Stocks Reach Overbought Levels Ahead of Fed Decision: Time to Take Profits?

2023.12.13 03:15

Stocks managed to rise today, as the pinning of volatility resulted in the falling below 12 for part of the day.

Unfortunately, with options expiring this Friday and the VIX Option expiring next week, the mechanical forces in the market are at play right now.

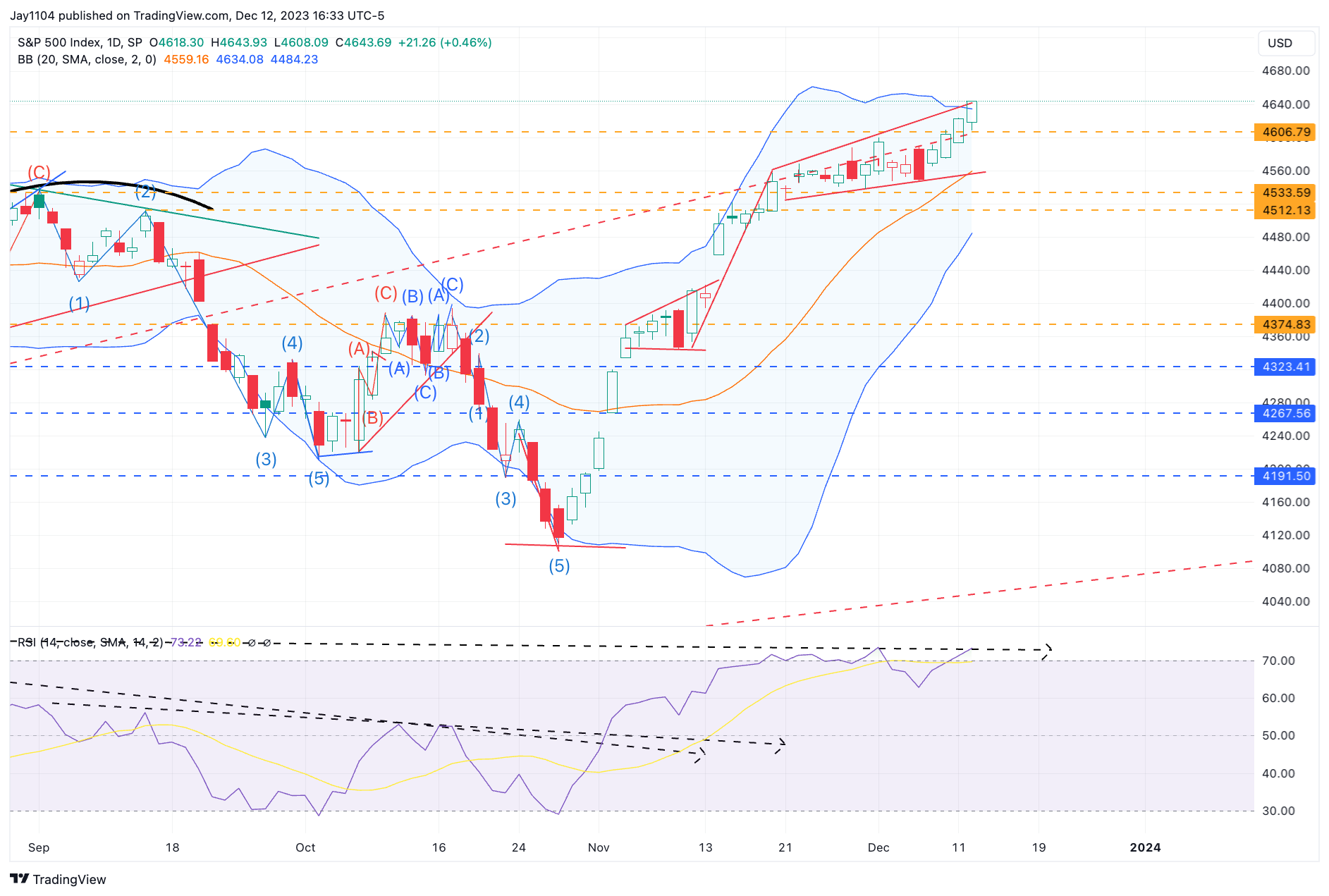

Today, the crossed the upper Bollinger band while the RSI moved above 70. Again, I use both signals to trigger overbought or oversold conditions.

