Superbubble’s Final Act? Or Is This Time Different?

2022.10.11 13:08

[ad_1]

Is this the “Superbubble’s Final Act?” Such was a fascinating piece of commentary recently from Jeremy Grantham, famed investor and co-founder of GMO. As he states:

“Only a few market events in an investor’s career matter; among the most important of all are superbubbles. These superbubbles are events unlike any others: while there are only a few in history for investors to study, they have clear features in common.

One of those features is the bear market rally after the initial derating stage of the decline but before the economy has begun to deteriorate, as it always has when superbubbles burst. In all three previous cases, the market recovered over half the initial losses, luring unwary investors back just in time for the market to turn down again, only more viciously, and the economy to weaken. This summer’s rally has so far perfectly fit the pattern.”

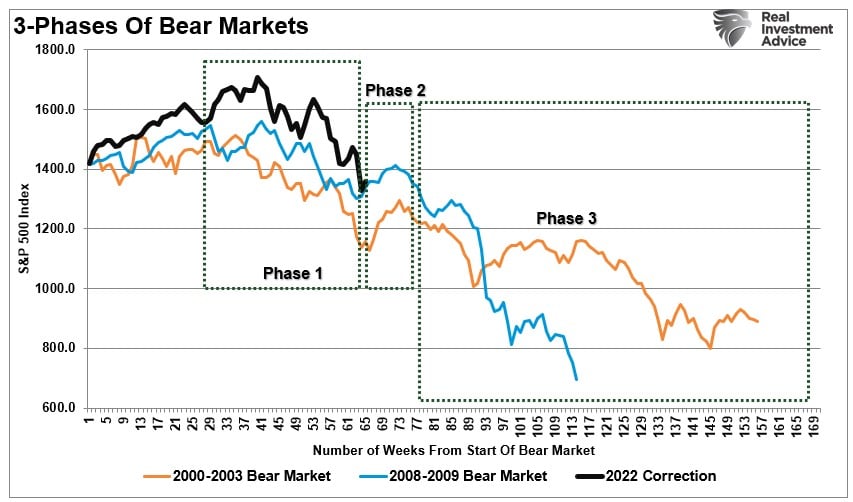

The chart below compares the 2000 “Dot.com” and 2008 “Financial Crisis” superbubbles. To Jeremy’s point, there are indeed some very concerning similarities.

2000-and-2008-Market-Analog

2000-and-2008-Market-Analog

What Jeremy is discussing is also a reflection of one of Bob Farrell’s 10-Investment Rules. Rule number eight states:

“Bear markets have three stages – sharp down, reflexive rebound, and a drawn-out fundamental downtrend.”

As noted, 2022 started with a sharp and swift decline lasting well into mid-year. With extremely bearish sentiment, it was no surprise that July and August saw an oversold bounce that retraced a portion of that decline. However, with that retracement now behind us, the concern is the 3rd phase of the superbubble has yet to commence. That 3rd phase is a slower and more grinding decline that coincides with deteriorating fundamentals.

While every cycle is different and unique, the question is this time different?

A Challenging Fundamental Backdrop

The biggest challenge for investors is constantly discerning the difference between short-term market movements and long-term fundamental drivers of markets.

For example, during a bull market advance, investors often dismiss any analysis that disagrees with the hope of higher asset prices. A good example, as discussed in

“The belief this time is different from the past has always been the most dangerous of phrases for investors. However, this is where participants exist today. While it is true that excessive monetary liquidity has certainly changed short-term market dynamics, there is no evidence it has mitigated long-term consequences.

Moreover, investors also believe that low-interest rates justify overpaying for earnings and sales.

‘Valuations don’t matter as much as they did in the past because ‘this time is different’ in that interest rates are so low.’”

