S&P 500: Overbought or Oversold?

2023.02.21 08:33

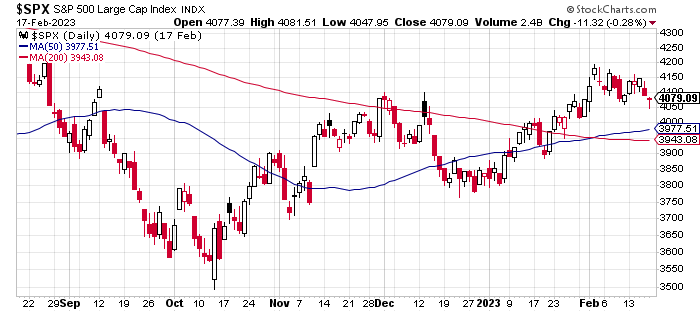

The low-hanging fruit has been picked. Casual observation suggests as much. The Index has rebounded sharply off its previous low in October, closing up 14% on Friday (Feb. 17) since October’s trough.

The market could continue to rally, of course. The question is whether the stars are still aligned in favor of further gains fueled by oversold conditions. That’s a tougher call to make at this point. For some perspective on why let’s run some basic analytics.

The first observation: stocks have enjoyed a solid tailwind in recent months. Until the trend stumbles, that’s a reason to expect more of the same. Score one for the bullish view.

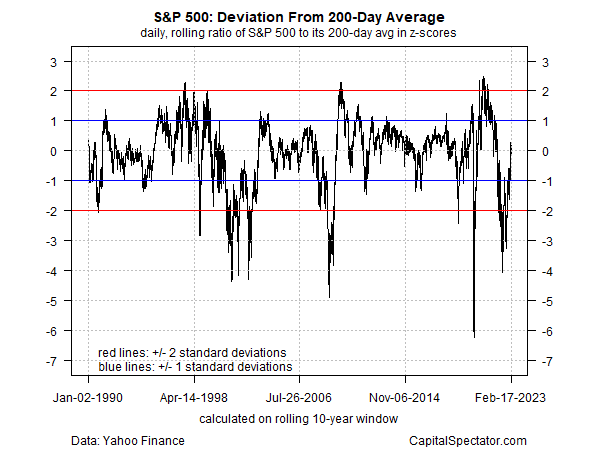

For guesstimating if the market is still oversold, or not, let’s turn to a set of metrics that offer more insight on this front. The next chart below quantifies the S&P 500’s trending behavior in z-scores in terms of the market’s deviation from its 200-day moving average. By this measure, the market’s recent recovery puts it in a neutral zone (within the -1/+1 range), which implies that a trend bias is “normal” at the moment. The case for expecting stocks to rally or fall in the near term, in other words, looks more like a coin toss in this corner.

S&P 500 – Deviation From 200 Day Average

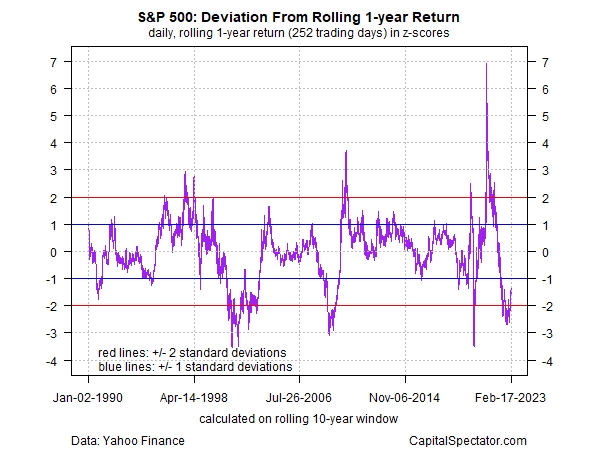

Let’s see if that profile is confirmed in alternative estimates of overbought/oversold conditions. Running the numbers based on a rolling 1-year return suggests there’s still a fair amount of bounce potential left in the market’s recent bounce.

S&P 500 – Deviation From Rolling 1-Yr Return

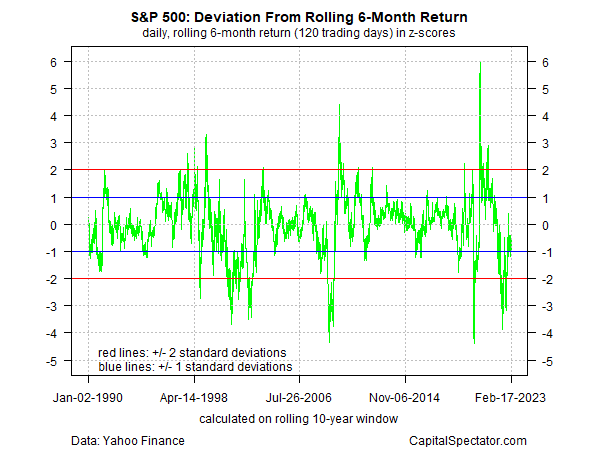

The six-month window suggests the oversold condition still applies, albeit modestly vs. the 1-year time frame.

S&P 500 – Deviation From Rolling 6-Month Return

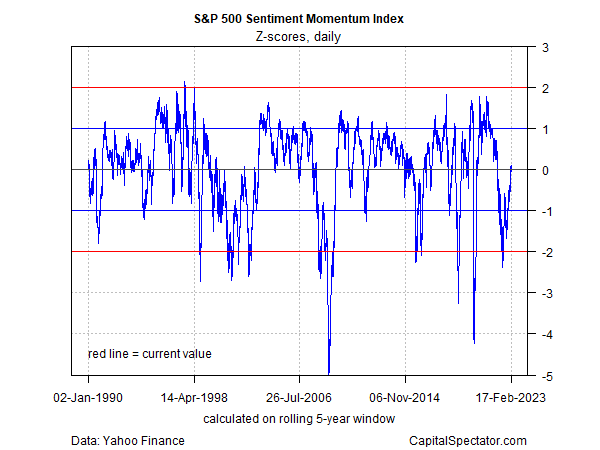

Finally, here’s my attempt to aggregate several measures of overbought/oversold conditions in one indicator – Sentiment Momentum Index. On this front, market conditions are in the neutral zone.

S&P 500 Sentiment Momentum Index

The overall message: the S&P 500 is straddling a neutral-to-modestly oversold state for the near term. Only the 1-year window in the charts above still reflects an oversold condition. My view: there’s a stronger case these days for keeping bullish expectations in check for the short-term outlook.