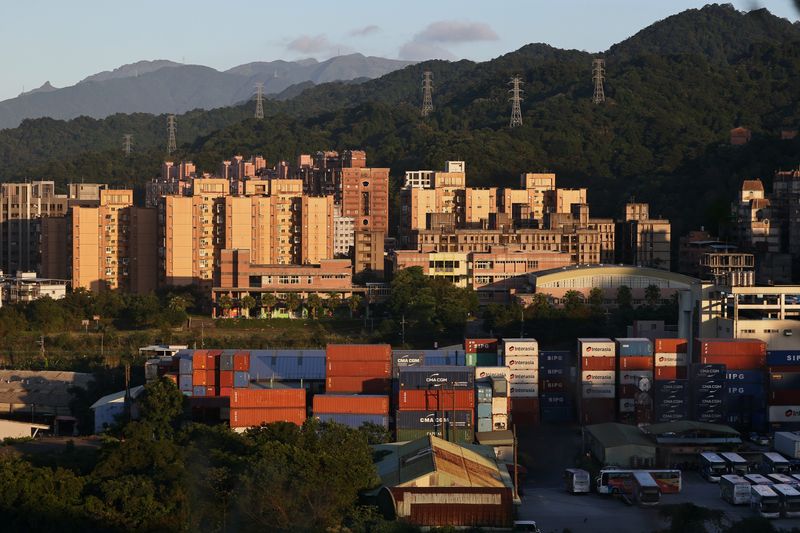

Taiwan October export orders beat forecasts on AI, China demand remains soft

2024.11.20 04:23

TAIPEI (Reuters) – Taiwan export orders maintained strong momentum going into the final quarter by beating expectations for October, as the island benefits from demand for artificial intelligence (AI) technology, though also grappling with softness from China.

Export orders rose 4.9% last month to $55.45 billion from a year earlier, the economy ministry said on Wednesday. That topped both the 3.6% gain forecast in a Reuters poll and September’s expansion of 4.6%, and marked the eighth straight month of growth.

Orders for goods from Taiwan, home to tech giants such as chip manufacturer TSMC, are a bellwether of global technology demand.

The ministry expects export order momentum to be sustained as new applications keep rolling out, boosting demand for semiconductors and servers, the ministry said. Consumer electronics products will enter the traditional hot demand season in the second half of the year, it added.

However, the momentum could be offset by geopolitical tensions and U.S.-China technology disputes, among other factors, it added.

The ministry said it expects export orders in November will rise between 4.7% and 8.6% year-on-year.

Taiwan’s orders in October for telecommunications products were up 0.5% from the prior year, while electronic products rose 11.2% from a year earlier.

Overall orders from China improved, down 0.1% versus a 3.6% fall the prior month. Orders from the United States jumped 12.6%versus an 8.3% gain in September.

Orders from Europe rose 2.7% in October after dipping 4.2% in September. From Japan, orders were up 5.3% versus a rise of 9.8% during the same period.