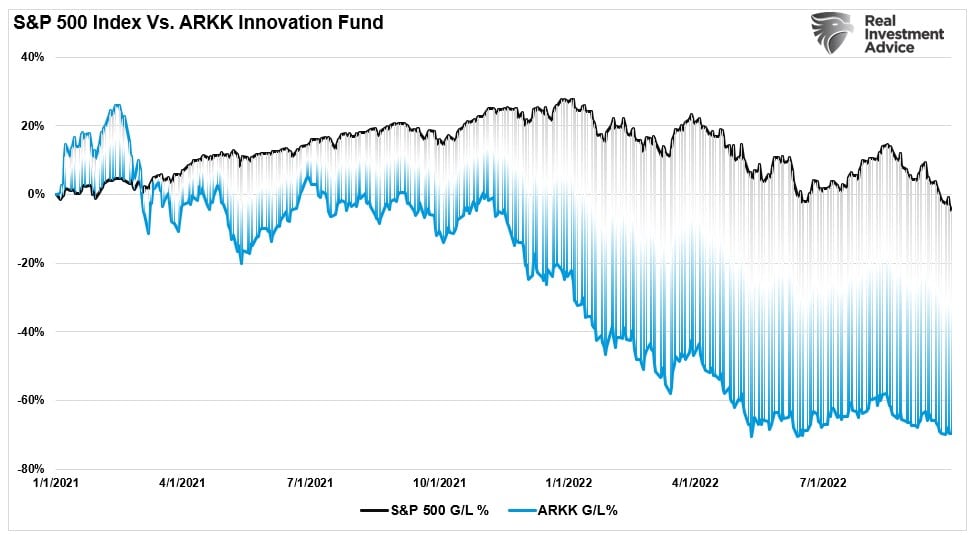

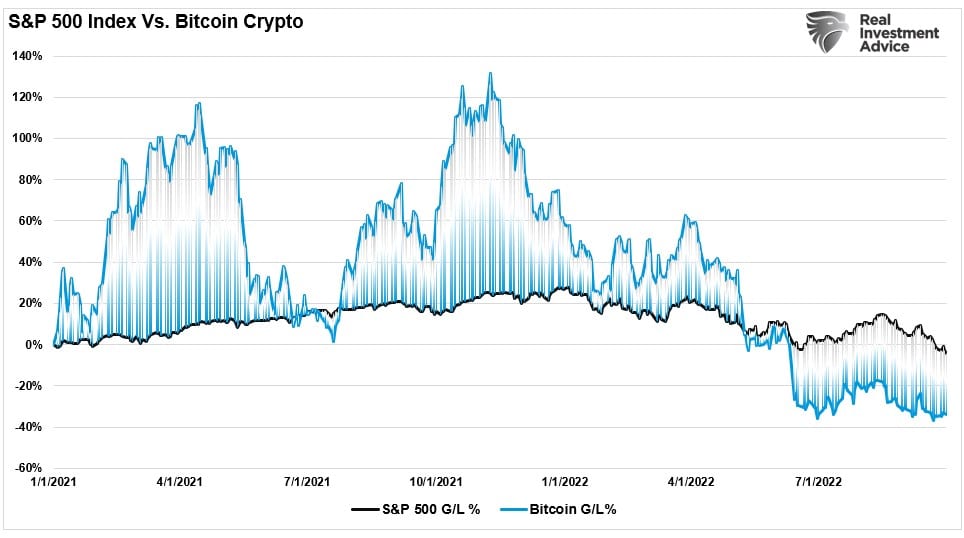

Of course, as we now see, that irrational rationalization had devastating consequences, particularly in market sectors devoid of earnings and revenue growth. The poster child of those types of investments was ARKK Investment Funds and Cryptocurrencies.

