Stocks Week Ahead: Key Data Could Test the Fed’s 2% Inflation Narrative

2024.12.09 02:56

It will be an important week, with finalized third-quarter data on Tuesday, the on Wednesday, the on Thursday, and Import/Export prices on Friday.

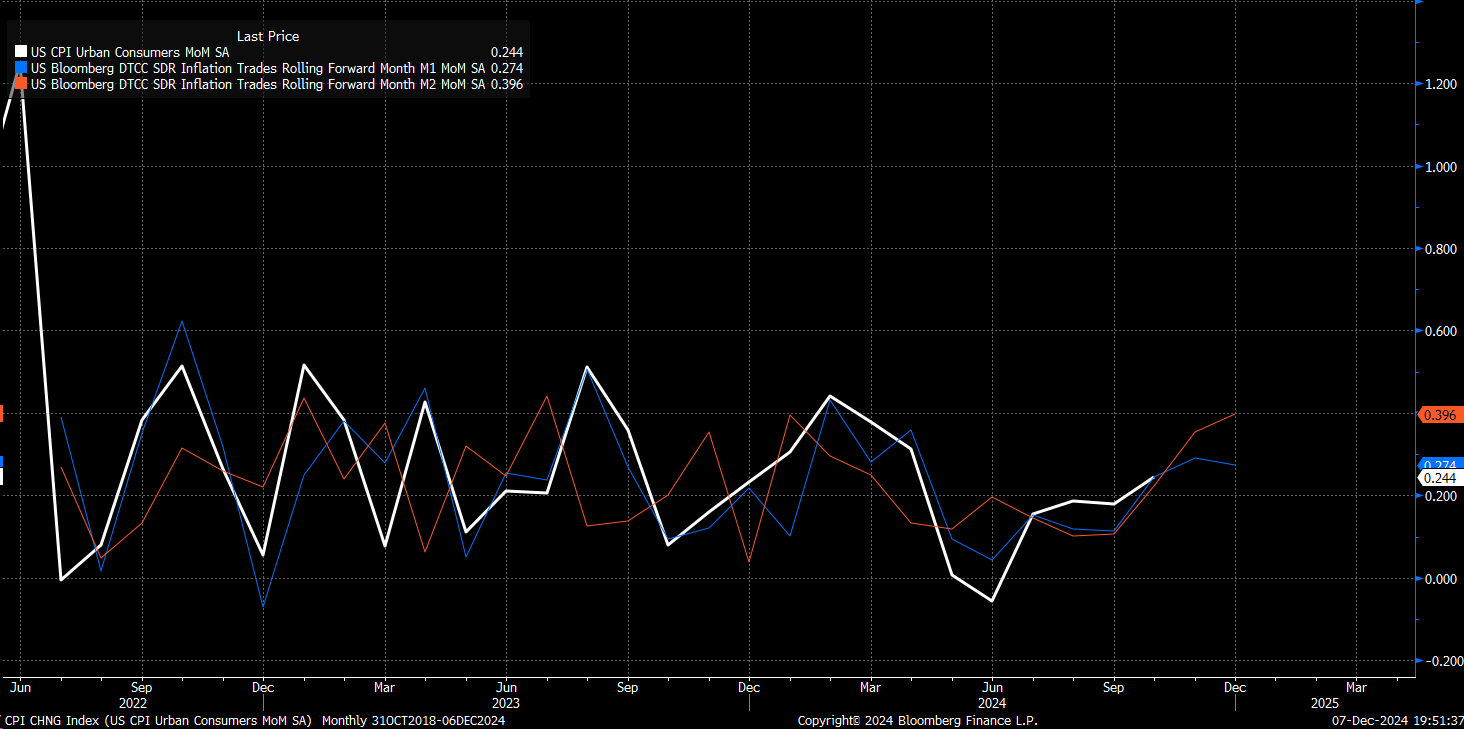

The CPI is expected to show a 0.3% m/m increase, up from 0.2% last month, while core CPI is also projected to rise by 0.3% m/m.

Headline CPI is anticipated to climb to 2.7% y/y, up from 2.6%, while core CPI is expected to rise by 3.3% y/y, in line with last month. PPI numbers are also forecasted to increase in November to 0.3% m/m from 0.2% and to 2.6% y/y from 2.4%.

The CPI on a m/m basis has been steadily rising since it bottomed in June. If the CPI Swap market is correct and the figure comes in at 0.27%, it would mark the highest CPI increase since April.

