S&P 500’s Sell Signal, Nasdaq Edges Lower, Russell 2000 Bounces: What’s Next?

2023.07.10 03:53

A bit of a mixed bag on Friday as the () managed to finish the day higher, while both the and close back at the open price, after a day built on a promise.

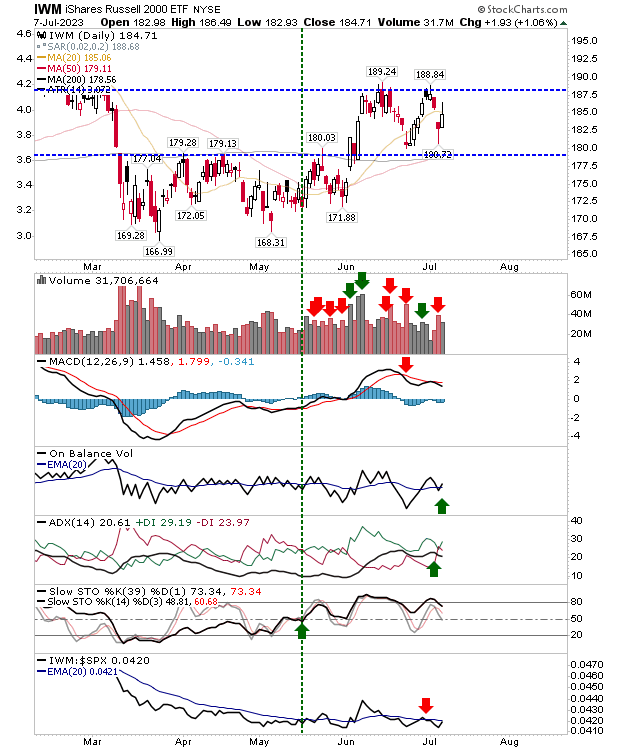

The Russell 2000 is the easiest to comment on, but it has the longest way to go before we consider it back to secular bullish form. Friday’s higher close edged back a little on the test of its 20-day MA, although the buying was enough to reverse the ‘sell’ triggers in On-Balance-Volume and the ADX. However, at this stage of the base building process, a challenge and break of $188 is needed before we can look at what comes next.

IWM Daily Chart

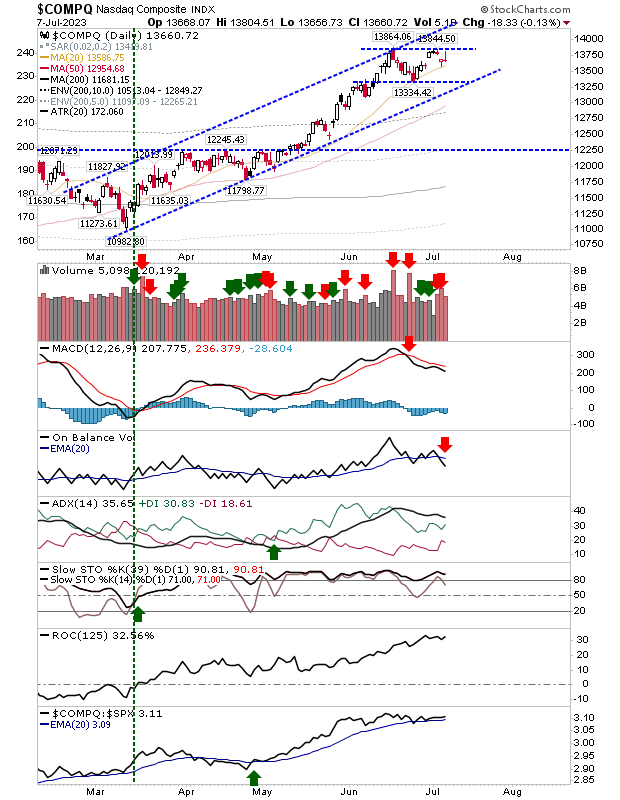

Next, we have the Nasdaq. It closed with a potentially bearish ‘gravestone doji.’ What curtails the damage a little is that the doji appeared within a mini-base of what still could turn into a double-top; ‘gravestone doji’ are particularly dangerous when they appear in isolation at the end of a rally as they mark reliable reversals. Technicals are mixed with bearish signals in the MACD and On-Balance-Volume offset by the bullish signals in ADX and Stochastics. The Nasdaq is also outperforming both the S&P 500 and Russell 2000.

