S&P 500, Nasdaq Well-Positioned to Follow Dow Higher This Week

2024.09.02 02:59

Indexes ended last Friday’s session on a strong note, setting the stage for a promising start to the post-Labor Day week.

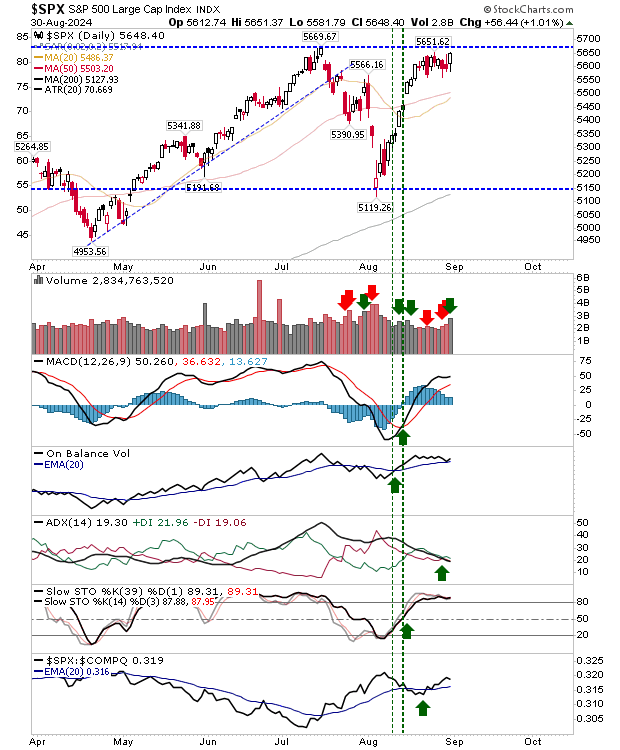

The stands out among the indexes, reclaiming the ground lost midweek and now hovering just below the July swing high. With volume indicating accumulation and technicals remaining net positive, the S&P 500 is well-positioned for the week ahead.

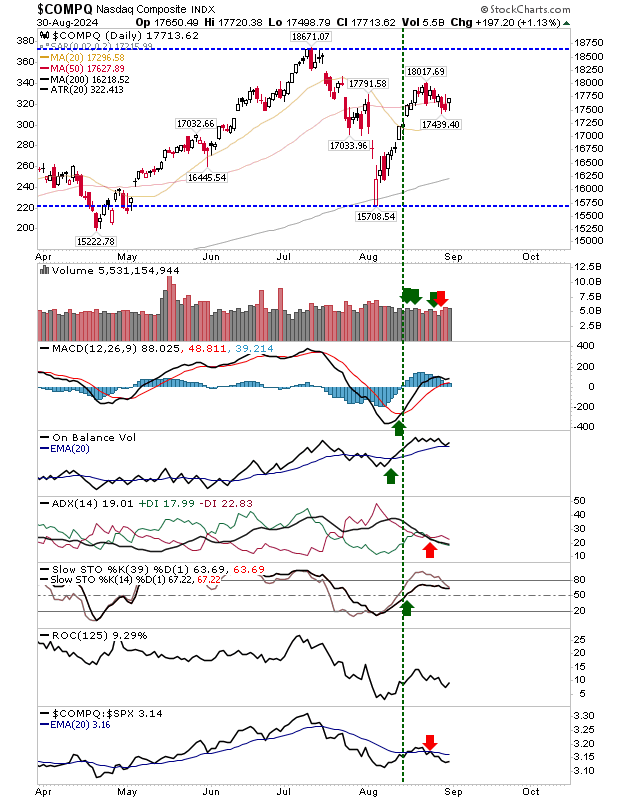

The had kept pace with the S&P 500 since the August low but lost ground in relative performance as it lingered near its 50-day MA.

However, despite remaining well off July highs it’s an index positioned to gain. The index has held its 50-day MA for two weeks and is bullish for other technical indicators despite a bearish +DI/-DI trend crossover.

For value traders, the Nasdaq is one to watch.

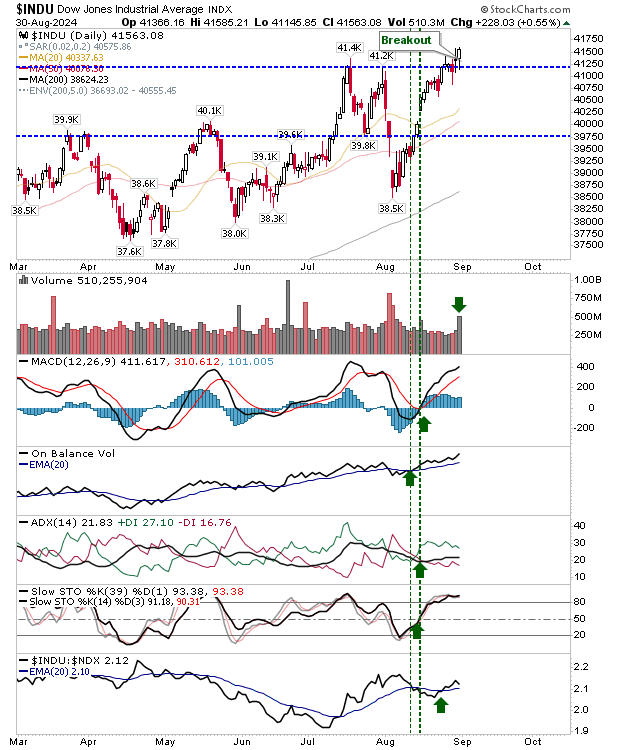

The strongest index was . I had thought the gravestone doji early last week was a topping reversal, but this was negated by Friday’s accumulation surge that easily cleared resistance. Technicals are net positive.

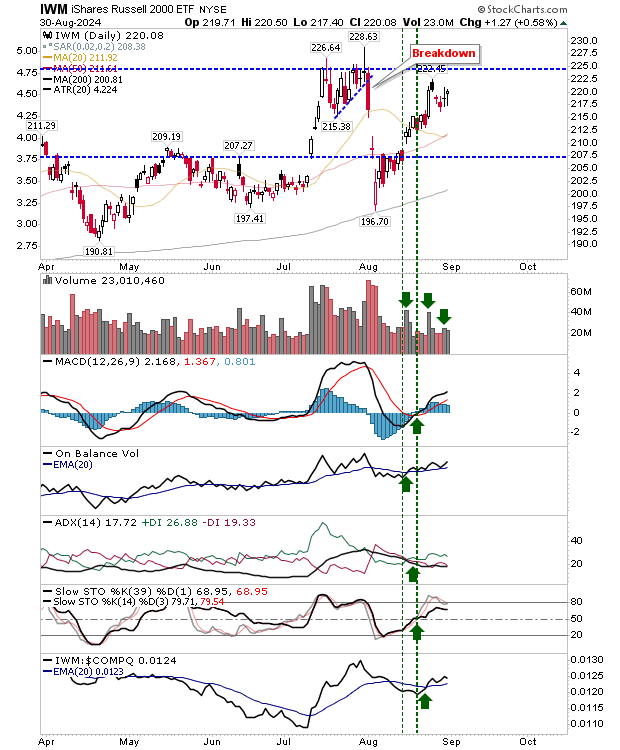

The () also gained but was unable to reverse the bearishness of last Monday’s ‘black’ candlestick.

If other indexes follow through, the Russell 2000 could indirectly benefit, but if Bears are to regain control, then the Russell 2000 will be attacked.

For the week, look to the S&P 500 to follow the Dow’s lead, but if there is any hesitation, then look for sellers to attack the Russell 2000.