Stock Market in Correction: How Much Can It Drop From Here?

2024.08.05 05:00

In my last two newsletters, “” and “,” I highlighted significant technical weaknesses within the stock market, particularly narrowing market breadth. This condition warned that the stock market was becoming increasingly susceptible to a correction even though major market indexes were advancing.

Over the past month, the market reached overbought conditions, hitting levels that preceded the indexes’ declines over the past year. Consequently, the combination of weak market internals and an overbought stock market has led to a market correction that began a little over two weeks ago.

Given that I have extensively discussed the decline in market breadth in my previous newsletters, I will not revisit that topic here. For those interested, the links above provide detailed insights into those issues.

This edition will focus on recent price action and the current stock market correction.

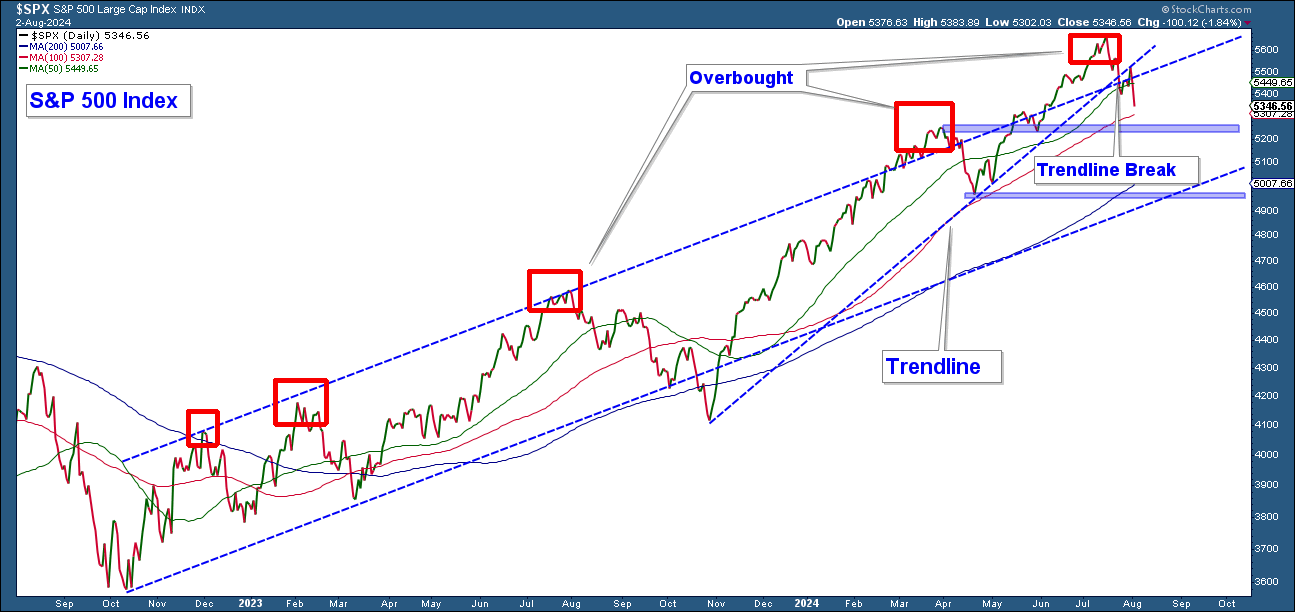

S&P 500 Index

The chart below is a daily chart of the , which has been advancing steadily since October 2023. The chart is annotated with an uptrending channel that encapsulates the price action over this period.

Throughout this uptrend, the price movement of the index has largely remained within the confines of this channel. Each time the index has approached the upper boundary of the channel, it has subsequently experienced a decline, which I have highlighted with red rectangles on the chart. This repetitive behavior underscores the importance of the channel boundaries in identifying overbought conditions.

At the beginning of June, the index advanced above the top of this channel, signifying an overbought market condition. This breakout above the upper boundary suggested a heightened risk of a market pullback.

Additionally, I have marked a trendline that extends from the last time the index reached the lower boundary of the channel in October 2023, continuing up to the highs of this past month. The recent move below this trendline was an initial signal that the market was transitioning from an uptrend to a decline.

