The ‘Biden Biotech Boom’ Will Send This Bargain Dividend Soaring

2022.09.15 06:56

[ad_1]

Some major—and almost totally ignored—news from Washington, D.C., is about to upend the biotech world, turning America into “the world’s pharmacy” in short order—and giving us a chance to buy a solid 6.8% dividend for just 91 cents on the dollar.

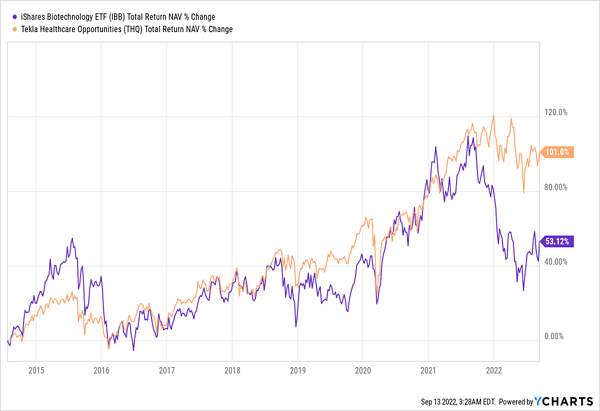

That might sound hard to believe for woebegone biotechs, which have fallen further than the S&P 500 this year, going by the performance of the benchmark iShares Biotechnology ETF (NASDAQ:). That’s despite the sector’s importance during the pandemic—and despite the fact that some 10,000 Americans turn 65 every day, sharply increasing demand for pharmaceuticals as the senior cohort grows.

Biotech Catches a Cold

IBB-Total Returns

The problem is that despite these tailwinds, biotech is weighed down by the same problems that are dragging on the rest of the economy: lower R&D funding as interest rates rise, and supply-chain issues that are hurting productivity.

But this sector is too important to America’s future for the government to let it wallow. So President Biden has stepped in. What his administration is doing will more than offset those negatives—and put the sector on an upward trajectory for years to come.

Let’s Squeeze the ‘Biden Biotech Boost’ for 6.8% Dividends and Upside

Before we go further, I should say that we espouse no political agenda here at Contrarian Outlook. We simply mine the overlooked dividend (and growth) opportunities before us. And the Biden plan is one, because it primes the 6.8%-paying closed-end fund (CEF) we’ll discuss shortly for strong gains.

The plan is a multi-billion-dollar project called the National Biotechnology and Biomanufacturing Initiative. Among other things, it’s designed to bring the production of more vital treatments to the US—an echo of the “onshoring” and “deglobalization” trends we’ve been covering here on Contrarian Outlook recently. At the same time, US pharma firms can use these funds to push out into new markets and grow their current ones.

The plans are ambitious and wide-ranging: there’s hope to develop new antibody therapeutics, alternatives to meat, biodegradable plastics and age-reversing technology.

All of this boils down to the fact that the government is turning on the flow of money to biotech at a time when the Fed is reducing the flow of money to the economy as a whole. That will set up the sector to regain its edge. But not all biotechs will benefit equally, which is why we’re playing the “Biden biotech boom” through an actively managed CEF.

This 6.8%-Yielding Fund Holds All the ‘Biden Biotech Boom’ Winners

The best biotech CEFs are managed not just by financial pros but also by Ivy League–trained medical doctors and researchers who can cast a critical eye on the research churned out by different pharma firms.

This is why CEFs are the ideal tools for biotech investing. Algorithm-run ETFs and individuals picking their own stocks simply can’t compete with financial and medical experts who know the sector inside and out.

The pros at the 6.8%-yielding Tekla Healthcare Opportunities Fund (NYSE:) are a perfect example. This fund, like all funds managed by Tekla, is run by a mix of financial and medical pros with decades of experience. The proof is in their performance: THQ has beaten the biotech index fund since THQ was launched nearly a decade ago, with almost double IBB’s returns in that time.

Ahead of the Market

THQ-Outperforms

THQ’s portfolio is solid, sporting a mix of blue-chip firms with healthy cash flows, like Johnson & Johnson (NYSE:) and Merck & Company (NYSE:), and smaller firms with solid pipelines of drugs and medical devices, like Medtronic (NYSE:), Becton Dickinson (NYSE:) and Intuitive Surgical (NASDAQ:). This combination has driven THQ’s market-busting returns while also sustaining its near-7% yield.

Finally, let’s talk valuation: THQ sports an 8.6% discount to net asset value (NAV, or the value of the stocks it holds), so we’re essentially buying for 91 cents on the dollar here. That discount is well below the 4.4% discount the fund has averaged over the last year and far off the 4% premium at which it topped out in that time. I’m expecting THQ’s discount to flip to a premium and retake that level on the strength of the Biden pharma package, taking the fund’s price along with it.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”

[ad_2]

Source link