The BoE’s Challenge: Simultaneous Wage Growth and Unemployment

2023.07.11 10:08

UK labour market data is making the Bank of England’s task of fighting inflation complex, with markets increasing expectations of a 50bp rate hike in early August. But we focus on falling employment, which could be the first sign of a recession.

UK reported wage growth acceleration

UK reported wage growth acceleration

A recent labour market report noted increased wage growth to 6.9% y/y, including bonuses. Excluding the turbulence during COVID-19, this is a record pace in the history of this indicator since 2001. But the most important signal is that wages are accelerating, in contrast to interest rate hikes. This will push up domestic inflation, including the most worrying sector, services.

Theoretically, the central bank should be stepping up its fight against inflation and pushing the monetary tightening pedal further down. This argument is supported by consumer inflation figures, which stood at 8.7% in the UK in May, much higher than in Japan (3.2%), the US (4%), France (4.5%) or Germany (6.1% in May and 6.4% in June).

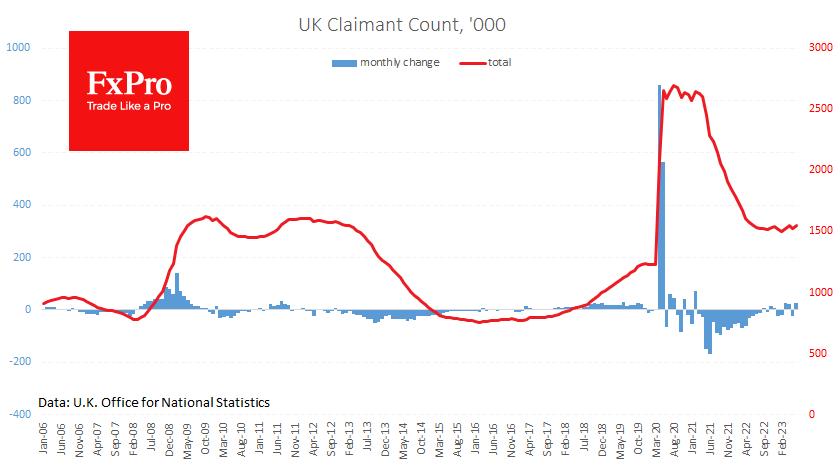

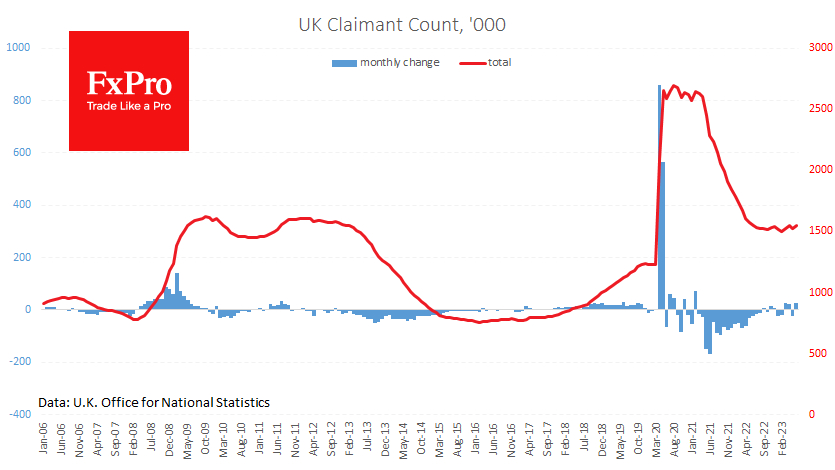

The unemployment rate rose to 4.0%. This is still historically low, but the rise from 3.5% in August makes it impossible to doubt the trend. The number of people claiming unemployment benefits rose by 25.7k in June and by 53.1k over three months.

