Syneos taken private for $4.46 billion by investment consortium

2023.05.10 12:07

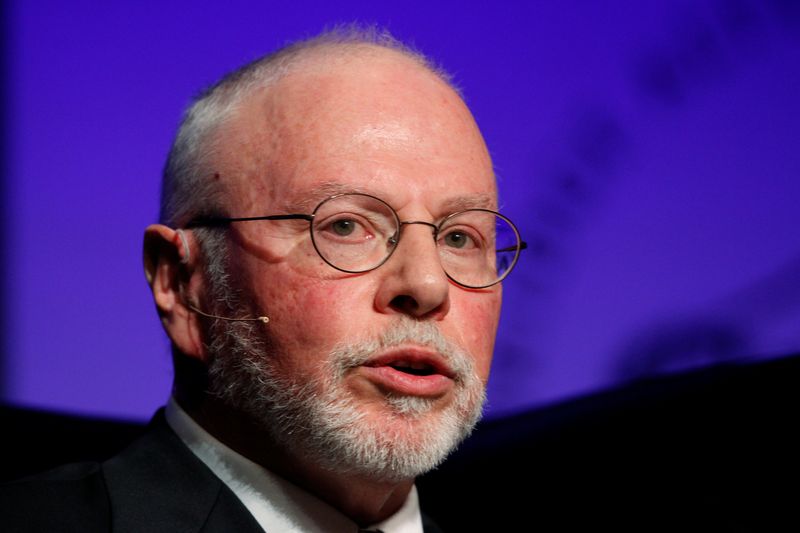

© Reuters. FILE PHOTO: Paul Singer, founder, CEO, and co-chief investment officer for Elliott Management Corporation, speaks during the Skybridge Alternatives (SALT) Conference in Las Vegas, Nevada May 9, 2012. REUTERS/Steve Marcus/File Photo

(Reuters) -An investment consortium, comprising of Elliott Investment Management, Patient Square Capital and Veritas Capital, has agreed to take Syneos Health (NASDAQ:) Inc private for $4.46 billion, the contract research firm said on Wednesday.

Shares of Syneos rose 8.7% to $41.8 in early trade.

The consortium will pay about $43 per share in cash, which represents a premium of about 12% to Syneos’ last close. The acquisition is valued at $7.1 billion including debt.

North Carolina-based Syneos has been facing challenges in winning new business as many of its clients, which include small and medium-sized biotech companies, have cut spending amid difficulties raising funding in a post-COVID market downturn.

Other companies which offer contract research services, such as Danaher Corp (NYSE:) and Thermo Fisher Scientific (NYSE:), have also flagged soft demand in the sector.

Reuters first reported in February that Syneos was exploring a sale. On Tuesday, sources familiar with the matter told Reuters that Syneos was nearing a buyout deal with a consortium.

Private-equity firms have increasingly been investing in the drug development sector, which was deemed as risky, by coming up with deals that compensate them for the uncertainty involved.

The deal comes days after a private-equity group including Warburg Pincus and Advent International agreed to buy Baxter International (NYSE:)’s biopharma solutions unit for $4.25 billion.

“Taking Syneos private will allow the company do some much-needed repair work out of the glare of public markets” said Elizabeth Anderson, Evercore ISI analyst, adding that the deal would help create long-term value for the company.

Syneos, which helps pharmaceutical companies with clinical trials and marketing their drugs, currently carries a debt of nearly $3 billion.

Goldman Sachs (NYSE:), UBS Investment Bank, RBC Capital Markets are among some of the U.S. banks that have agreed to finance the deal, which is expected to close in the second half of 2023.