S&P 500, Nasdaq Set to Continue Higher and Russell 2000 Could Follow Suit

2024.06.27 04:26

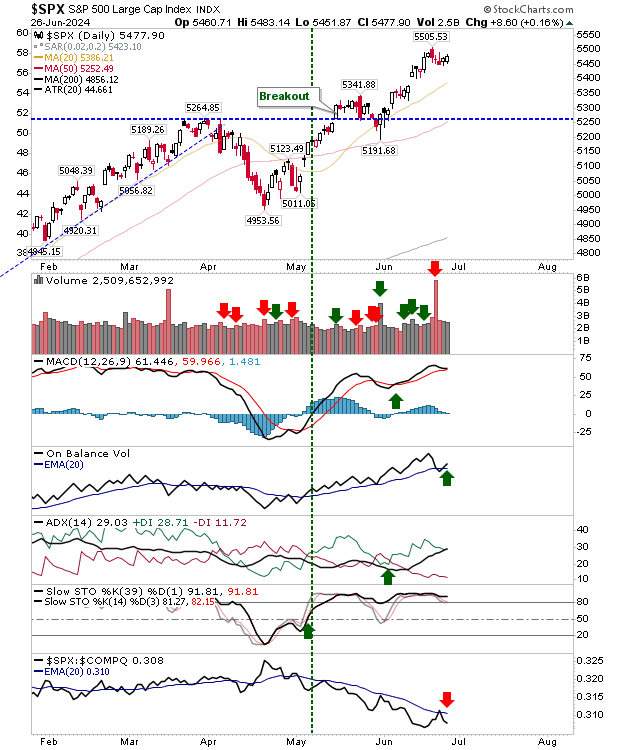

Index rallies have so far remained remarkably robust even when a move down looks the easiest path. The and experienced selling into Monday and posted two small days worth of gains, albeit on lighter volume.

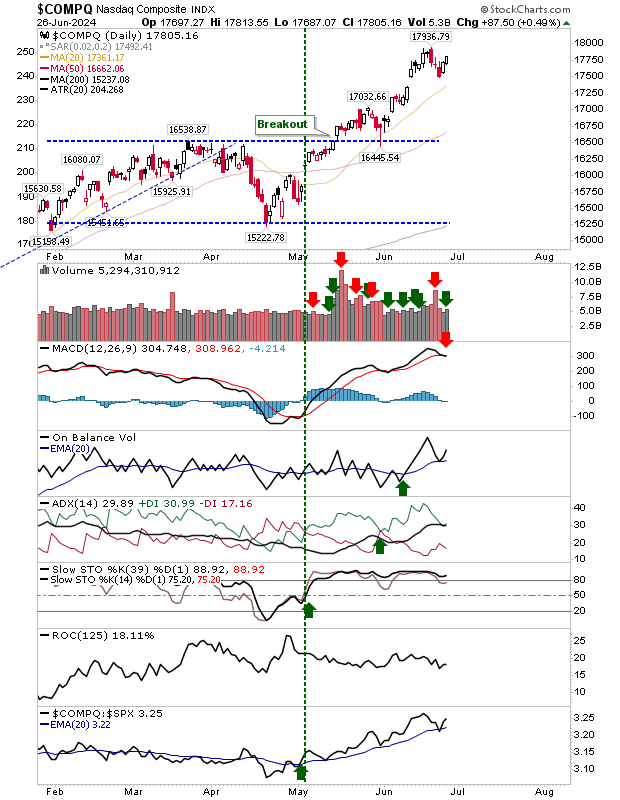

However, the setup continues to look bullish for both indexes. Technicals for the S&P 500 are net bullish, but the Nasdaq generated a new ‘sell’ trigger, although the latter is still outperforming relative to peer indexes.

The Nasdaq did record a bullish accumulation day despite the MACD trigger ‘sell’.

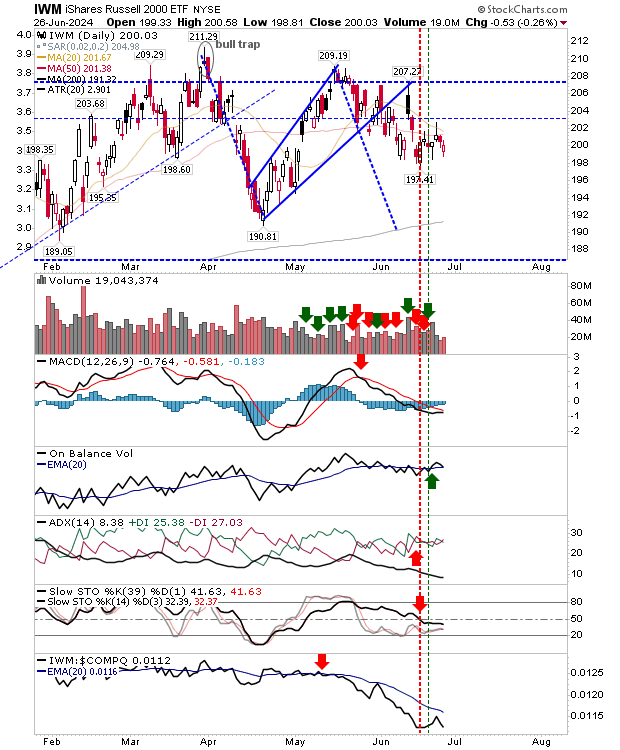

The () has turned more range-bound, within a larger range. It lurks near 20-day and 50-day MAs, both of which are playing as resistance with the 200-day MA some way below. I had drawn in the possibility of the measured move lower from the May high, but the index has done a good job of resisting this; given this, despite recent scrappy action, things could be picking up for bulls.

For the coming week, look to the S&P 500 and Nasdaq to continue its advance and perhaps take the Russell 2000 with it. The bull market remains intact.