It could mean that we trade lower, or consolidate sideways for a while.

The also traded above its upper Bollinger band today, and the RSI suggests this index is also overbought and due to either drop or consolidate sideways.

I am just pointing out the condition and what I have observed from my past experiences.

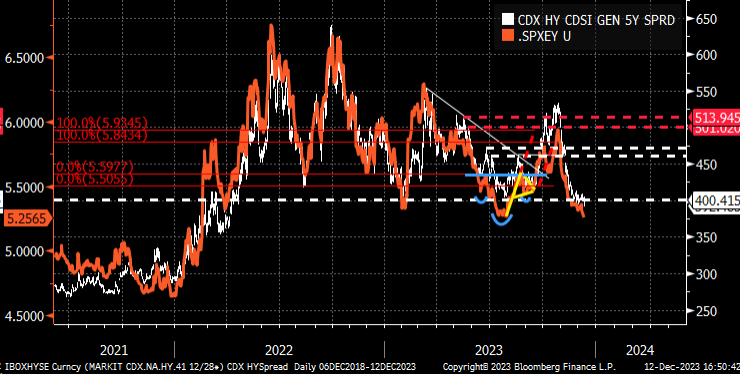

Interestingly, today, we saw credit spreads narrow to 392 on the CDX High Yield Index.

This is putting it on a path that is troublesome from the Fed’s standpoint because this index is about the closest thing I have found to a real-time financial conditions index, and when it is falling, it is a sign of a lot of easing.

So we are about to see either the greatest collapse in the financial conditions ever or a big reversal.

It also seems to track changes in the S&P 500 earnings yield closely and even serves as a leading indicator.

So, if credit spreads widen, the S&P 500 earnings yield will rise, and the S&P 500 will fall. When credit spreads narrow, the earnings yields fall, meaning stock prices rise.

Maybe it is by chance, or maybe it’s not the day before the December . Still, the CDX High Yield index also appears to have hit or come very close to hitting the lower Bollinger band.

At the same time, it has also seen its RSI drop below 30, suggesting that the CDX index is either due to rally or to consolidate sideways.

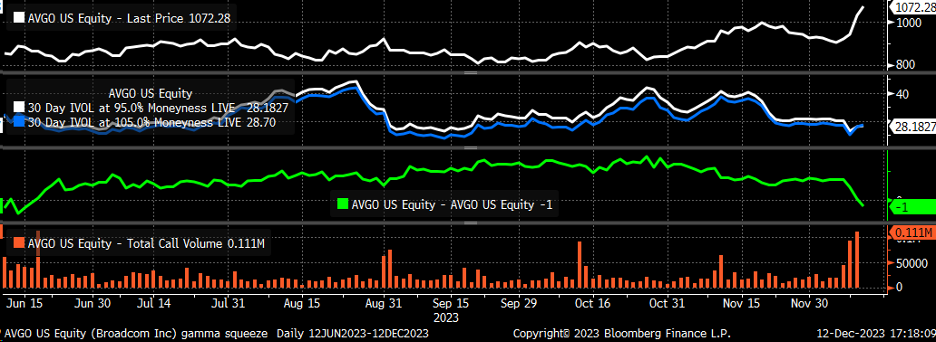

It seems like Broadcom (NASDAQ:) has replaced Nvidia (NASDAQ:) as the hyperbolic stock in the market. It appears to be a gamma squeeze.

It has the makings of one all over the place. Call IV rising above Put IV, call volume exploding.

What is perplexing is how or why; I didn’t even think the results were that good. But hey, fundamentals do not matter when it comes to a gamma squeeze.

Original Post