Stock Markets Analysis and Opinion

S&P E-Mini: Second Leg Up Likely

2023.07.05 10:45

Emini daily chart

- The has formed five consecutive bull bars on the daily chart. The rally is strong enough for a second leg up following any pullback.

- The bears tried to form a bear flag following the selloff down to June 26th. However, after three consecutive bull bars up to June 29th, the bears failed, and the bulls got an upside breakout.

- While the rally to June 30th is strong, it follows a bear micro channel down to June 26th. This will lower the probability of the bulls and increase the odds of sideways trading.

- The bulls want a strong upside breakout above the June 16th high and for the market to rally for a measured move.

- More likely, the bulls will become disappointed near this price level, and the market will continue sideways.

- The bears are hopeful that the market will form a double top with the June 16th high, leading to a break below the June 26th neckline and selloff for a measured move down.

- Some bears sold, betting on a second leg down after the selloff to June 26th. These bears are trapped and will likely buy back shorts on any pullback, so the bulls will probably get a second leg up.

- Overall, traders should expect the bulls to get a second leg up following the recent rally up to June 30th; however, since the market is in a trading range, the bulls will likely become disappointed.

Emini 5-minute chart and what to expect today

- Emini is down 20 points in the overnight Globex session.

- The Globex market on the 60-minute chart sold off overnight.

- This is likely due to profit-taking by the bulls and some aggressive selling by the bears.

- At the moment, the market will probably gap down on the open.

- Today will probably have a lot of trading range price action on the open.

- There is an FOMC report at 11:00 PM PT, which increases the risk of a lot of trading range price action leading up to the report.

- As always, traders should expect the market to go sideways for the first 6-12 bars on the open. Most traders should consider not trading during this time and wait for a clear breakout with follow-through.

- There is often a swing trade that begins before the end of the second hour. It is common for the swing trade to start after the formation of a double top/bottom or a wedge top/bottom. Most traders should focus on trying to catch the opening swing.

- Since today is an FOMC day, traders should be flat at least 30 minutes before the report is released. Once the report is released, traders should wait at least 10 minutes before placing any trades.

- Lastly, since the FOMC report often has big bars, traders must be sure and trade small. When in doubt, a trader should consider trading 20% of their normal position size during the report.

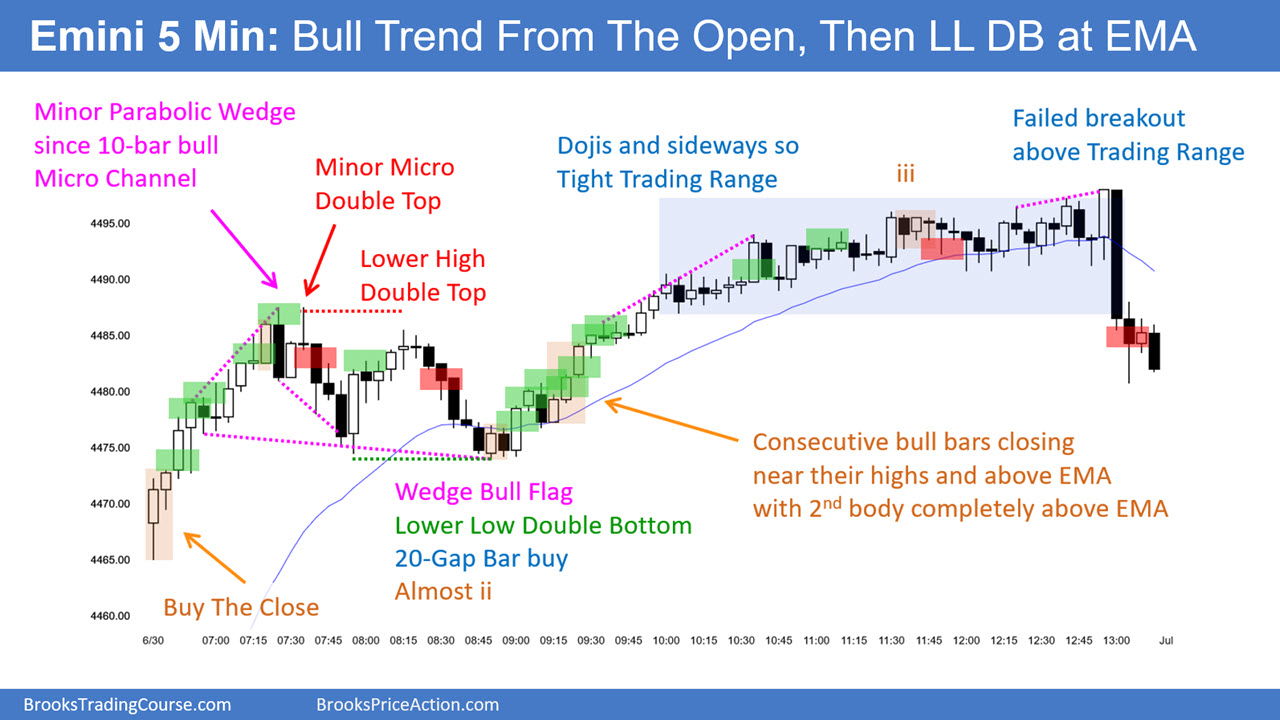

Last Friday’s Emini setups

Here are several reasonable stop-entry setups from last Friday (before US holiday). I show each buy entry with a green rectangle and each sell entry with a red rectangle. Buyers of both the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a near 4-year library of more detailed explanations of swing trade setups (see Online Course/BTC Daily Setups). Encyclopedia members get current daily charts added to Encyclopedia.