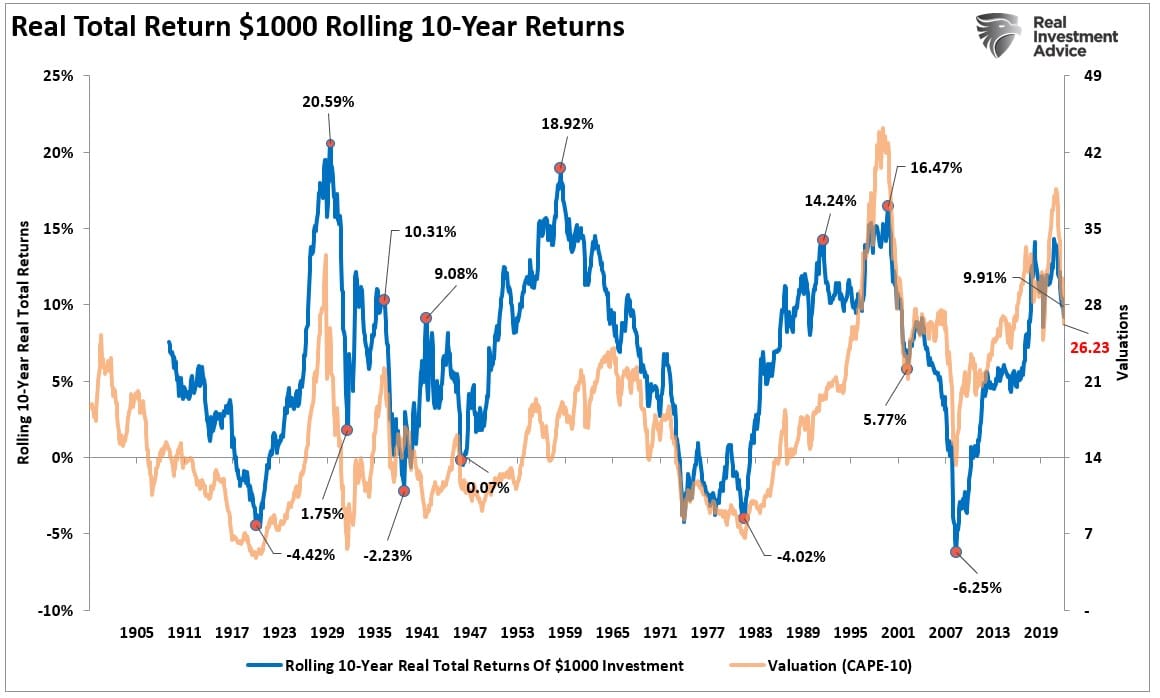

It is imperative to remember valuations are very predictive of long-term returns from the investment process. However, they are horrible timing indicators. Because valuations, and fundamentals in general, take a long-time to play out in the markets, it is not surprising investors dismiss them in the heat of the bull market.

However, currently, we find ourselves at the crossroads where markets and fundamental realities meet. From this point, the outlook for equities over the next 9-12 months is more bearish than bullish. For example, those valuations that many ignored over the last few years as the Fed distorted markets with repeated monetary injections still suggest forward returns will be substantially lower over the next 10-years.

10-Year-Valuation-vs-Forward-Returns

10-Year-Valuation-vs-Forward-Returns

Notably, the “difference this time” is the Fed is not acting accommodatively. Instead, the Fed is aggressively tightening monetary policy to slow economic growth and reduce demand-driven inflation. The consequence of those actions must be, by their very nature, negative concerning both economic and earnings growth.

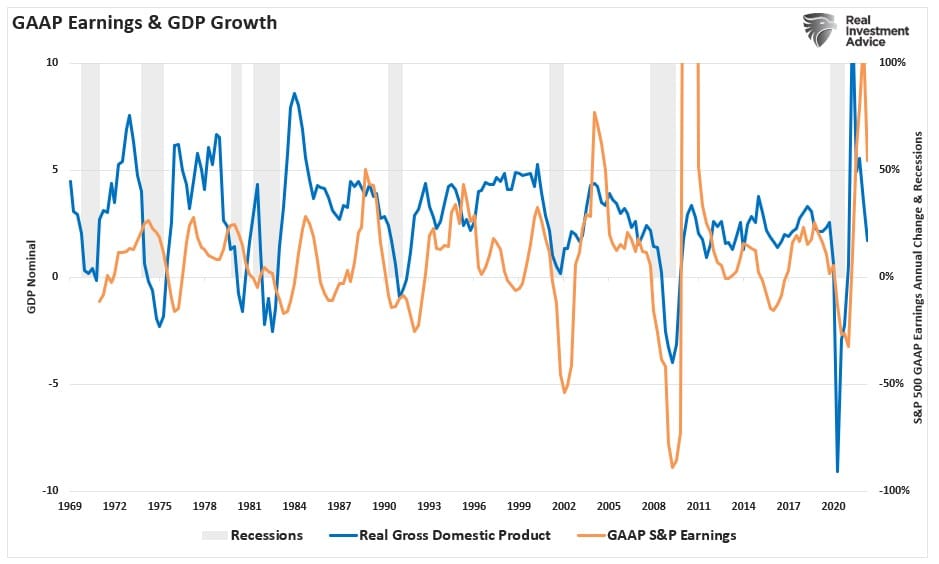

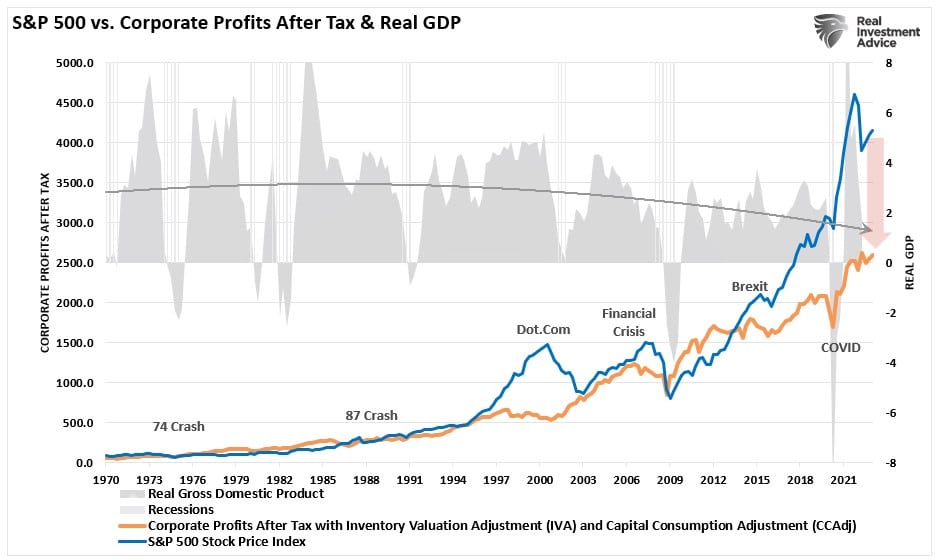

The most obvious indication that a decade of monetary interventions created a “superbubble” is in the deviation of the financial markets from corporate profitability. The eventual reversion in economic growth and, ultimately, corporate profitability leaves investors highly vulnerable to a much more significant decline as prices move to reflect economic realities.

