Tesla: Should You Ride the Momentum or Cash Out?

2023.06.06 08:51

- Many analysts say Tesla is overvalued

- But Elon Musk has promised star figures for this year

- Is it time to sell the stock or ride its upward momentum?

Tesla (NASDAQ:) has attracted a bit of attention in recent days, thanks to its impressive rally. After a 20.8% decline in April, the electric vehicle manufacturer surged by 24% in May. This has catapulted CEO Elon Musk back to the top spot of the Bloomberg billionaire index.

The discussion surrounding Tesla potentially benefitting from Artificial Intelligence has generated considerable buzz for the stock in recent months. But, Adam Jonas, an analyst at Morgan Stanley, warns in a recent note that while it’s tempting to talk up Tesla’s AI prowess, the stock’s direction will be dominated by supply and demand for electric cars over the next 12 months.

And, in this regard, it doesn’t seem to be doing badly. Tesla and Chinese rival BYD (SZ:) are leading the transition to electric vehicles, according to ‘The Global Automaker Rating 2022’ report, published by the International Council on Clean Transportation (ICCT).

This report ranks the world’s leading light vehicle manufacturers on their transition to electric vehicles, including market share, technology, and strategic vision. Tesla also leads in other criteria, such as range, charging speed, and efficiency.

Global Automaker Rating 2022

Global Automaker Rating 2022

Source: ICCT

Tesla shares have risen significantly this year, gaining more than 77%, eclipsing the 33% advance of the index and even outpacing the 64% jump of the NYSE FANG+ index.

Note, however, that this year’s surge comes on the back of a 65% drop in 2022, which was the worst annual performance in the company’s history, according to Bloomberg.

Tesla’s gain in May is making investors wonder if the electric vehicle maker’s stock has resumed its uptrend.

Many experts say that Tesla is overvalued, considering that its market capitalization is now at almost $690 billion, while other top automakers in the automotive sector do not even reach one-sixth of that.

For comparison, Volkswagen is worth $73.7 billion, and BMW is worth $67.2 billion.

Fundamentals

To help us analyze Tesla’s current situation, we turn to the professional tool InvestingPro:

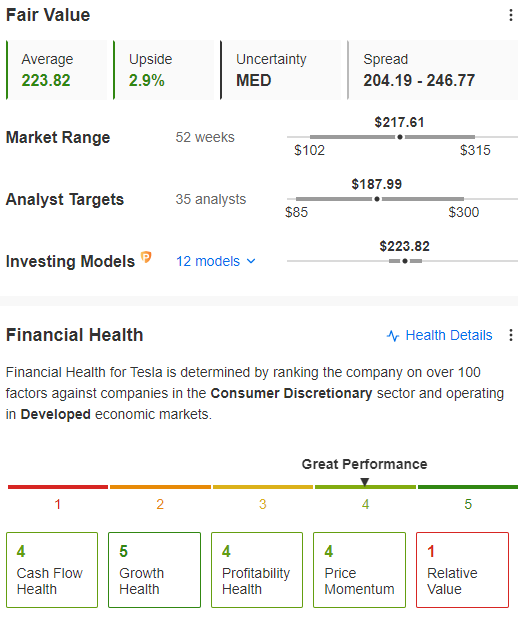

Tesla closed yesterday’s Wall Street session at $217.61. According to InvestingPro, the market value stands at 223.82, its risk is medium, and its financial health looks decent.

Tesla – Fair Value

Source: InvestingPro

In the company’s favor is its high return on invested capital, more cash than debt on the balance sheet, and a steady rise in earnings per share (EPS).

On the downside, a total of 20 analysts have revised its earnings estimate downward for the next period. The stock trades at a high multiple of earnings, and price moves are quite volatile.

Likewise, InvestingPro highlights that the company does not pay dividends to its shareholders.

It should also be noted that although the stock is up 26% in one month, it is still down 7.3% over the past 12 months.

Tesla – Price History 1 Month

Source: InvestingPro

Tesla – Price History 1 Year

Source: InvestingPro

Tesla will release its Q2 2023 results on July 24. Analysts have lowered their EPS expectations for this quarter by -42.8% from $1.37 to $0.78 per share on a trailing 12-month basis. The estimated revenue is $24.272 billion.

Tesla – Earnings

Source: InvestingPro

In the first quarter, the EV maker posted sales of $23.33 billion (up 24% year-over-year) and delivered 422,875 vehicles, up 36%. In January, Elon Musk forecast 2 million deliveries this year.

However, profit was $2.513 billion (down 24%), and EPS was $0.85, slightly below market expectations ($0.86).

If you want to maximize returns from your investments, try the InvestingPro professional tool for free for 7 days through this link.

Find All the Info you Need on InvestingPro!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest nor is it intended to encourage the purchase of assets in any way.