Stocks Week Ahead: Can GDP, PCE Help Sustain Year-End Run?

2023.12.18 02:58

The market surged this past week following a confusing Fed meeting that created more questions than answers. The Fed tried to go into damage control on Friday by sending out John |Williams, Raphael Bostic, and Austan Goolsbee. None did much on the surface to improve the situation Jay Powell left behind following the Wednesday press conference.

This week will be the Austan Goolsbee show, with the Chicago Fed President speaking four times starting today through Wednesday. We may have already gotten a sneak peek of what he will likely say following a Wall Street Journal piece on Friday where the Chicago Fed President noted concerns over rising unemployment down the road.

The equity markets seemed unphased by the doom and gloom type of language. Still, then again, Friday was December options expiration, creating a rather significant $5.8 billion buy imbalance for the market on the close late in the day. This week will also be the final whole week of the year and feature more than just Austan Goolsbee. It will include a auction on December 20 and a TIPS auction on December 21 at 1:00 PM ET.

We will also get economic data, including the final read on the third-quarter and the November reading. The PCE is expected to show that inflation moderated again in November to 2.8% y/y, down from 3.0% last month, while the is expected to rise 3.3% in November, down from 3.5% in October.

As inflation falls, it becomes interesting because what has driven the market outside of the mechanical aspects we have discussed AdNauseam over the past seven weeks makes me believe the rally has been built like a house of cards due to multiple expansions.

Despite the rally, earnings estimates haven’t gone up. They had fallen since October 31, which was when estimates for the in 2024 were at $242.67 and, as of December 15, were at $241.71, while forecasts for the fourth quarter of 2023 have continued their decline to $54.72 from $56.15 per share.

What makes this impressive is that assuming these are bottom-up estimates, which I believe are, they use the S&P 500 index value to back into the earnings per share. The idea is that you sum up the operating profits of all the Index components by multiplying each stock’s outstanding shares by the median earnings estimates for the company.

Then, you divide the index’s market cap by the summation of the earnings estimates, essentially giving you the PE ratio. You then divide the Index’s value by the PE ratio to get the EPS. So, in theory, as the Index’s market cap rises to keep the PE constant, the value of the earnings should increase.

But in this case, the multiple expansion suggests that earnings must grow to justify the valuation. Therefore, the S&P 500 was trading at 16.95 times 2024 earnings while trading at 4,117 on October 27. Now, it is trading at 4,719, or 19.5 times 2024 earnings estimates, and for the Index to grow into the PE ratio of 16.95, earnings for 2024 would need to climb to $278.41 per share, or an additional 15%. Good luck with that.

Additionally, net margin estimates for the fourth quarter dropped to 10.9% from 11.4%, and first-quarter net margin estimates are expected to be at 11.6%. Yet, from the first quarter’s estimates of 11.6%, net margins are expected to expand the rest of 2024 to 12.1%, despite only being that high one other time since 2019, which was in 2021—another likely good luck with that situation.

SPX Index-Net Profit Margins

SPX Index-Net Profit Margins

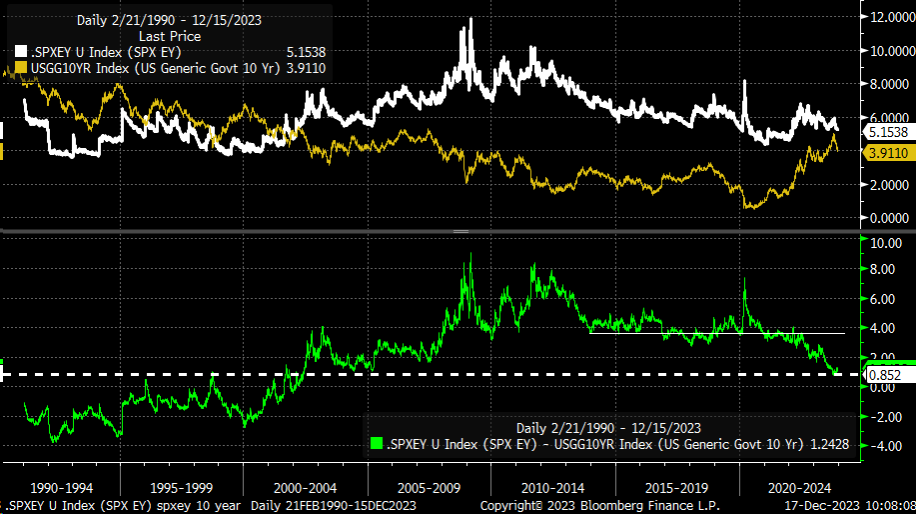

You can’t even say the rally is because yields have been falling, either. After all, the earnings yield of the S&P 500 never really rose with bond yields. The spread between the Index’s earnings yield and the contracted to around 80 bps, from an average of about 3.5% over the past 10 years.

For the spread to be about 3.5%, the S&P 500 earnings yield would need to rise to around 7%, giving the S&P 500 a PE of 14.3 and valuing the Index at 3,460. That is a big difference from today’s valuation.

This really tells us that when the fundamentals do not make sense, then it takes me back to the thesis of the last few weeks, of the deep negative gamma regime sparking a short-squeeze in the options market, which led to systematic short-covering, and then repositioning to go long in these funds, which then lead to vol compression, and then the pinning of gamma heading into last week’s OPEX.

So now that OPEX is over, and Vixperation ends on Wednesday, if this market was built on sand, then this is likely to be this week that things should start to melt and that JPMorgan collar trade, which lives down around 4,500 could offer an excellent magnet for the market over the final two weeks of the year. If we return to around 4,100 in early 2024, it wouldn’t be shocking. Because, at least at this point, that, at best, seems like fair value for this market.

Original Post