Stocks dip, dollar steadies as investors seek rates clarity

2023.07.03 23:16

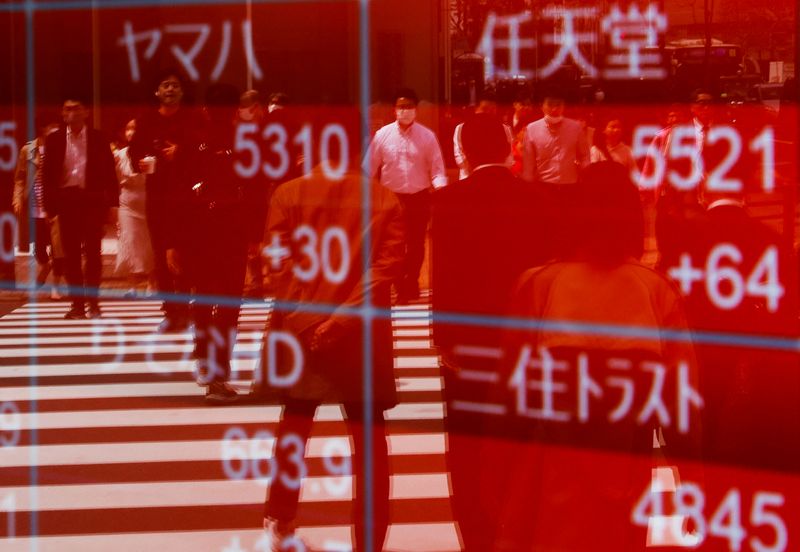

© Reuters. FILE PHOTO: Passersby are reflected on an electric stock quotation board outside a brokerage in Tokyo, Japan April 18, 2023. REUTERS/Issei Kato/File Photo

By Xie Yu

HONG KONG (Reuters) – Most Asian stocks fell on Tuesday, while the U.S. dollar and oil steadied, as investors held safe ranges awaiting more clues on whether central banks will continue their aggressive interest rate hikes.

Market conditions were also subdued heading into the U.S. Independence Day public holiday on Tuesday, with most of Wall Street closed.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.1%, by Tuesday mid-morning.

Australian shares were mostly flat, as investors waited to see whether the central bank will tighten again when it announces a policy decision later in the day.

share average fell 1.1% as investors exited some bullish positions after the benchmark index closed at a 33-year high in the previous session.

China’s mainland benchmark and Hong Kong’s were each down by 0.2%.

U.S. E-mini stock futures slipped 0.1% in Asian trade. Wall Street stock indexes ended Monday’s shortened session up slightly along with Treasury yields.

In coming days, investors are watching out for a mixed bag of economic data ahead of second-quarter earnings, while uncertainty remains over the Federal Reserve’s policy path, said Manishi Raychaudhuri, head of Asia Pacific equity research at BNP Paribas (OTC:).

The minutes from the Fed’s last meeting are due later this week, which could provide additional clues on policy direction but also inject some volatility, he said.

“If the Fed overtightens and decides to do more rate hikes than twice as the market widely expected, then there’s a concern that the recession may turn out to be deeper than what is being factored in,” Raychaudhuri said.

Geopolitical tensions also persist, he noted, with China’s export controls on minerals adding more uncertainty around global trade relations.

In the currency market, the , which tracks the greenback against six major peers, rose slightly to 102.97.

Oil prices held steady on Tuesday, after settling 1% lower on Monday, as markets weighed supply woes from cuts for August by top exporters Saudi Arabia and Russia against economic data that suggested demand was weak.

futures were up 0.3% at $74.87 a barrel. U.S. West Texas Intermediate crude also added 0.3% to $70.06.

The Treasury market is shut Tuesday for Independence Day. On Monday, a widely watched section of the U.S. Treasury yield curve hit its deepest inversion since the high inflation era of Fed Chairman Paul Volcker, reflecting financial markets’ concerns that an extended Fed hiking cycle will tip the United States into recession.