Stock Valuations Do Not Matter… Until They Do

2022.09.23 03:33

[ad_1]

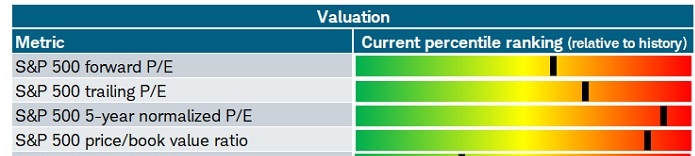

Those who refuse to give up the idea that the stock bubble has burst, or refuse to consider that the market will drop further, ignore stock valuations.

Consider the popular earnings-based and book-based metrics. In what world has the 21% decline from the top provided bargains?

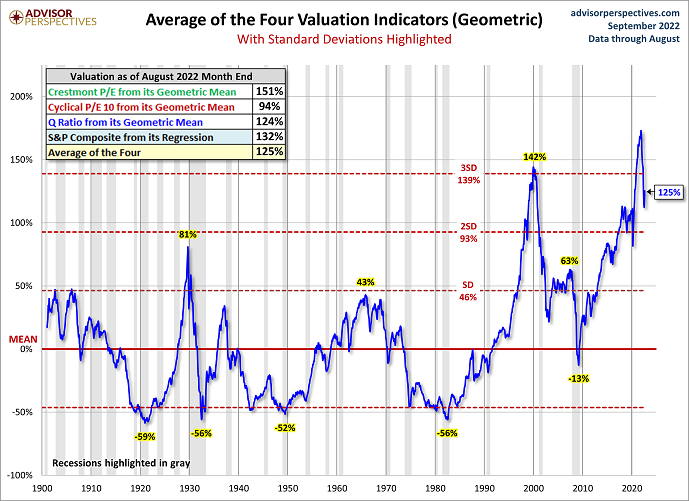

If you bring regression-to-the-mean analysis to the bearish party, or the Q ratio, or even market-cap-to-GDP, the selling may be in the earlier innings.

Average Of 4 Valuation Indicators

Average Of 4 Valuation Indicators

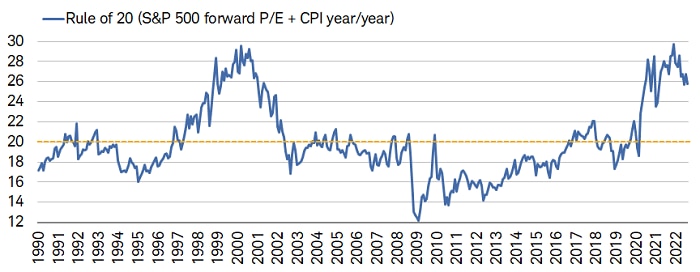

A number of inquirers asked me whether or not inflation can play a role. Indeed, it can. There is the “Rule of 20.”

This particular metric identifies “fair value” at a point where the Forward 12 month P/E combines with the year-over-year change in the consumer price index (). Fair value is when the sum is 20.

It is easy to see that, until 2022, we had been living in a make-believe world not unlike the dot-com disaster in 2000. Clearly, there’s room for stocks to fall.

SP 500 Forward P/E + CPI Y/Y

SP 500 Forward P/E + CPI Y/Y

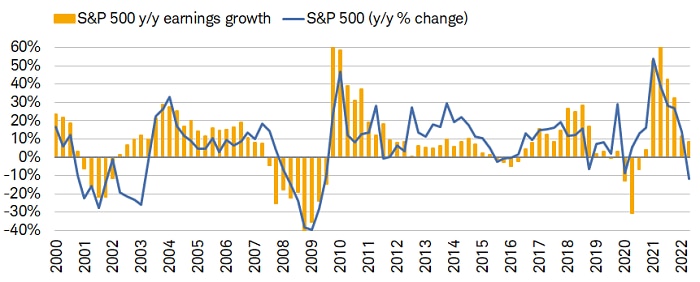

There’s more. Primarily, the Forward P/E is not static.

In essence, the “E” in the forward P/E should be declining as it is overstated in a weakening economic backdrop. That will make the Forward P/E even pricier.

To wit, the chart below has yet to account for the year-over-year earnings growth to turn negative. That is what happens in every recession. And there’s very few folks out there who see any path for the Fed to avoid a recession, whether it turns out mild or harsh.

SP 500 Earning Growth Y/Y

SP 500 Earning Growth Y/Y

Remember, the first two quarters of 2022 served up negative GDP. That alone marks a technical recession.

Will the 3rd and 4th quarter improve markedly? Maybe. Perhaps the U.S will avoid a negative print in Q3.

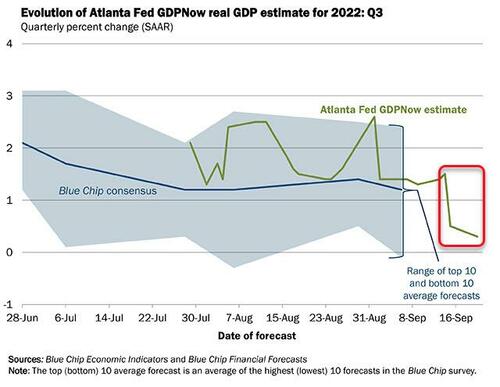

Nevertheless, the projections are hardly looking good. The latest GDP Now tracker projects an economy teetering on a 3rd consecutive quarter of economic heartache.

Atlanta Fed GDP Estimates

[ad_2]

Source link