The concern is that December is currently pricing in a 0.4% m/m rise. The believes inflation is back to 2%, so the outcome remains uncertain.

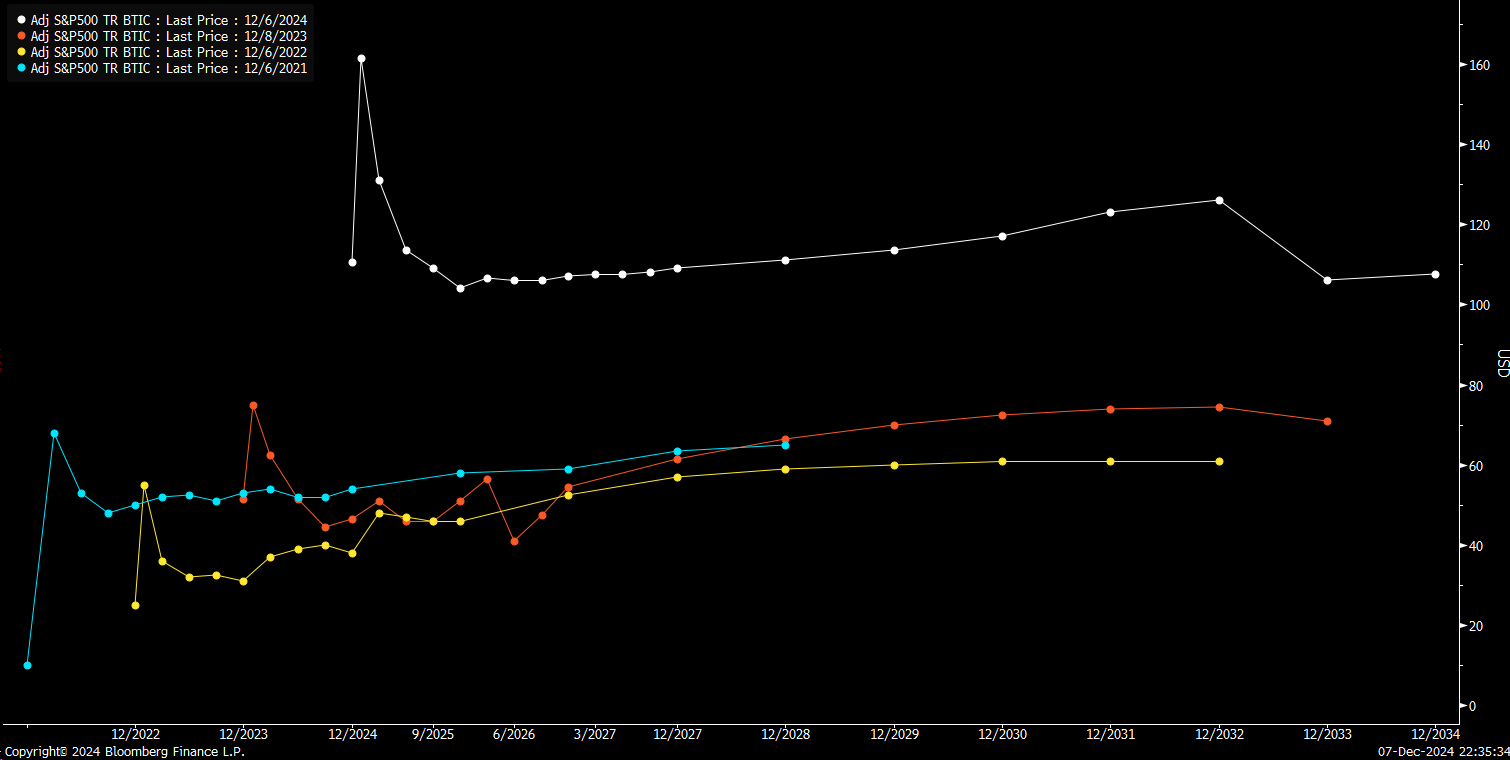

In the meantime, market strains appear to be persisting, as noted last week. The spread between the December and January contracts of the Total Return Index Futures is around 57.5, with those spreads turning negative for the March contracts.

This suggests that, at present, there is a high cost associated with contracts expiring in January, but this cost declines rapidly for March.

