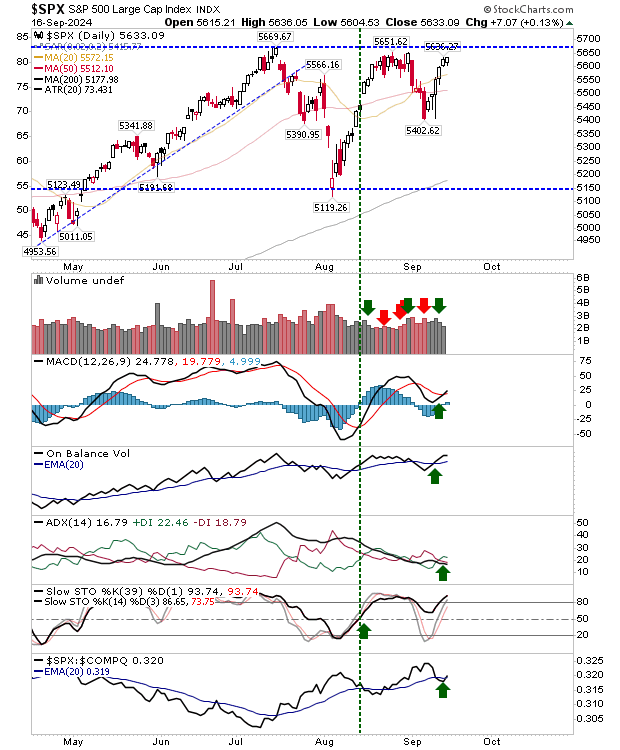

S&P 500 on the Verge of a Triple-Top Breakout – Watch Volume to Confirm the Move

2024.09.17 03:05

After blasting through 20-day and 50-day moving averages with little fanfare, the , , and () all finished with topping doji.

This opens up the possibility for gaps down today amid bearish “evening star” candlestick formations.

However, the S&P 500 keeps knocking on the door to break through and challenge all-time highs. Supporting technicals are net bullish and the index has done well to reclaim prior losses.

As a reminder, triple tops are rare, so when markets return to resistance (or support) for a third time, then the most likely outcome is a breakout.

We will want to see a pick-up in volume on such a move. Should this index deliver it will be an important marker for other indexes.

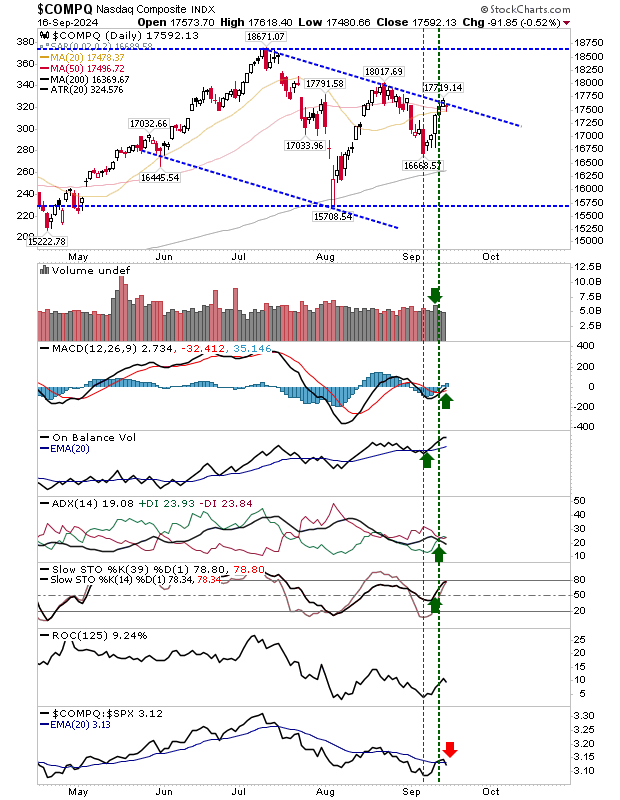

The Nasdaq is looking the most bearish of these indexes as it stalls out at channel resistance. Its 20-day and 50-day MAs are also nearby, and the tight action of the last few days has left the index clinging to this moving average support.

