Stocks Push Higher as the VIX Continues to Melt

2022.11.09 01:56

[ad_1]

Stocks finished the day higher on Monday, following on from Friday’s rally. Yields were higher across the board, and the was again weaker. Still, the was able to generate a 1ish% rally. The market seems to be retracing some losses from last week on a continued decline in longer-dated implied volatility and dollar weakness.

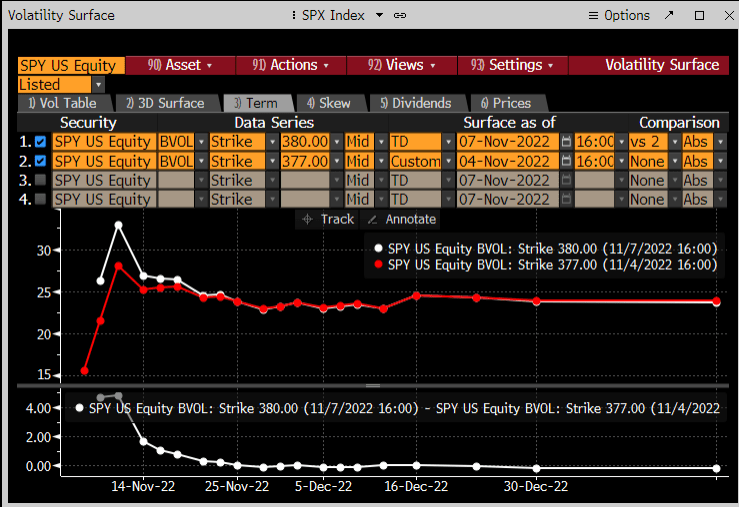

But the concentration of implied volatility continues to build up for the Nov.11 expiration date for the ETF.

So again, this is a sign that the market is assigning a lot of risk to the report. Instead of buying longer-dated hedges, traders are focused on the “day of risk,” which is why the has been falling steadily. Maybe the feeling is to hedge yourself for the day of and worry about what’s next after the fact.

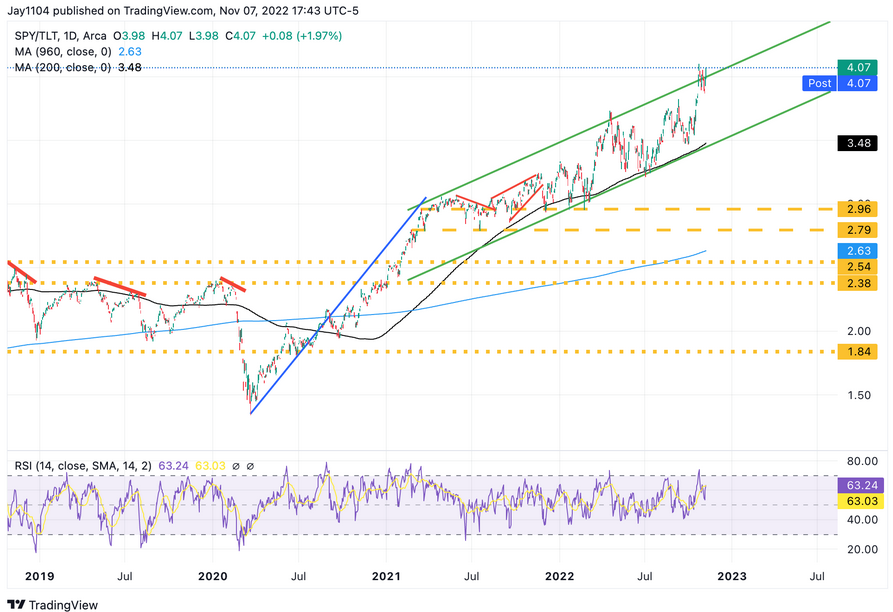

TLT ETF

The ETF was smashed again, and the ratio of the SPY to TLT was back to the upper end of the range. It indicates that stocks are overvalued to bonds, and the further this ratio rises, the more likely it is that stocks reverse hard.

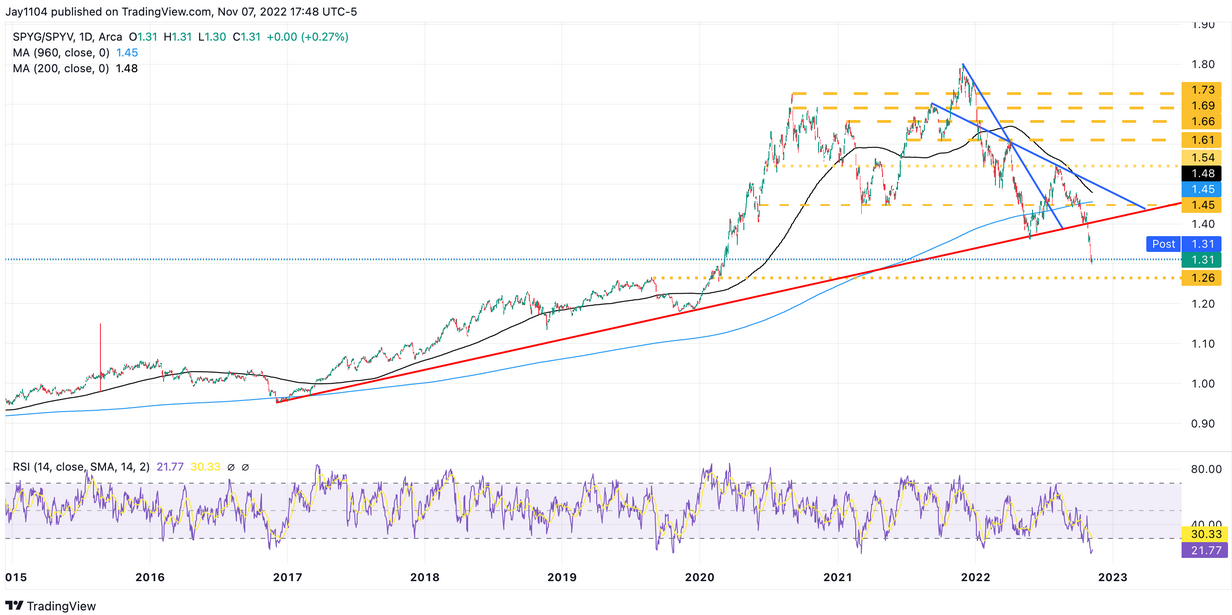

SPYG to SPYV

The )-to- ratio is closing in on its 2019 highs, indicating that the reset is nearly over or the worse is still to come. But the reset is not over just yet.

Tesla

Tesla (NASDAQ:) had a lousy day falling by 5% and closing below support at $209. It was a significant break, as that $200 to $205 had held up very well for several weeks, and the fact that it broke today suggests there is further down in store for the stock, potentially down to $181.

Goldman Sachs

Goldman Sachs (NYSE:) has been one of the stocks leading the higher after results. I don’t understand the thought process here. The interesting thing about Goldman is that the VIX on Goldman has collapsed, and the price action looks like short-covering. We should find out soon if short-covering is the reason because the VIX on Goldman is pretty close to the bottom of the range.

Goldman Sachs Daily Chart

Goldman Sachs Daily Chart

Mcdonald’s

Finally, McDonald’s (NYSE:) hit a new all-time high just yesterday, which is shocking in this environment. But what is it telling us about inflation after the company blowout same-store sales comps in the third quarter of 9.5% versus estimates of 5.8%? It is probably not a good thing when it comes to inflation.

Original Post

[ad_2]

Source link