Despite the recent decline, the index remains near the top of the channel, suggesting that it is still long-term overbought. This overbought condition implies that there is potential for the index to fall much further, given that it is currently positioned well above the lower boundary of the channel

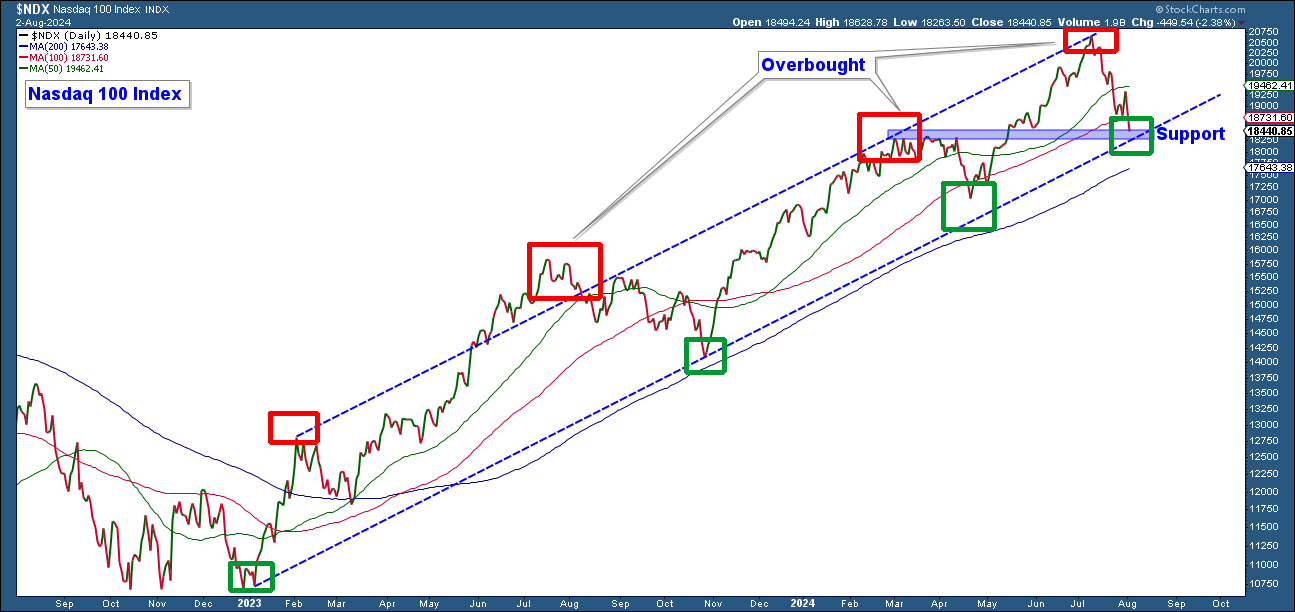

Nasdaq 100 Index

The chart mirrors the S&P 500 in terms of its structure, featuring an uptrending channel that has contained its advance over the same period. This channel captures the index’s price movements and highlights key levels of support and resistance.

As with the S&P 500, the NASDAQ 100 has historically encountered resistance and experienced declines when reaching the upper boundary of this channel. On the chart, I have marked these occurrences with red boxes to indicate the points where the index has previously hit the upper boundary and then pulled back. Conversely, green boxes highlight the times when the index reached the lower boundary of the channel and subsequently advanced, marking the end of previous downtrends and the start of new uptrends.

The current situation is noteworthy: the NASDAQ 100 is now positioned right on the lower boundary of its uptrending channel. This proximity to the lower boundary is critical, as it will be telling whether the index can advance again without breaking below this level.

A decisive move below the lower boundary of the channel in the coming weeks would be a significant bearish signal for the broader stock market.

Such a breach could indicate a shift in market dynamics and potentially foreshadow a more substantial decline across various indexes.