Technicals are net positive, opening up for a breakout in the downward channel and a challenge of July highs, but price action is key.

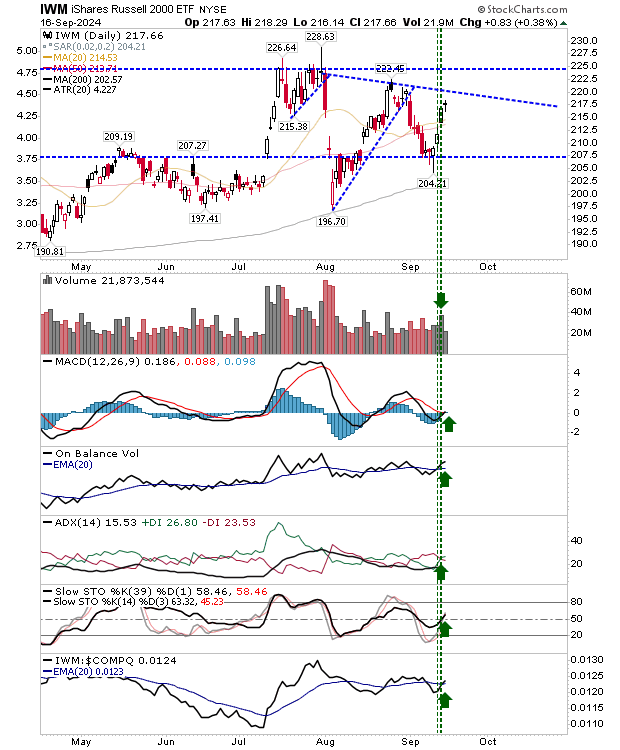

The index that offers shorts the best opportunity is the Russell 2000 ($IWM). It has tapped out before it managed to reach resistance. And its bullish turn in technicals is still vulnerable to whipsaw, although it’s important to note, all technicals are bullish.

The index is also working towards a relative outperformance against the Nasdaq, so while things look weak for the near term, it could be setting up for a leadership role soon.

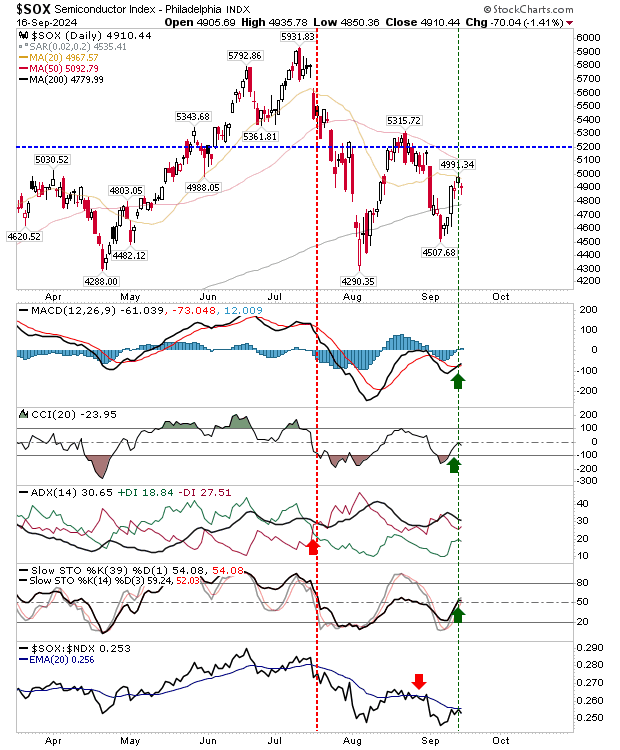

Where bulls do need to be cautious is the . It hasn’t delivered the recovery of the Nasdaq and is struggling to hold on to its 200-day MA with an overhead squeeze from the 20-day and 50-day MAs. If there is to be a bearish reversal – and what we are seeing in lead indexes is false – then this is the index to lead things lower.

We have a tale of two cities. Bulls can look to the S&P 500 to play the role of leadout and bring the Nasdaq and Russell 2000 along with it. Bears can track the struggles in Semiconductors, that could contribute to a reversal off channel resistance in the Nasdaq and see selling aggression return to the Russell 2000.