SP500-Corporate-Profits-vs-GDP

SP500-Corporate-Profits-vs-GDP

This Time Is Not Likely Different

The risk to investors is that this time is “not” different. As Jeremy Grantham notes:

“Economic data inevitably lags major turning points in the economy. To make matters worse, at the turn of events like 2000 and 2007, data series like corporate profits and employment can subsequently be massively revised downwards. It is during this lag that the bear market rally typically occurs.”

He is correct. The problem for investors is that it is often too late to make much of a difference when they realize that current expectations are too elevated. Historically, the outcomes of these misaligned expectations are brutal and financially devastating. As Jeremy further states:

“Why are the historic superbubbles always followed by major economic setbacks? Perhaps because they occurred after a very extended build-up of market and economic forces, with a major surge of optimism thrown in at the end. At the peak, the economy always looks near perfect: full employment, strong GDP, no inflation, record margins. This was the case in 1929, 1972, 1999, and in Japan (the most important non-U.S. superbubble). The ageing cycle and temporary near perfection of fundamentals leave economic and financial data with only one way to go.”

While many hoped the market lows for 2022 were set back in June, they weren’t, as new lows came last week. Those lows likely won’t be the last.

- The Fed is aggressively tightening monetary policy to quell inflation.

- At the same time, the Fed is reducing market liquidity by $95 billion per month.

- High levels of inflation are quickly eroding Americans’ savings and spending ability.

- Inflation will likely remain more “sticky,” eventually eroding corporate margins.

- Governments acting erroneously to inject liquidity to combat inflation will cause inflation to remain high.

- Inflation, and government policies, will act as a “tax” on consumers, further eroding spending capacity.

- Forward earnings estimates remain overly optimistic, requiring lower asset prices to compensate.

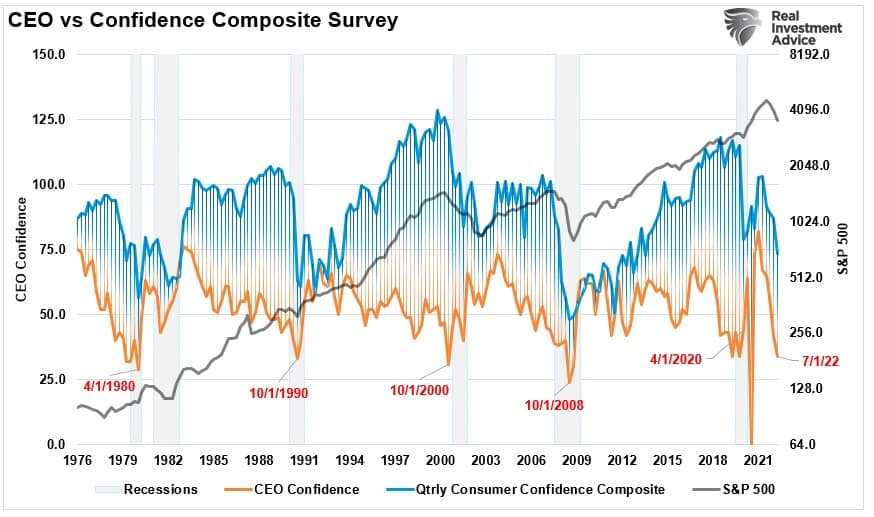

- Layoffs are increasing, hiring is slowing, and CEOs and consumers are bracing for recession.

CEO-vs-Consumer-Confidence

CEO-vs-Consumer-Confidence

These are just a few of the issues currently, but the impact of these, and many other negative factors, continue to erode consumer and business confidence measures.

Given the current economic and financial backdrop, if the current bear market did indeed bottom in July, it would be the first time such occurred historically. Nonetheless, we should not dismiss the possibility entirely. Given the recent Government responses to downturns, another bailout will not be surprising.

However, those “bailouts” are not on the horizon currently and will likely come amidst a steeper decline in asset prices. Let me conclude with Jeremy’s final point:

“But these few epic events seem to act according to their own rules, in their own play, which has apparently just paused between the third and final act. If history repeats, the play will once again be a Tragedy. We must hope this time for a minor one.”

We can always hope.

[ad_2]

Source link