COMPQ Daily Chart

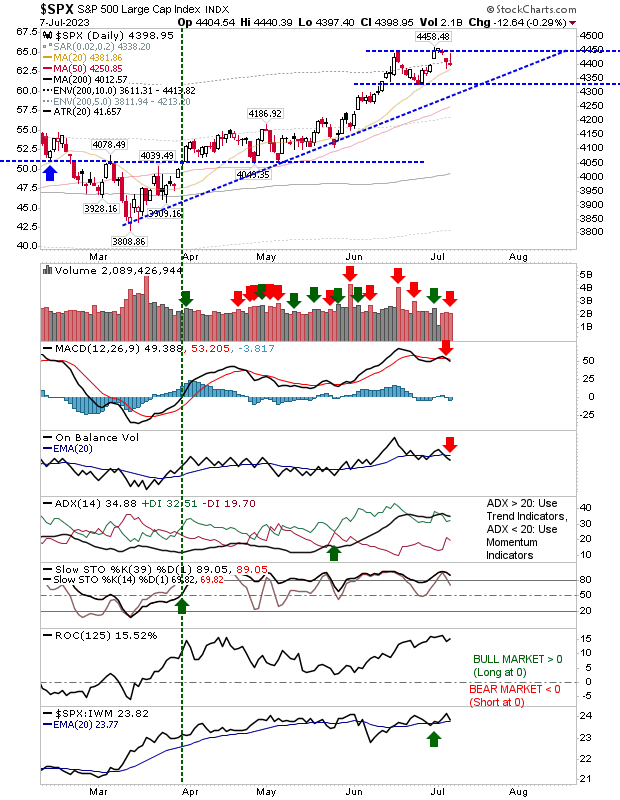

The S&P 500 had a similar experience as the Nasdaq, except the MACD switched back to a ‘sell’ trigger to go with the sell in On-Balance-Volume. While the S&P 500 is underperforming relative to the Nasdaq, it still has an edge over the Russell 2000 ($IWM).

SPX Daily Chart

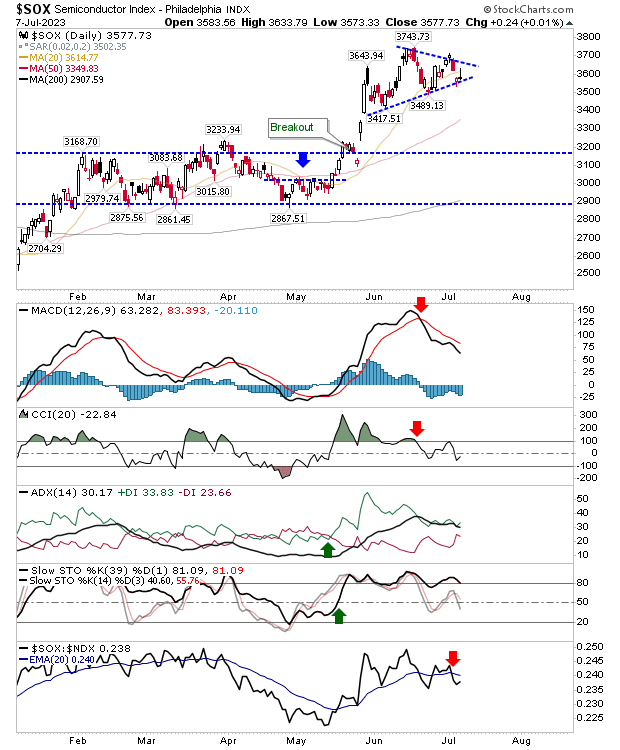

One interesting development to watch is the . While action in the Nasdaq and S&P 500 mirrors each other closely, the Semiconductor Index is shaping a bullish triangle/pennant. Momentum has managed to stay overbought during the development of this pattern, which is typically a good sign for a breakout higher. Let’s see if it does.

SOX Daily Chart