This may indicate a rising funding cost and that the market is beginning to experience some form of strain. If these pressures persist or worsen, it could trigger a deleveraging event as costs become unsustainably high.

It is not unusual to see this type of bump in costs around the turn of the new year, as this has been the case over the past three years. However, this year’s costs are nearly double what they have been in previous years, making this an especially interesting scenario.

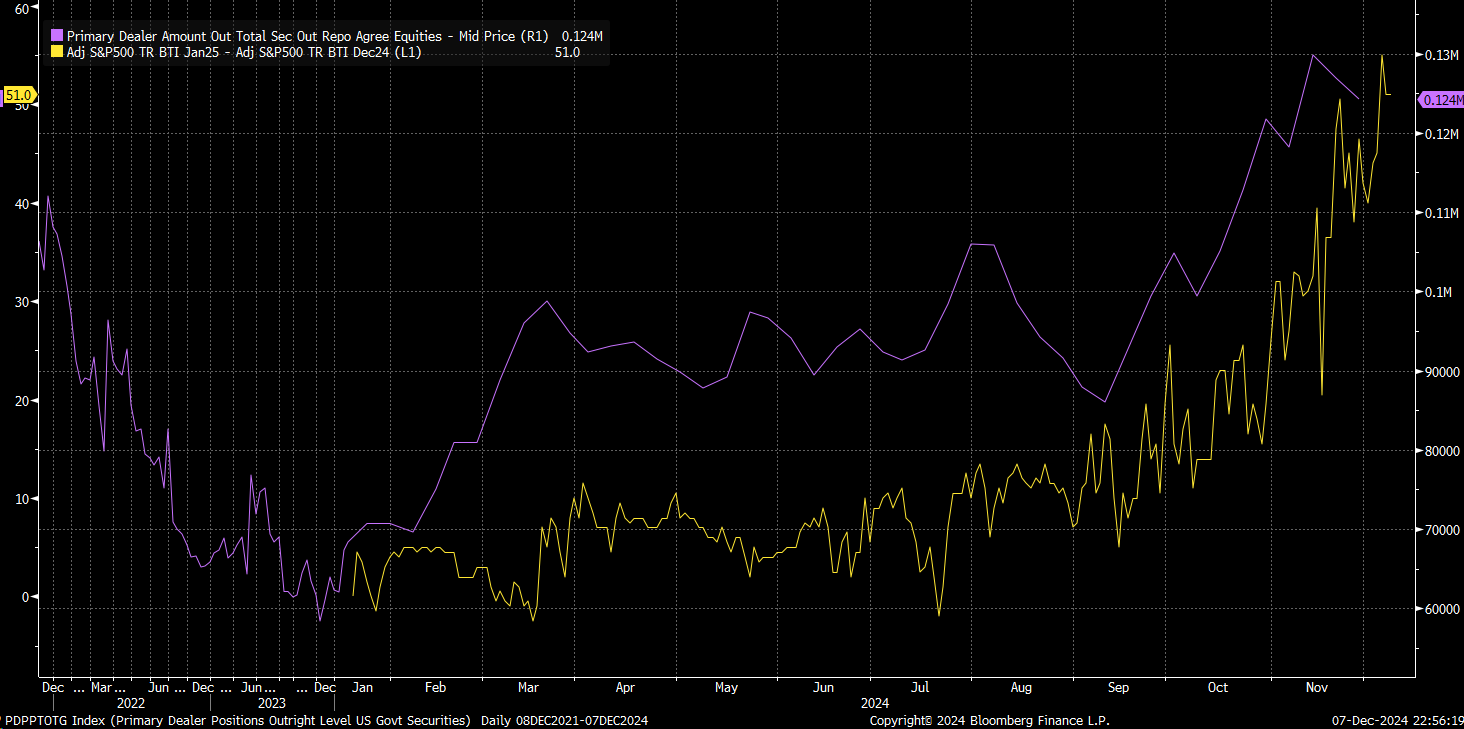

There is undoubtedly less liquidity in the market compared to past years, with the reverse repo facility now at just $130 billion, down from a peak of $2.5 trillion.

Additionally, primary dealer repo activity has surged recently, indicating an increase in equity-backed repo agreements, where equities are used as collateral to raise cash. This could be a sign of growing liquidity strain.

