The Consumer Is Dying and Amazon Could Get Cut in Half

2023.01.12 07:42

[ad_1]

New data two weeks ago by the Census Bureau shows that more than 35% of all households used credit cards or personal loans to make ends meet in December (for non-discretionary expenses). That’s up from 32% in November and 21% in December 2021.

Along those lines, Bank of America’s debit and credit card data shows that spending per household on holiday items during the holiday shopping season (last eight weeks of the year) was down 3.4% YoY. This is a nominal number, which means real spending on holiday items was down at least 10.5% using just the CPI YoY “inflation” rate. Based on the big increase in consumer debt in recent months, I suspect debt-strapped household spending will decline more quickly this year.

The dying consumer is accompanied by numerous indicators of economic contraction. Amazon (NASDAQ:) announced that it is taking its job cuts up to more than 18,000 from the 10,000 originally announced late last year. It also appears to be in cash conservation mode, as it will eliminate or curtail experimental and unprofitable businesses. It’s also trying to sell excess capacity on its cargo planes. Good luck with that, as logistics companies are starting to drown in excess freight hauling capacity.

One of the CNBC reporters was excited to announce that online holiday sales “jumped” 3.5% YoY. Of course, I had to point out to her via a tweet that adjusting the nominal sales data by just CPI inflation implies a 4% decline YoY in real (“unit”) online retail sales.

The attribution for the 3.5% nominal increase was recorded high discounting. That’s even worse news for e-commerce companies like AMZN because the discounting will hammer profit margins. Recall that in Q3 AMZN’s e-commerce business generated an operating loss and generated a $2.6 billion YTD operating loss.

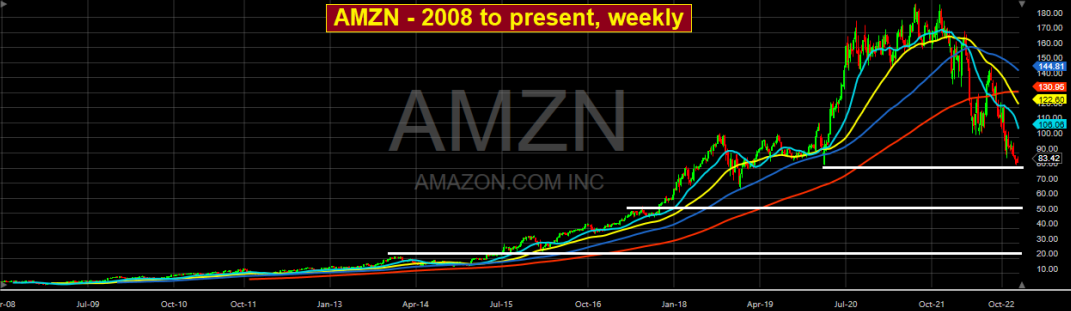

Amazon 2008 to Present Weekly Chart

Amazon 2008 to Present Weekly Chart

While the easiest money shorting AMZN has already been made, I think AMZN could get cut in half, at least, over the next twelve months. This view, of course, depends on the performance of the entire stock market. Despite falling 55% from the all-time high the stock hit in July 2021, AMZN still trades with a 78x trailing P/E and a 52x forward P/E (next twelve months’ earnings estimates, which will prove to be too high).

This compares with Walmart (NYSE:), which trades with a P/E of 44, Target (NYSE:) with a 20 P/E, and Best Buy with a 12 P/E. Roughly 15% of AMZN’s revenues come from its cloud services business, for which the rate of growth is rapidly decelerating. Microsoft (NASDAQ:), which is one of its biggest cloud competitors, trades at a 25 P/E.

These comparative numbers suggest to me a real possibility that AMZN’s earnings multiple has room to fall at least 50%. A worse-than-expected Q4 will be a catalyst that would set the earnings multiple contractions in motion.

The reason I say AMZN may be in cash conservation mode is the dramatic fall in its cash during 2022. Through the end of Q3, AMZN’s cash (plus marketable securities) was $58.6 billion, down from $96 billion at the end of 2021. Against this cash, AMZN has $69 billion in debt or nearly $11 billion of debt net of cash. At the end of 2021, AMZN’s cash exceeded its debt outstanding by $29 billion. A bad Q4 earnings report should crush the stock. I’ve started accumulating June 2023 near-money puts.

[ad_2]