S&P 500: Surge in Volume Could Signal Dormant Bears Are Waking Up

2025.01.24 03:02

It was another light day of trading volumes. When we look at the , there was less volume yesterday than yesterday, with just under 1.1 million contracts traded. This marks roughly the lightest trading day since December 26.

Volumes have diminished as the market rises; it’s not necessarily a negative signal. Instead, it indicates an absence of sellers rather than underlying market strength. When volume eventually returns, it could signal the sellers’ re-entry. That’s an important consideration, as thinning volumes tend to foreshadow shifts in market dynamics.

Yesterday was relatively uneventful until about 3:50 PM, when the market-on-close imbalances were released. The imbalance showed a decent buy imbalance of roughly $1.5 billion. In a low-volume session, such an imbalance significantly impacts the closing print, contributing to the rallying about 35–40 basis points in the final ten minutes of trading.

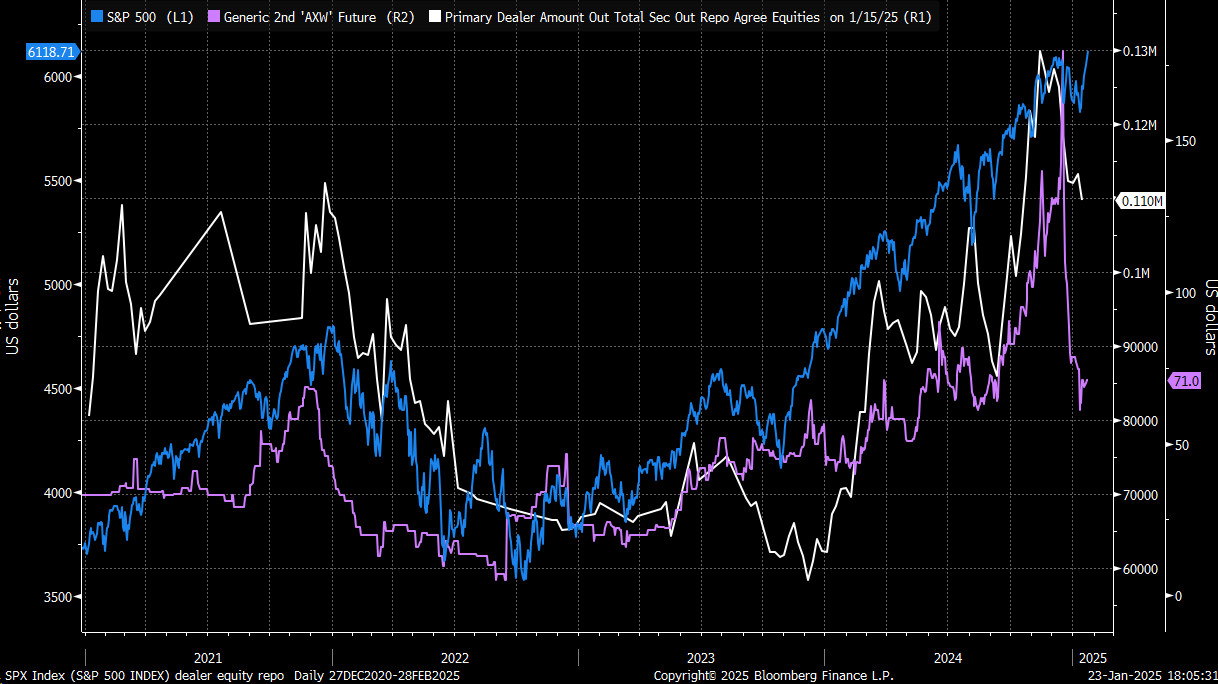

BTIC S&P 500’s total return equity financing costs have declined significantly since peaking in December. New data on primary dealer positioning in equity repo markets showed a decline in total securities held as of the week ending January 15, aligning with lower equity financing costs. This indicates weaker liquidity, reinforcing that this rally might be “on air.”

We’ve seen similar patterns, such as the quick rise from November 19 to December 6 and the even faster climb since January 13. However, unlike previous instances, this rally lacks the buildup of excess leverage or liquidity, suggesting a more fragile foundation. If selling volume returns, we could see a retest of the 5,875 level on the S&P 500.

Bond Yields Continue to Climb

Bond yields climbed for the second straight day, with the back to 4.65% and the 30-year yield at 4.87%. The yield curve steepened further, with the minus the spread at 55 basis points, a level that has acted as support/resistance since October 2022.