UK Claimant count went up in recent months

UK Claimant count went up in recent months

So, wage growth in May came simultaneously as employment fell. We often see such cuts in times of crisis, when layoffs of the lowest paid initially push up the average wage level in the economy. But then, by hurting consumption, these cuts trigger a cycle of ever more widespread layoffs. Given the UK’s high and still rising interest rates, we may see this spiral in the coming quarters.

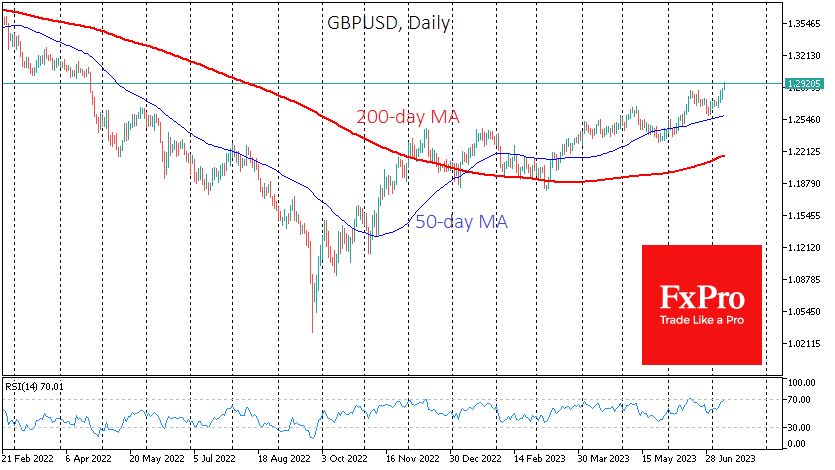

Interestingly, the exchange rate has not contributed significantly to the acceleration in inflation and remains close to its level of a year ago. However, the Pound is now rallying on speculation that the Bank of England will not only continue to hike interest rates but will do so more aggressively at its next meeting in early August.

GBPUSD has a good chance of rising to just above 1.30 now

GBPUSD has a good chance of rising to just above 1.30 now

Tactically, GBPUSD has a good chance of rising to just above 1.30 now that it has fully climbed out of the hole it fell into last April. However, given the dark clouds on the macroeconomic horizon, we are less optimistic that the Pound’s rally can continue.

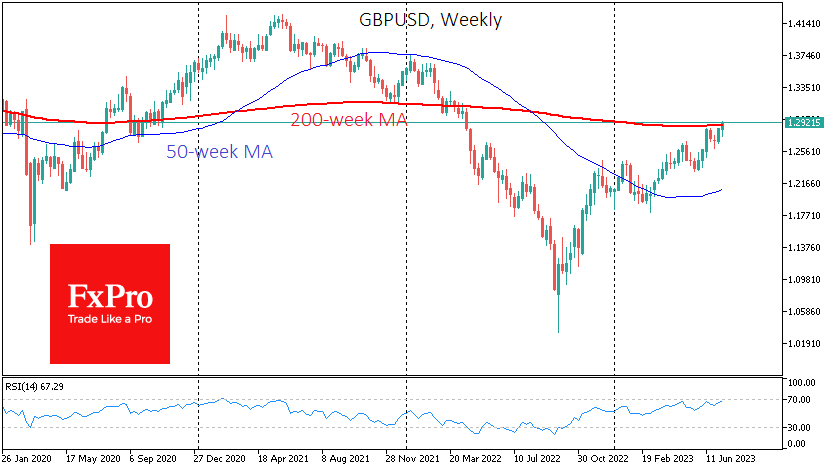

GBPUSD has spent much time near its 200-week average in recent years, reversing or gaining strength before continuing the move. A rise above 1.2890 has brought the pair back above this curve. At the same time, the RSI on the weekly and daily charts are approaching the overbought territory. This is not a signal for an immediate stop but an indication that the upward potential is nearly exhausted, at least for the next few weeks.

GBPUSD has spent much time near its 200-week average in recent years

GBPUSD has spent much time near its 200-week average in recent years

The FxPro Analyst Team