Stocks Drop And Approach New Lows

2022.11.04 23:29

[ad_1]

Stocks Drop And Approach New Lows

Budrigannews.com – Stocks moved lower yesterday, with the dropping by around 1%. It looked like one of those pause days we see pretty often on the charts, in between bigger-sized moves. Today with the , anything is possible, but given the strength of the data in many recent surveys and , I think we have seen little, if any, change in the . Estimates are pretty low, with the nonfarm payroll rising by around 198,000 and the unemployment rising to 3.6%.

But based on how we have seen these big drops followed by pause days work before, I think we probably continue to head lower and towards filling that gap at 3,580.

TIP

The iShares TIPS Bond ETF (NYSE:) is very close to making a new low here, and as we have tracked now for a very long time, if the TIP ETF makes a new low, the Invesco QQQ Trust (NASDAQ:) won’t be far behind. Watch the TIP ETF today for clues.

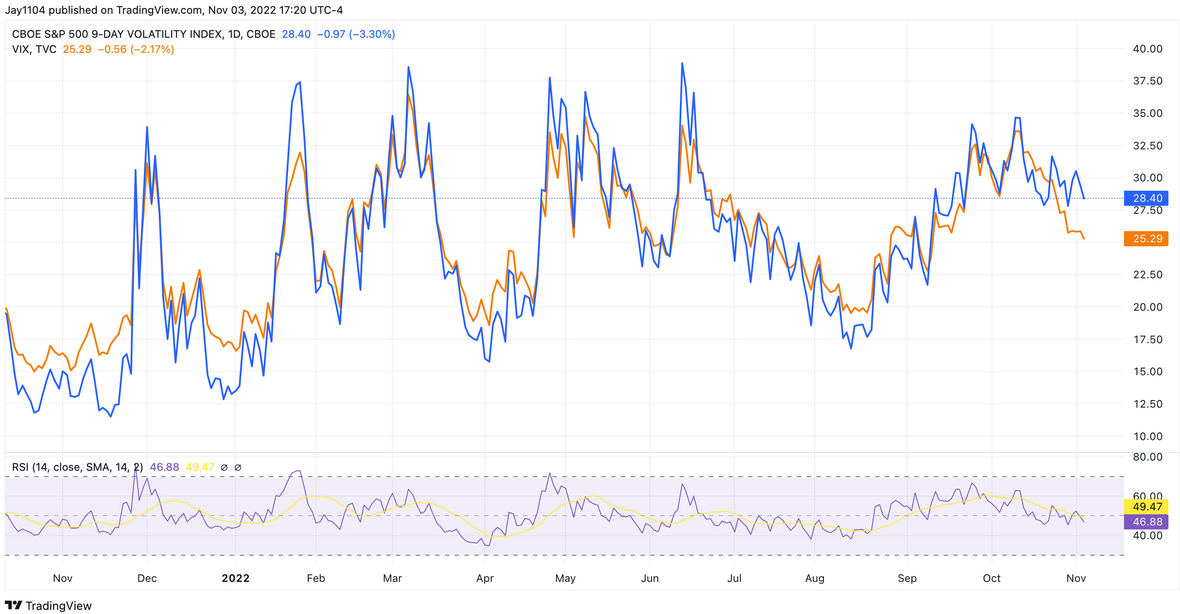

VIX

The moved lower yesterday, and we are seeing traders looking for hedges more aligned with the economic data schedule. With S&P 500 options that now expire every day, why buy a put that is 30 days away when you can buy a put that expires next week? So you can see that the VIX fell yesterday, but the VIX 9-Day Volatility Index remained in the same range it has been for some time.

PayPal

(NASDAQ:) was clocked after hours on weak payment volumes and weaker-than-expected revenue guidance. So much for my bull flag and rising RSI. At this point, the stock is in the range that could lead to it retesting the lows around $69.50. After that, you could be talking about a stock that goes under $60 because support thins out after that. It is just amazing what has happened to this stock.

Adobe

Adobe (NASDAQ:) fell sharply yesterday, and this has been one of the stocks I like to watch for broader market sentiment. So I will watch closely to see if Adobe will soon make a new low. If it does, it is probably a harbinger of what will come for the rest of the market.

[ad_2]

Source link