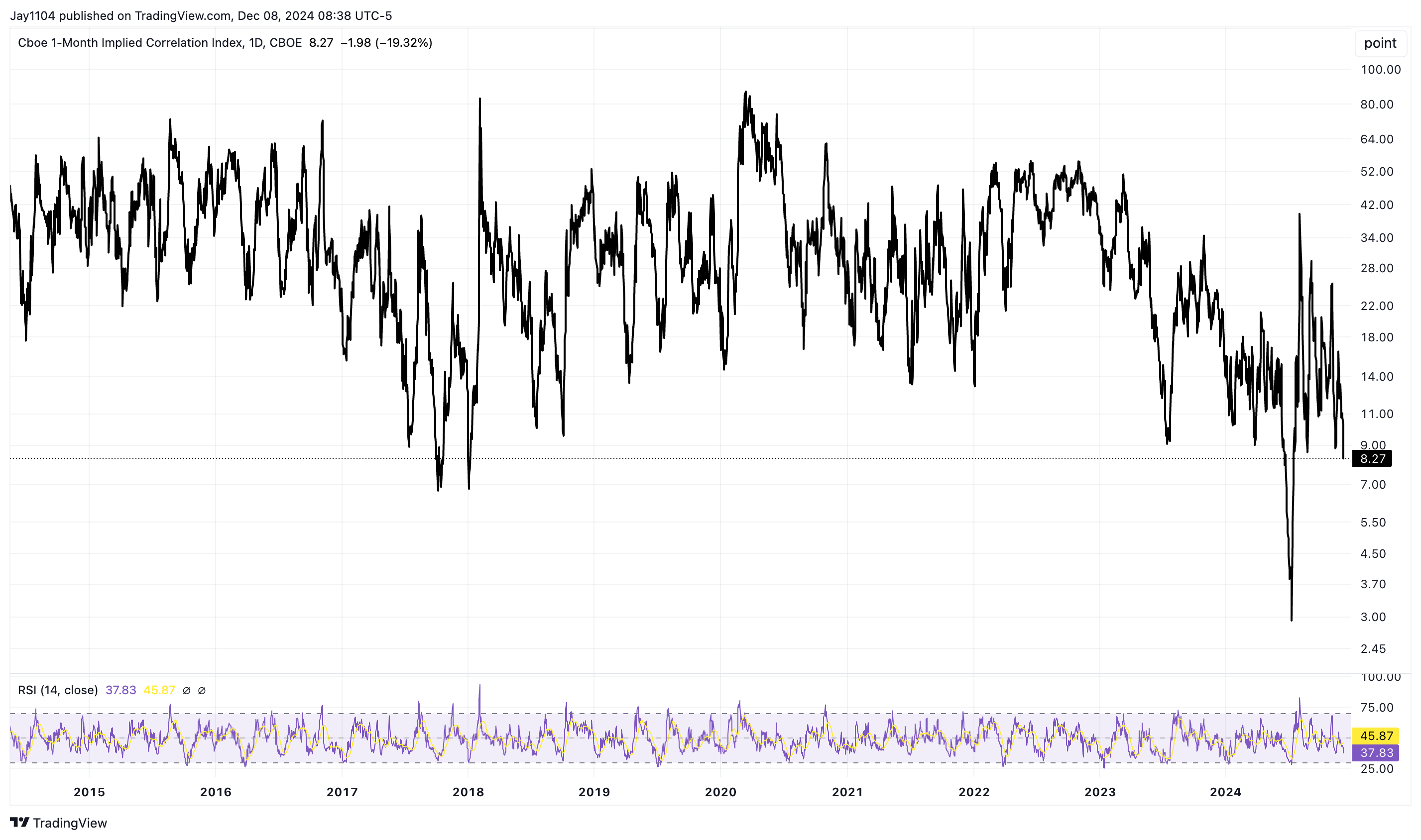

This comes at a time when 10- and 20-day realized volatility has plummeted and seems to be approaching a bottom, at least for now. This suggests that realized volatility likely has only one direction to move next—upward.

Additionally, the 1-month implied correlation index has dropped below 10, a historically rare condition. Levels this low have only been observed in late 2017, preceding the January 2018 decline, and in July 2024, preceding the August 2024 decline.

This is further amplified by the fact that, based on metrics such as price-to-book, price-to-earnings, price-to-sales, and dividend yield, this is likely one of the most expensive markets of the modern era.

Valuation alone cannot pinpoint a market top, but when combined with other factors, it can strongly suggest that a climactic event may be approaching.

Original Post