Stock Markets Analysis and Opinion

Tesla Earnings: Technicals Reveal Stock Headed Lower, Rally Ended in September

2024.10.22 17:13

Tesla (NASDAQ:), Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems.

The company operates through Automotive and Energy Generation and Storage. The Automotive segment includes the design, development, manufacture, sale, and lease of electric vehicles as well as sales of automotive regulatory credits. The Energy Generation and Storage segment is involved in the design, manufacture, installation, sale, and lease of stationary energy storage products and solar energy systems, and sale of solar energy systems incentives.

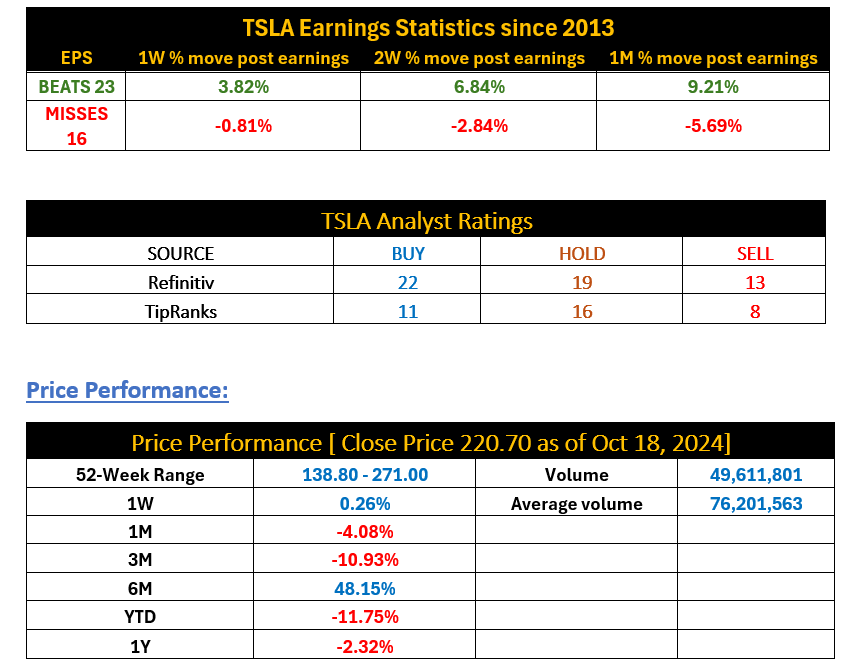

Tesla Q3 2024 reports earnings at 4:07 pm Wednesday, Oct 23.

Key Highlights:

- Tesla’s third-quarter deliveries came in above estimates earlier this month.

- Prices gapped down post Robotaxi event due to a lack of details about whether Tesla would plan to operate its fleet of robotaxis or sell them to customers, and the lack of an anticipated lower-cost Tesla model announcement.

- Analysts expect Tesla’s revenue to rise from the same time last year, while profit is projected to fall slightly.

Technical Analysis Perspective:

- TSLA monthly prices tend to consolidate gains after a sharp rally since its inception.

- A volume spike on monthly charts is the beginning point of a rise. See May 2013 (highlighted volume bar) & Jan 2020 in the following chart.

- Two rectangle pattern consolidations in 2011 – 2013 and 2014 – 2019 were followed by sharp rallies.

- TSLA has been hovering inside a large symmetrical triangle since November 2021 after recording the highest stock price at 414.50.

- Downward move ended at 101.81 in January 2023

- Rise to 299.29 completed in July 2023

- Decline to 138.80 ended in April 2024

- Rally to 264.86 most likely ended in September 2024.

- Now a final drop to 180 to 155 is in progress to complete 5th point of the triangle.