting up a potential pullback opportunity. LPL Research maintains a positive view on precious metals as an asset class.