S&P 500 Remains Below 4,600: A Topping Pattern?

2023.08.02 11:42

- The S&P 500 will likely open lower following Fitch’s U.S. credit rating news

- Investors await quarterly earnings releases

- The short-term outlook remains bullish

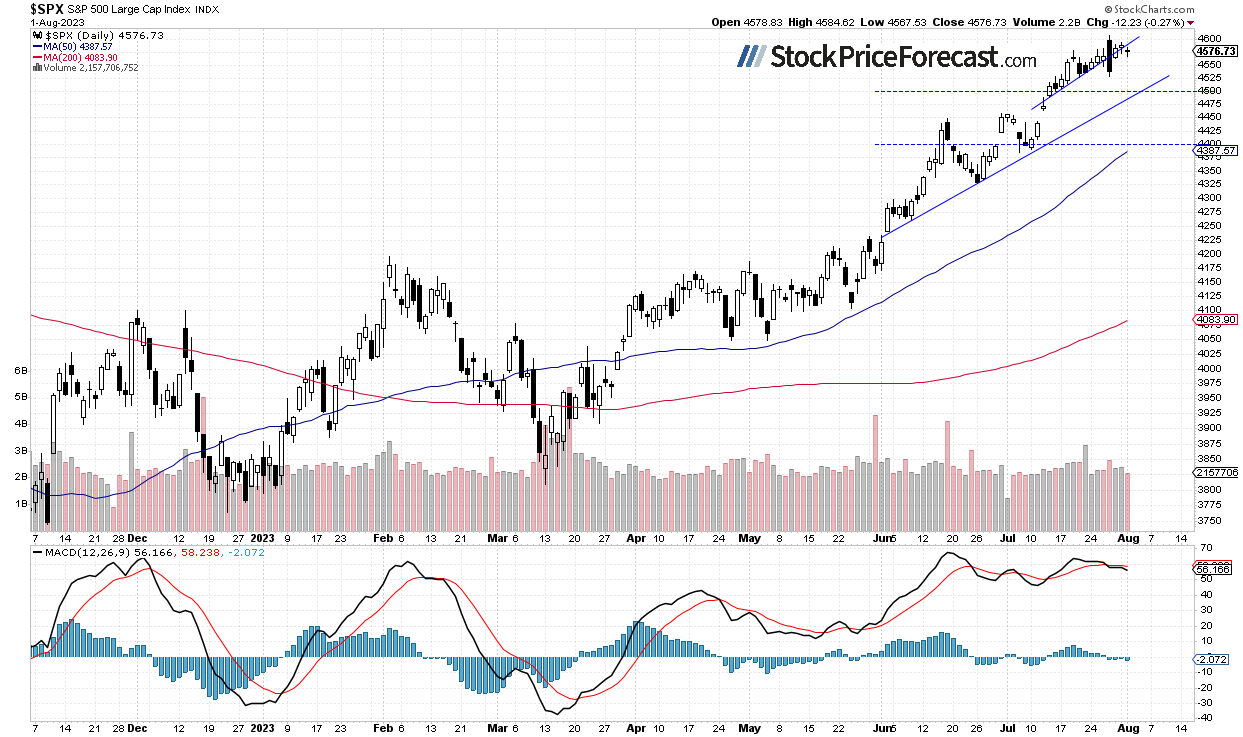

The broad stock market index lost 0.27% on Tuesday as it extended a short-term consolidation following last week’s Thursday-Friday volatility. The continues to trade below the 4,600 level as investors await the important quarterly earnings releases from Apple (NASDAQ:) and Amazon (NASDAQ:) tomorrow and the monthly jobs data release on Friday.

Last week on Thursday, the market reached a new medium-term high of 4,607.07. It was the highest since March 2022. There is still a lot of uncertainty concerning monetary policy, and some technology/AI stocks’ valuation concerns, but the investors’ sentiment remains bullish.

Stocks are expected to open 0.6% lower today as global markets react to news about the U.S. credit rating downgrade from Fitch. The S&P 500 remains above a two-month-long upward trend line as we can see on the daily chart:

Futures Contract Extends a Consolidation

Let’s take a look at the hourly chart of the contract. It continues to trade relatively close to the 4,600 level. The nearest important resistance level is at around 4,600-4,620, and the support level is at 4,560.

Conclusion

The S&P 500 index will likely open lower again. The market may extend its consolidation following negative U.S. credit rating news. However, investors will be waiting for the important earnings releases from AAPL and AMZN and Friday’s jobs data release. It still looks like consolidation and a relatively flat correction within an uptrend.