S&P 500, Nasdaq Technicals Still Net Bullish, but Friday’s Resistance in the Way

2024.05.14 03:00

Friday’s highs continue to play as a top but yesterday’s losses didn’t undercut Friday’s lows, leaving things in a bit of a ‘No-Mans Land’.

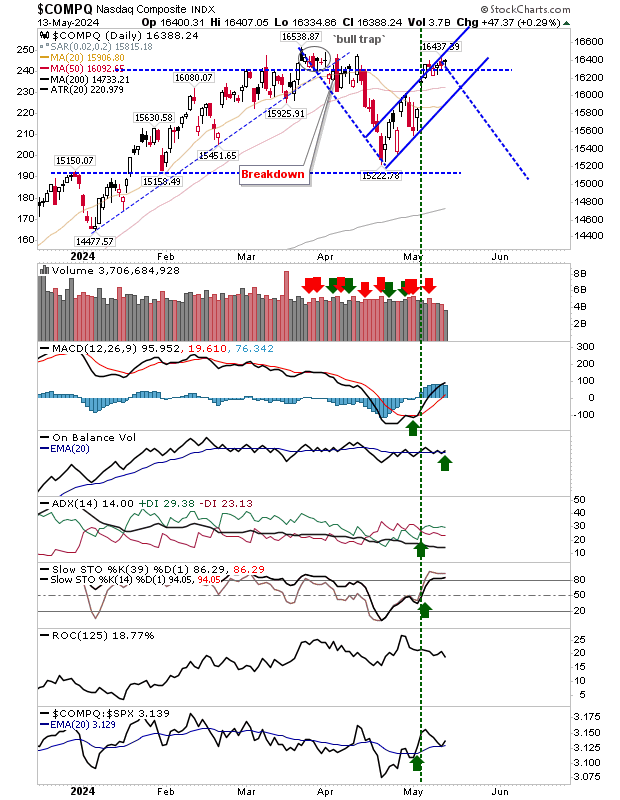

The returned to a ‘buy’ trigger for On-Balance-Volume and kept its challenge of the ‘bull trap’ intact. This could still go either way.

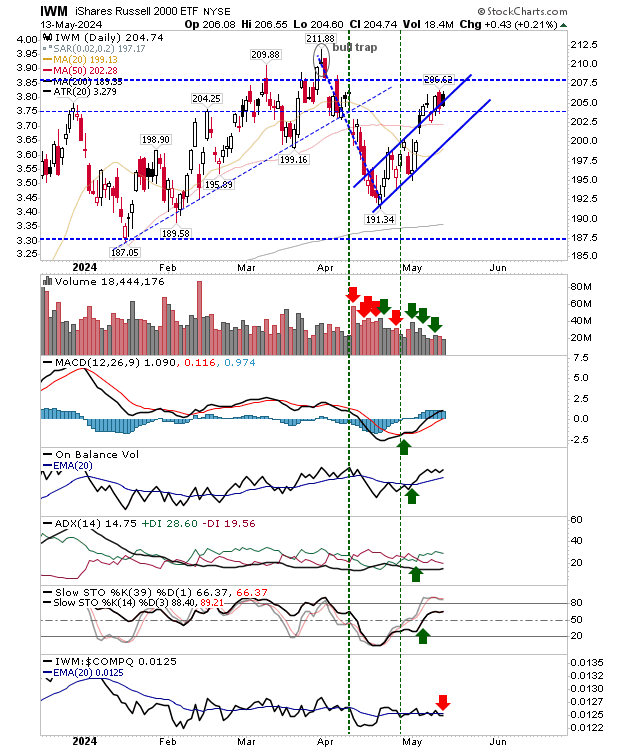

The () has been running along the upper path of ‘bear’ flag resistance and the ‘black’ candlestick today piles on to the bearish ‘cloud cover’ from Friday. Another day’s worth of losses would drop it back inside the ‘bear flag’ and leave it vulnerable to a move back to ‘bear flag’ support. Technicals are net bullish.

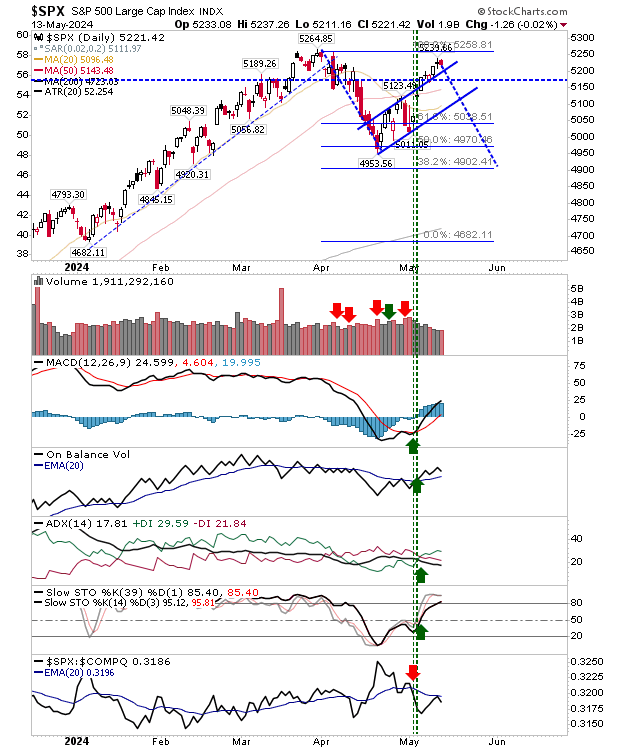

The also found itself toying with a challenge of the 52-week high. Technicals for this index are also net bullish and today’s selling volume was relatively modest.

While yesterday tacked on a second bearish day on to Friday’s, we do have broader rallies that started from an oversold (and vulnerable) state, that bypassed the zig-zag correction risk, and now appear to be playing out as peaks in sideways consolidations.

We could, of course, blow past these levels and continue with the rallies started in late 2023, although it does feel a little tired for this. The lack of trading volume plays into this. That, in itself, leaves markets open to any major volume move.