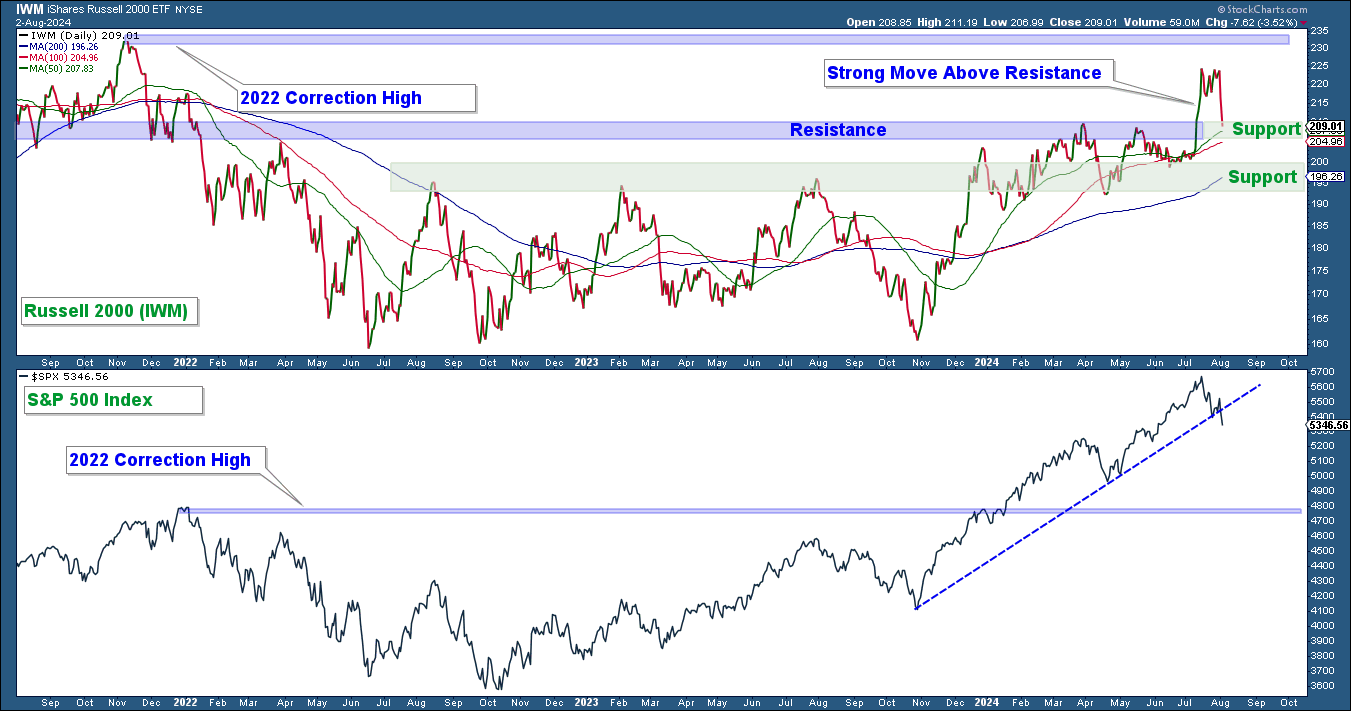

Small Cap’s

The , representing small-cap stocks, has been a notable underperformer compared to the S&P 500 and NASDAQ 100 over the past three years. This underperformance persisted even as the larger indexes saw significant gains. At the tail end of the S&P 500 advance small-cap and value stocks advanced strongly. This seemed promising because sector rotation is often a hallmark of a sustainable bull market. However, this advance may have been driven more by short covering than by genuine investor interest in shifting from growth to value and small-cap stocks.

To confirm whether this initial advance was part of a sustainable sector rotation, I closely watched for follow-through in the value and small-cap segments of the market. Unfortunately, these segments have recently been dragged down as the major indexes accelerated their declines.

The chart below shows the Russell 2000 ETF () in the upper panel and the S&P 500 in the lower panel for comparative purposes. The December 2022 highs are marked on both charts to highlight the performance disparity.

Key Takeaways:

- Relative Underperformance: IWM has been underperforming relative to the S&P 500. While both charts show the December 2022 highs, IWM remains below its high, indicating ongoing weakness compared to the S&P 500.

- Recent Advance Reversal: The recent advance of IWM, though initially impressive, has reversed. While it hasn’t retraced its entire recent advance, it has fallen significantly alongside the major indexes over the past week.

- Critical Support Levels: The current situation is critical. IWM is sitting right on a support level, which is marked on the chart. The market implications of what happens next are significant. If IWM resumes an upward move without violating this support level, it would be a bullish signal for the market. Conversely, a decisive move below this support level, and subsequently the next support level noted on the chart, would be a bearish signal for the broader market.

Conclusion

The market is currently in a correction. Both the NASDAQ 100 and the Russell 2000 (IWM) are at critical levels that will determine the market’s near-term direction. The NASDAQ 100 must stay above the lower end of its uptrending channel, and IWM must hold above its key support levels. A break below these levels could signal further declines while holding these levels would be a positive sign for a potential market advance.

Current Portfolio Allocation: Emphasizing Defense

Given the current market environment, we have positioned all client accounts with a distinctly defensive allocation. Both conservative and aggressive models had extremely low levels of equity allocation going into July. As the market began to decline, we swiftly sold the remaining equity holdings to mitigate potential losses.

Reducing losses associated with major market corrections is crucial, especially for those in or nearing retirement. Significant downturns can have a lasting impact on the value of retirement portfolios, potentially delaying retirement plans or reducing the quality of life during retirement. By proactively adjusting allocations and focusing on risk management, we aim to protect client assets from severe declines.

The market is very overbought from a valuation perspective, with price-to-earnings (P/E) ratios at historically high levels. This means stock prices are elevated relative to earnings, making the market vulnerable to a major bear market. Additionally, the economy is showing signs of slowing down. If the economy continues to weaken and slips into a recession, it would likely push stock prices substantially lower.

Given these factors, downside risk is at historically high levels, and risk management is paramount. By maintaining a defensive allocation and being prepared to adjust further as conditions evolve, we aim to safeguard client portfolios against significant losses and ensure financial stability through turbulent market periods.