Steepening Yield-Curve, $5 Billion Options Sell-Off Threaten Stock Rally

2024.09.20 05:45

Stocks finished the day higher, embarrassingly invalidating the 2b top pattern I thought had formed yesterday. It was a somewhat questionable move higher, with most gains occurring overnight during a low-volume, low-liquidity session.

Once regular trading resumed, the gains were minimal, with the market only advancing by 13 basis points.

QYLD Options Sell-Off, Steepening Yield Curve Pose Test for Nasdaq 100 Bulls

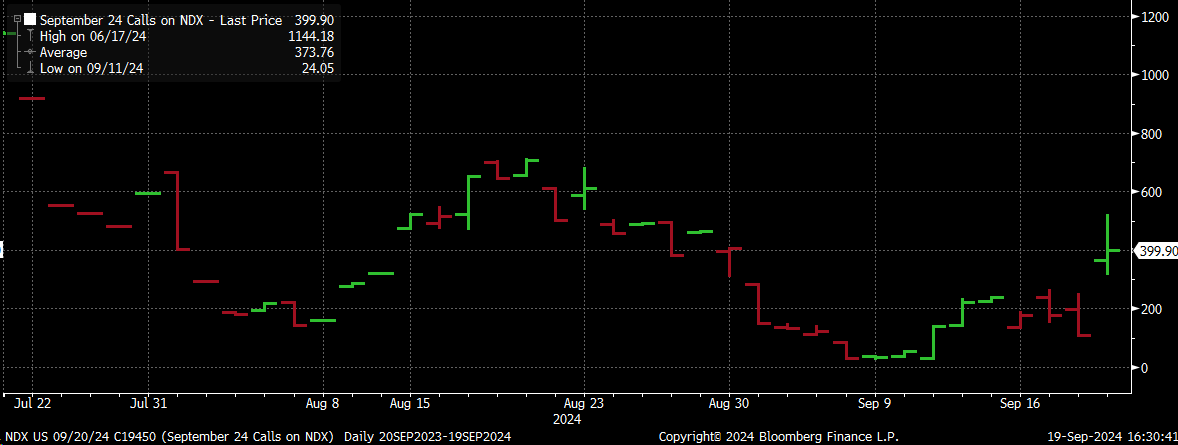

Yesterday, the had to buy back the 19,450 strike price calls that expire today. The day before yesterday, they closed at $110.30 per contract, but yesterday they closed at just about $400.

So the Notional delta went from around $4 billion yesterday to $8 billion. Imagine creating $4 billion in notional value out of thin air overnight.

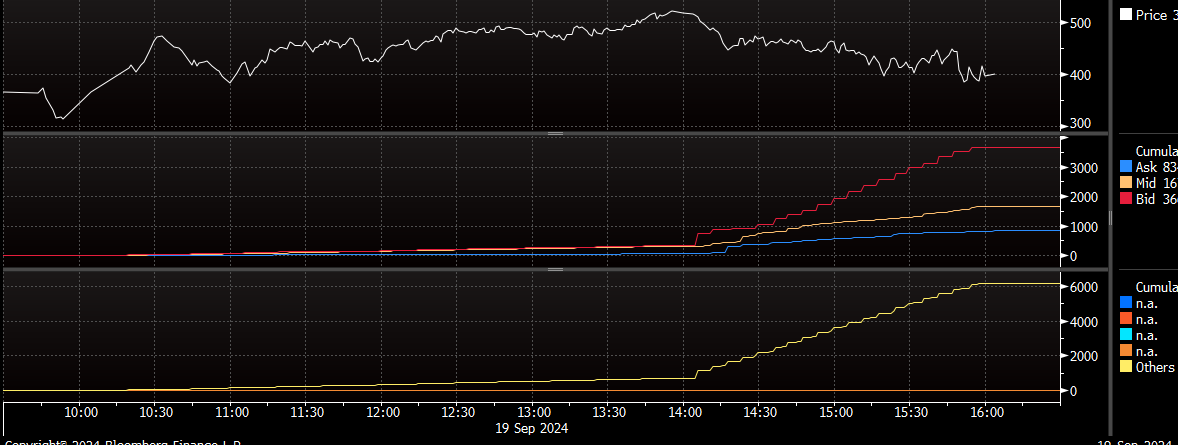

Anyway, as usual, the option contracts were bought back around 2 p.m., which continued for the rest of the afternoon.

It does seem odd that in the 930 minutes between 6 PM last night and yesterday’s 9:30 AM opening, rose 2.14% on just 146k contracts, but during the 7 hours between 9:30 AM and 4:30 PM, with 415k contracts traded, the futures only rose by nine basis points.

But today, the QYLD ETF is set to sell about $4 to $5 billion in notional NDX options, probably starting around lunchtime.

So, should the futures market players be eager to get a head start the NASDAQ futures might need to drop overnight.

Yield Curve Continues to Steepen

The continued to steepen yesterday, closing up five basis points to around 14 basis points.

Historically, as in going back to May 2023, at the start of the AI revolution, when the yield curve is flat or inverting, the Nasdaq 100 () tends to rise, whereas when the yield curve is steepening, the QQQ usually moves lower.

Therefore, based on this pattern, one would not have expected the QQQ to rally yesterday or to continue to rally if the curve steepening continues.

S&P 500: Gap Pattern Signals Weakness Ahead

In theory, the S&P 500 formed a wall with a gap pattern at the open—similar to the pattern seen after the post-Labor Day drop. This suggests that yesterday’s rally may not be sustainable, and the gap is likely to be filled, in theory of course.

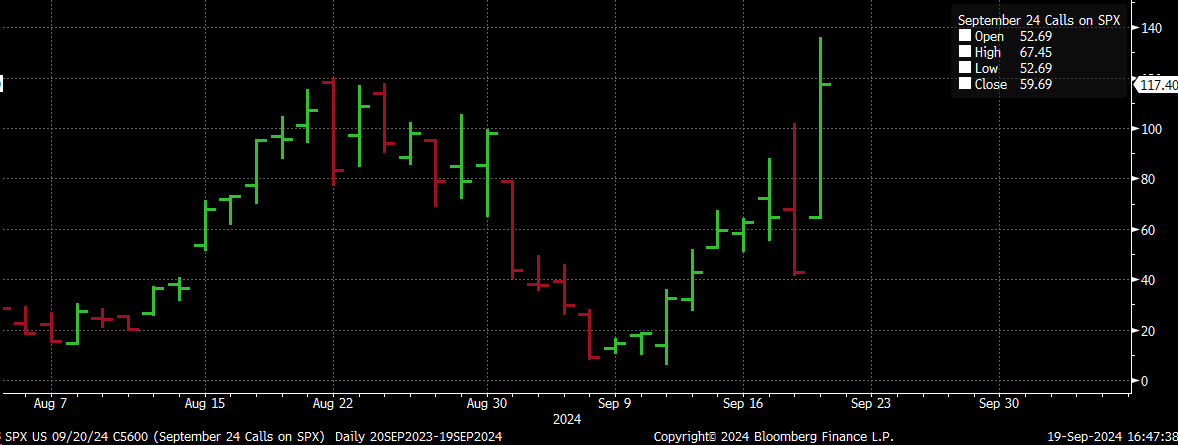

Quarterly OPEX Awaits

Let us not forget today is also quarterly OPEX, and we’ll find out if the market makers will let all those holders of 5,600 calls make out on those options after trading for $42.70 on Wednesday, which closed yesterday at over $100.

Original Post