This steepening suggests the possibility of a bear steepener, which could add 100–150 basis points to the 30-year yield. This scenario assumes the ’s rate-cutting cycle is over, as indicated by 3-month Treasury Bill forward contracts over the next 12–18 months, with 12- and 18-month forwards trading above the 3-month spot Bill rate.

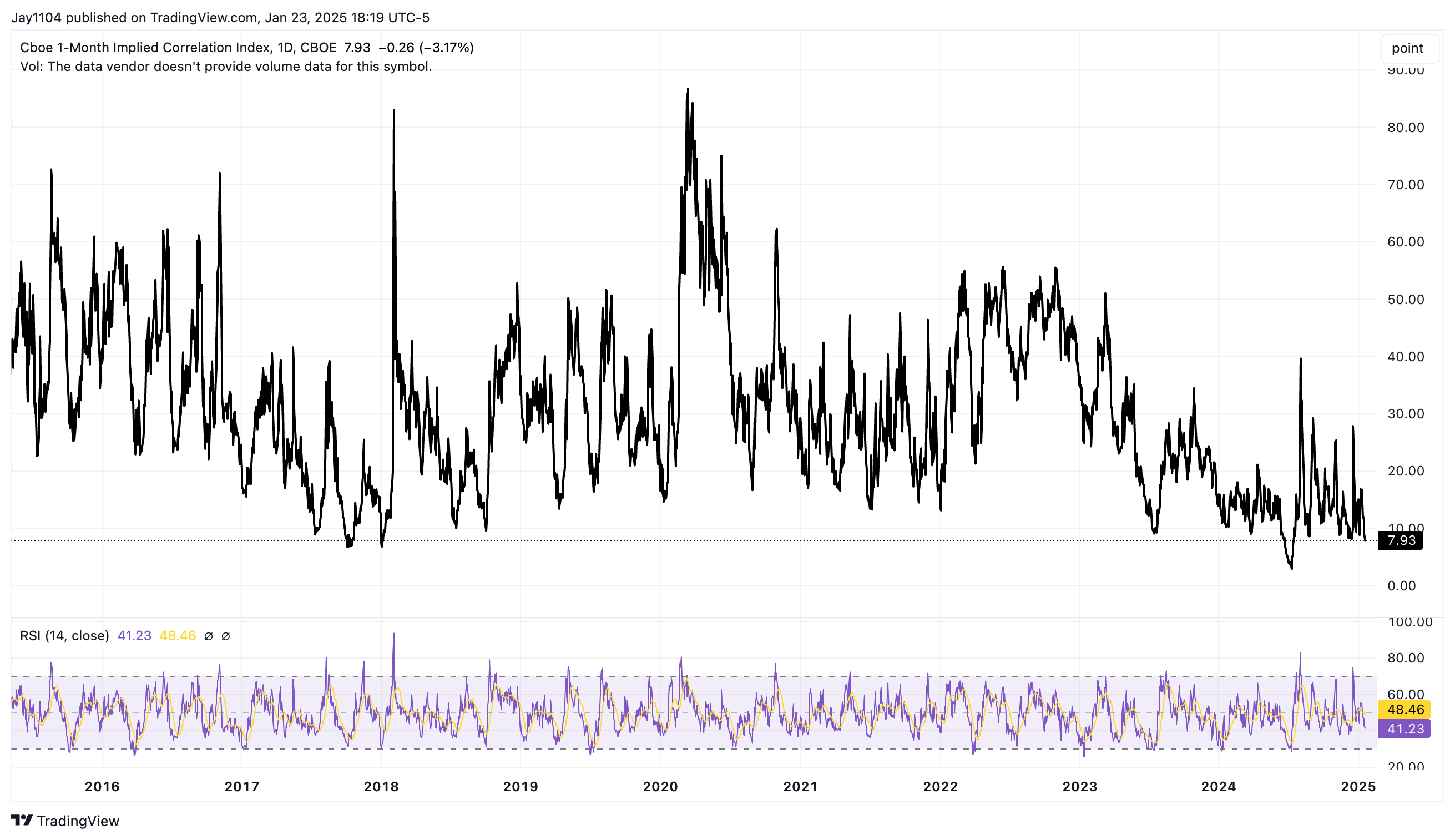

Implied volatility and correlation levels remain at the low end of their ranges, with limited room to decline further. If neither liquidity nor volatility supports the market, it’s unclear what other factors could drive additional upside. Every trading day is like a “choose-your-own-adventure” story, and yesterday delivered its twist in the final minutes.

Original Post