StandardAero valued at $10.4 billion as shares jump in NYSE debut

2024.10.02 14:08

By Niket Nishant

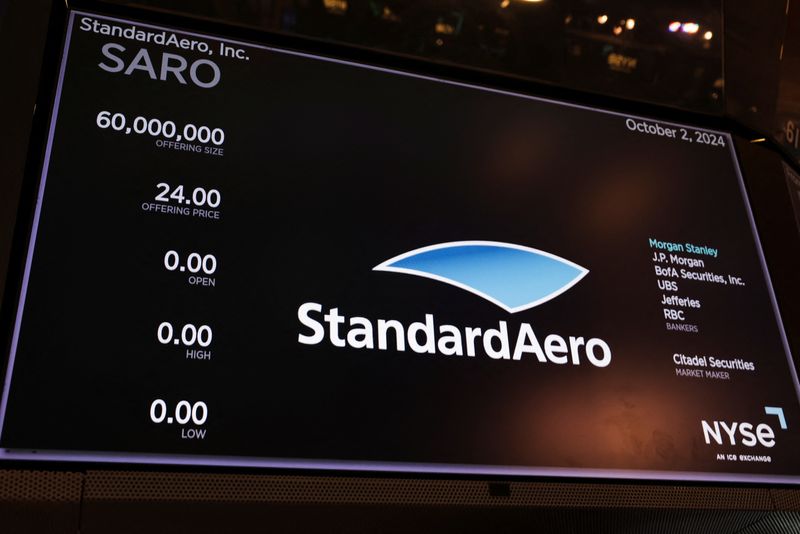

(Reuters) -Carlyle-backed StandardAero racked up a $10.38 billion valuation after its shares opened 29% above the offer price in their NYSE debut on Wednesday, as investors bought into what could be one of the last major U.S. listings of the year.

The aircraft maintenance services provider had priced its offering above range to raise $1.44 billion in the third biggest U.S. initial public offering of 2024.

StandardAero’s shares opened at $31, compared with the IPO price of $24. The company had initially targeted a range of $20 to $23.

U.S. IPOs have picked up pace in the last few weeks as a rally in equities and renewed hopes of a soft landing for the economy draw back investors after a brief summer lull.

Such share sales have raised $32.2 billion from 155 deals this year as of Sept. 30, outpacing 2022 and 2023 levels, according to Dealogic.

Carlyle, which offloaded some of its stake, will remain the majority shareholder of StandardAero after the IPO. It had acquired the company from Veritas Capital for about $5 billion in 2019. Another pre-IPO investor, Singapore’s sovereign wealth fund GIC also sold some stake.

TAPERING OFF?

StandardAero’s listing could be among the last major new issues in 2024 but most analysts expect the recovery to take roots next year.

“We’re coming to a pocket in the calendar where you have a whole bunch of uncertainty around the election, which is probably going to keep a lid on activity over the next couple of months,” said Mark Schwartz, EY Americas IPO and SPAC advisory leader.

Still, a rally in equities may encourage some to push forward with their plans.

“I anticipate that companies already in the pipeline, especially those that stand to benefit from the AI wave, will push forward with their IPOs before the election,” said Joe Endoso, CEO of private market investment platform Linqto.

Cerebras Systems, a startup looking to challenge the dominance of Nvidia (NASDAQ:) in the AI chip market, revealed financial details earlier this week as it draws closer to a listing.

Founded in 1911, StandardAero provides maintenance, repair and overhaul services to commercial, business and military aviation.

Strong travel demand against the backdrop of slower new plane deliveries has compelled carriers to rely on older jets that typically require complex maintenance.

The Scottsdale, Arizona-based company’s customers include aircraft engine makers GE Aerospace, RTX unit Pratt & Whitney, Rolls-Royce (OTC:) and carriers such as American Airlines (NASDAQ:) and Southwest Airlines (NYSE:).

Reuters was the first to report that Carlyle was evaluating options for StandardAero.

J.P. Morgan and Morgan Stanley are the lead underwriters for the IPO. Other underwriters include BofA Securities, UBS Investment Bank, Jefferies and RBC Capital Markets.