S&P 500 Update: Is Pullback to Around 3800 Complete?

2022.12.23 00:42

S&P 500 Update: Is Pullback to Around 3800 Complete?

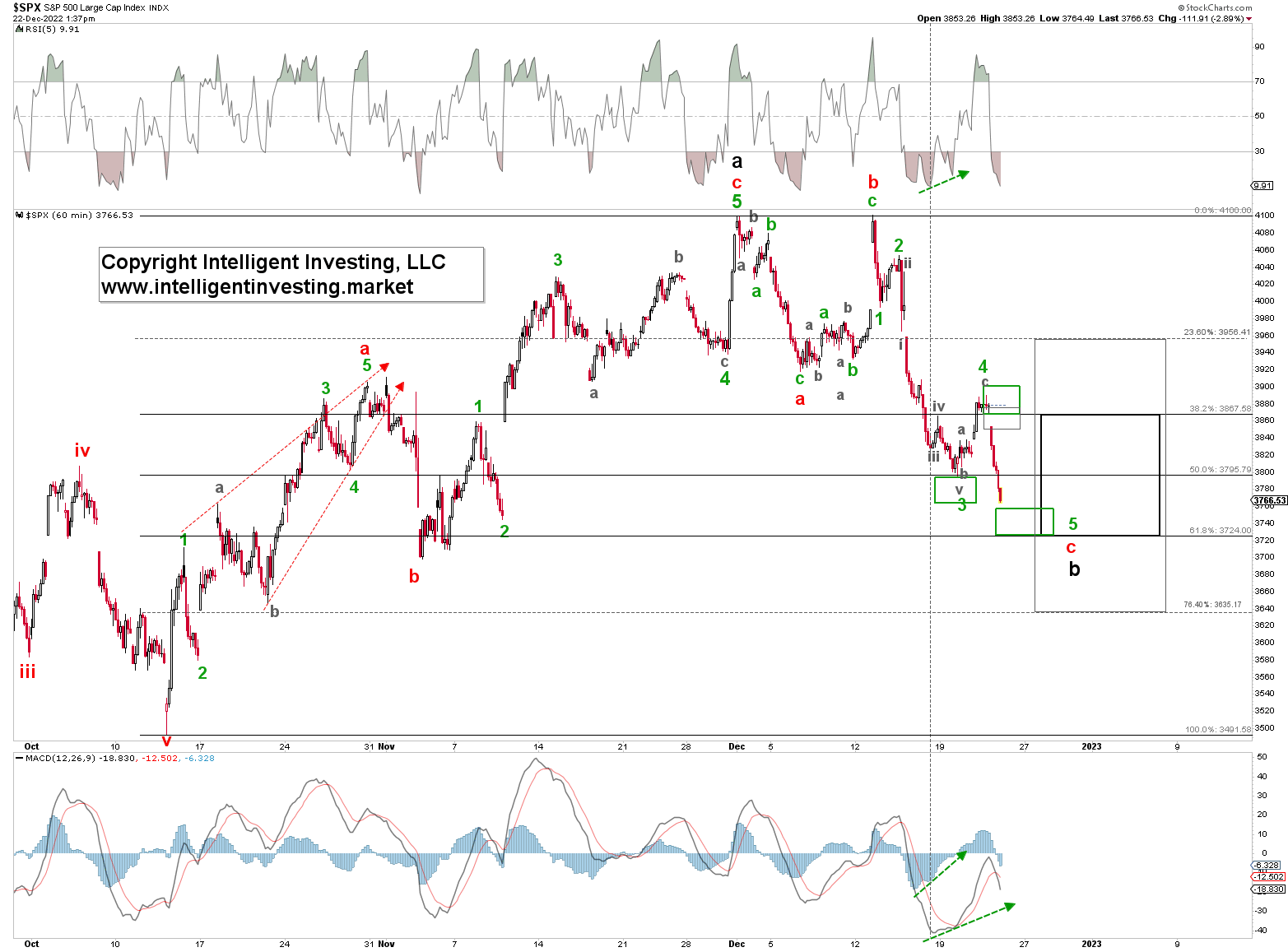

Over the last several weeks, we have been expecting the (SPX) to find a bottom around $3800+/-100 according to the Elliott Wave Principle (EWP). Although we did not get every twist and turn correctly, which is an impossible task, one can browse through each article’s link to the previous article to see what we were looking for the week prior. For example, last week, see , we found:

“… we can narrow down the ideal target zone for all of the anticipated black W-b. From last week’s “$3730-3870″ to ideally $3840-3860, assuming the market will follow the ideal Fibonacci-based impulse pattern as shown by the green and grey target zones in Figure 1. Once more price data becomes available, we can narrow this target zone even further.”

Fast-forward to today, and the index is currently trading at $3765. Thus my primary expectation for a continued move lower was validated. However, the SPX decided not to follow an ideal Fibonacci-based impulse pattern but to extend the waves. Are, as D. Rumsled would say, “a known unknown.” Albeit the index is only 1.9% below the W-5 target zone of this perfect pattern, we must thus adjust and narrow it down a little bit more. See Figure 1 below.

In the hourly chart above, we were already tracking the five sub-waves of the red W-c of black W-b last week. Why five waves? Because of the C-wave of a flat correction. The internal structure of a flat is a-b-c which in turn is a 3-3-5 pattern. Here green W-3 bottomed at $3795, yesterday’s high was green W-4, and now green W-5 is underway with an ideal target zone of $3725-3755. Today’s low, so far, is $3764.

Thus, as said two weeks ago:

“Once the $3800+/-70 zone is reached, …, we must entertain the notion all of black W-b has already bottomed out. The index will have to move below $3635 (the 76.40% retrace of the October 13 – December 1 rally), with the first warning below $3725, to start to suggest there will not be a more significant C-wave rally to $4300+.” In addition, last week, we “shifted the timing of the low to preferably mid next week.”

So far, so good. Besides, the famous Santa Rally is the last five trading days in December and the first two trading days in the following January. With the US stock markets closed on 12/26 and 01/02 in observance of Christmas and New Year, the window of opportunity for a Santa Rally will officially open tomorrow and end on January 4. When combining these facts with the EWP count, we have been tracking over the last few weeks; it is prudent to conclude that a sustained bottom could be close.

[ad_2]