‘Steady hand’: China surprisingly retains central bank chief

2023.03.12 04:37

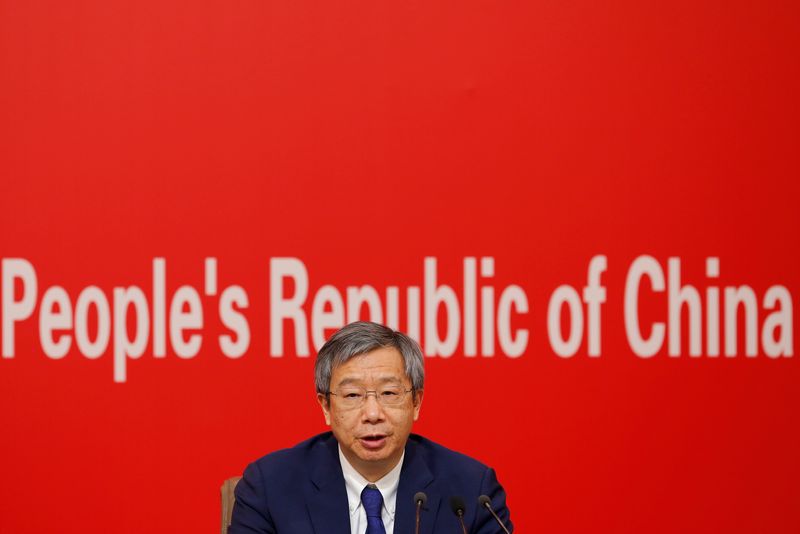

© Reuters. FILE PHOTO: Governor of People’s Bank of China (PBOC) Yi Gang attends a news conference on China’s economic development ahead of the 70th anniversary of its founding, in Beijing, China September 24, 2019. REUTERS/Florence Lo

By Kevin Yao

BEIJING (Reuters) – Yi Gang’s surprise re-appointment as China’s central bank governor on Sunday means a pro-market mind of high international stature will continue to represent the world’s second-largest economy on the global stage.

Yi, 65, was widely expected to retire as President Xi Jinping installs close allies in key roles in a sweeping government reshuffle at the start of his precedent-breaking third five-year term.

A new leadership team, formed mostly of home-grown talent loyal to Xi, raises concerns among the international business community amid rising tensions between China and the West over trade, technology, the war in Ukraine and other issues.

But Yi retaining his post as the governor of the People’s Bank of China provides some relief as a familiar face, albeit at the helm of a diminished institution, focused mainly on monetary policy after the launch of a new financial watchdog.

The PBOC governor has high global exposure through institutions such as the Group of 20, the International Monetary Fund, the World Bank and others.

“Yi’s core competitiveness lies in his professional quality and international background,” Xu Hongcai, deputy director of the economic policy commission at the state-backed China Association of Policy Science, told Reuters.

“The central bank governor is not a job that can be easily taken over by someone else. We need someone like Yi who can communicate on the international stage, such as G20,” added Xu, who has previously worked at PBOC.

Yi reached retirement age and was expected to be replaced after he was dropped out of the Communist Party’s Central Committee in October. Veteran Chinese banker Zhu Hexin, who heads the CITIC conglomerate, was seen as the leading candidate for the top PBOC post.

Unlike Zhu, who built his entire career in China, Yi spent more than a decade in the United States, completing his doctorate at the University of Illinois and teaching at Indiana University, making him one of China’s highest-ranking “sea turtles”, as overseas returnees are called.

Still, he comes from a humble background, enrolling at the elite Peking University after spending several years in the countryside during Mao Zedong’s “Cultural Revolution”.

REFORM-MINDED

Yi, who helped implement major currency reforms in 2005 and 2015, has long advocated interest rate and currency liberalisation. In August 2019, the PBOC replaced benchmark bank lending rates with the market-driven loan prime rate (LPR).

The 2015 reform led to a wave of capital flight and currency depreciation and China has focused on sealing, rather than opening, its capital account since.

Yi has repeatedly cautioned against risks from excessive credit and money growth.

Still, China’s debt has risen at a faster pace than its economy in recent decades and is now almost three times as large. Under Yi, the central bank has cut the reserve ratio 14 times since early 2018, pumping more than 10 trillion yuan into the economy.

While some economists argue that inflation in China is benign because the economy’s productive capacity has better access to resources, including credit, than the consumers, other economists praise Yi for keeping prices under control.

Yi’s main challenge remains to keep an increasingly indebted economy growing, while its population declines and ages, the developed world is on the brink of recession, and geopolitical tensions mount.

But analysts say Yi has limited room for more reforms as the Communist Party tightens its grip on the economy.

“Yi has been a steady hand in managing policy and the appointment underlines the importance of policy stability,” said a policy insider who spoke on condition anonymity.

“The PBOC will continue with its modest easing this year, and the possibility of rolling out big reforms is low.”